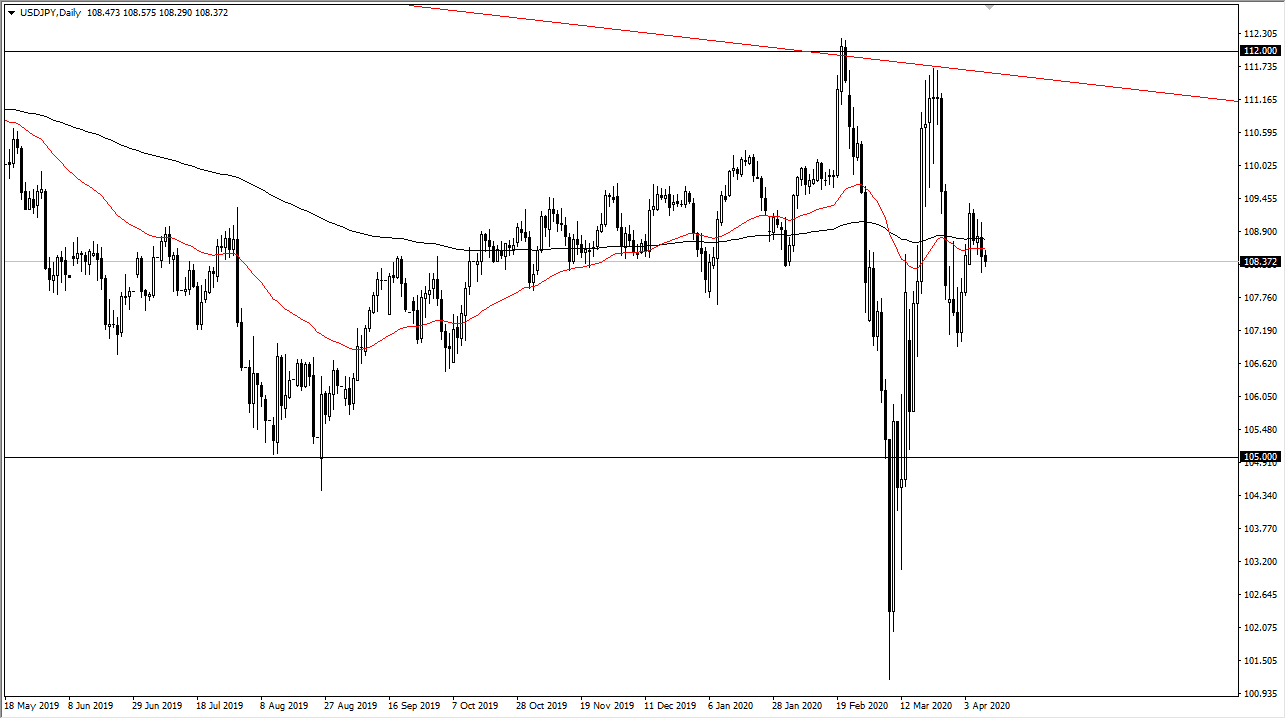

The US dollar was very quiet during Good Friday against the Japanese yen as one would expect, being a major holiday around the world. At this point, the US dollar is essentially hanging around the ¥108.50 level, an area that is essentially “fair value” when it comes to the overall range. I see the range between the ¥112 level on the top, and the 105 level on the bottom. Furthermore, the moving averages are hanging around this area, be it the 50 day EMA and the 200 day EMA. Both of those are flat, showing just how neutral this market is.

It’s a bit difficult to trade this market right now, until we get to the outer reaches of the range. If we get closer to the ¥112 level, then I’m going to be looking for signs of exhaustion that I can sell into. Alternately, if we bounce from the ¥105 level, I’d be more than willing to start buying. Having said that, it more or less makes this pair one that you should be trading on the periphery only. All things being equal, I believe that this is more of an indicator than a market that is tradable.

What I mean by that is if the market falls, that shows Japanese yen strength. If you can find another currency that is falling against the US dollar, perhaps the Australian dollar as an example, then you want to short the AUD/JPY pair. You can say the same thing as far as triangulating any three currencies, as long as you use the US dollar is the common denominator as it is the world’s reserve currency. That being said, the true strength of the currency is measured against the greenback so triangulating USD/JPY, and the GBP/USD pair opens up the possibility of trading the GBP/JPY pair through triangulation. Ultimately, if you were to short the USD/JPY pair and by the GBP/USD pair, you are essentially long GBP/JPY. A lot of retail traders don’t understand this, and therefore hurt themselves by trading correlated pairs via triangulation. However, you can also use triangulation to help with your other trades. That’s essentially how I’m using this pair right now but once we get to the outer range of consolidation then I’m willing to put money into it. Until then, this is essentially a market that is completely untradable but not necessarily useless.