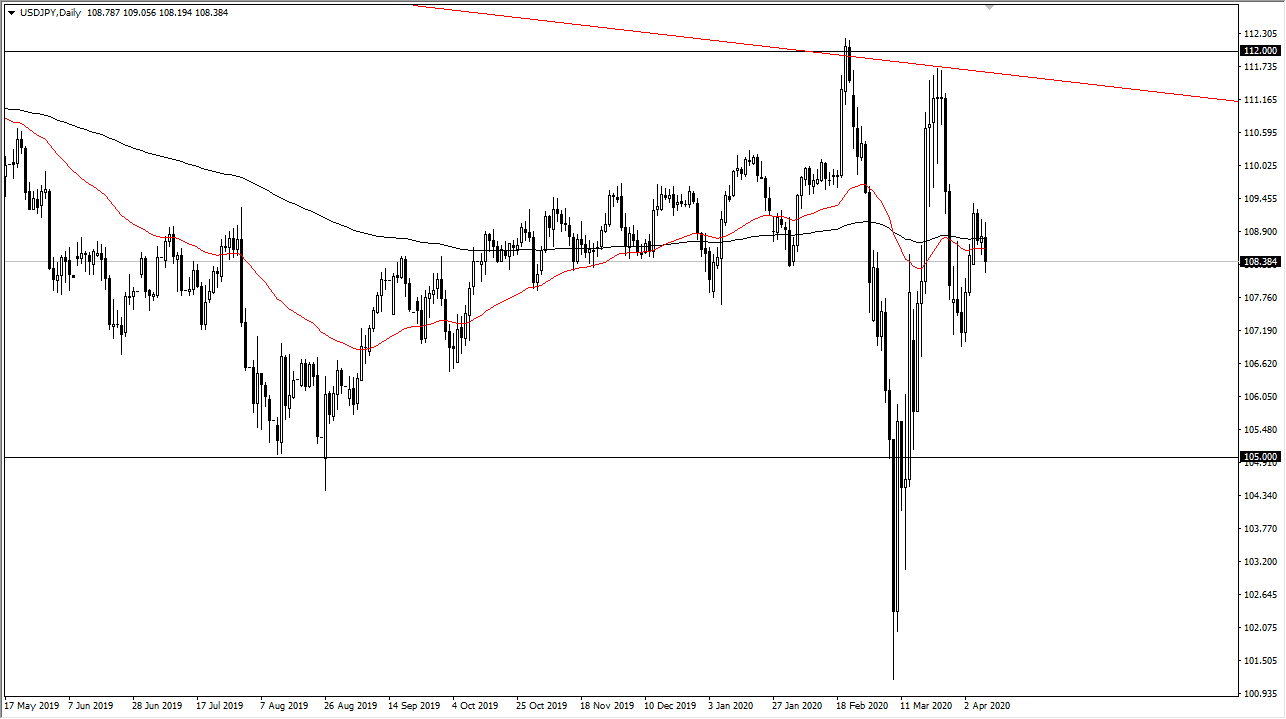

The US dollar has initially tried to rally during the day on Thursday but gave back the gains as we continue to tread water around the 50 day EMA, and of course the 200 day EMA. As both of those moving averages are flattening, it suggests that the market is still trying to find its way forward, and therefore it makes quite a bit of sense that we are simply going to hang around in this general vicinity.

Looking at this candlestick for the day on Thursday, it shows just how difficult it is going to be to discern the next direction. At this point, I believe that this chart is probably best used as some type of indicator for Japanese yen strength or weakness. At this point, if the market falls, then it suggests that the Japanese yen should continue to pick up a bit of value in this area and perhaps you can buy the Japanese yen against other currencies that are going to be much more volatile. The opposite is true, as the market goes higher it should show yen weakness and therefore you can take advantage of that and other pairs.

At this point, the pair itself is almost impossible to trade as we are essentially near the “fair value” level, as there is massive resistance at the ¥111 level above, and there is massive support underneath at the ¥105 area underneath. Because of this, the market will continue to show a lot of volatility, and therefore it’s likely that we will see choppy behavior to say the least. Furthermore, you should keep in mind that the US dollar will continue to move based upon the Federal Reserve and its latest moves, but having said that both of these currencies are considered to be a “safety currency”, and therefore it’s likely that the market will continue to be very difficult to deal with. The choppiness should continue to be a major factor in this pair, so at this point I want trade the pair, especially considering that if we do get a sudden run on risk appetite in one direction or the other, it could have a massive influence on yen itself. Keep your position size small if you do choose to trade this pair, but I will simply be using this as an indicator of Japanese yen strength, not for anything else