The US dollar fell hard against the Japanese yen to kick off the week on Monday, but it should be noted that liquidity may have been a bit of an issue as Easter Monday was in full effect and most of the European banks were even trading. That being said though, we have recently seen a bit of a pullback anyway, so this may have simply been an exacerbation of what was already coming. After all, the US dollar is being pumped into the system with the equivalent of a fire hose by the Federal Reserve. This would suggest that eventually the US dollar should lose value, because of the massive amount of liquidity measures being taken.

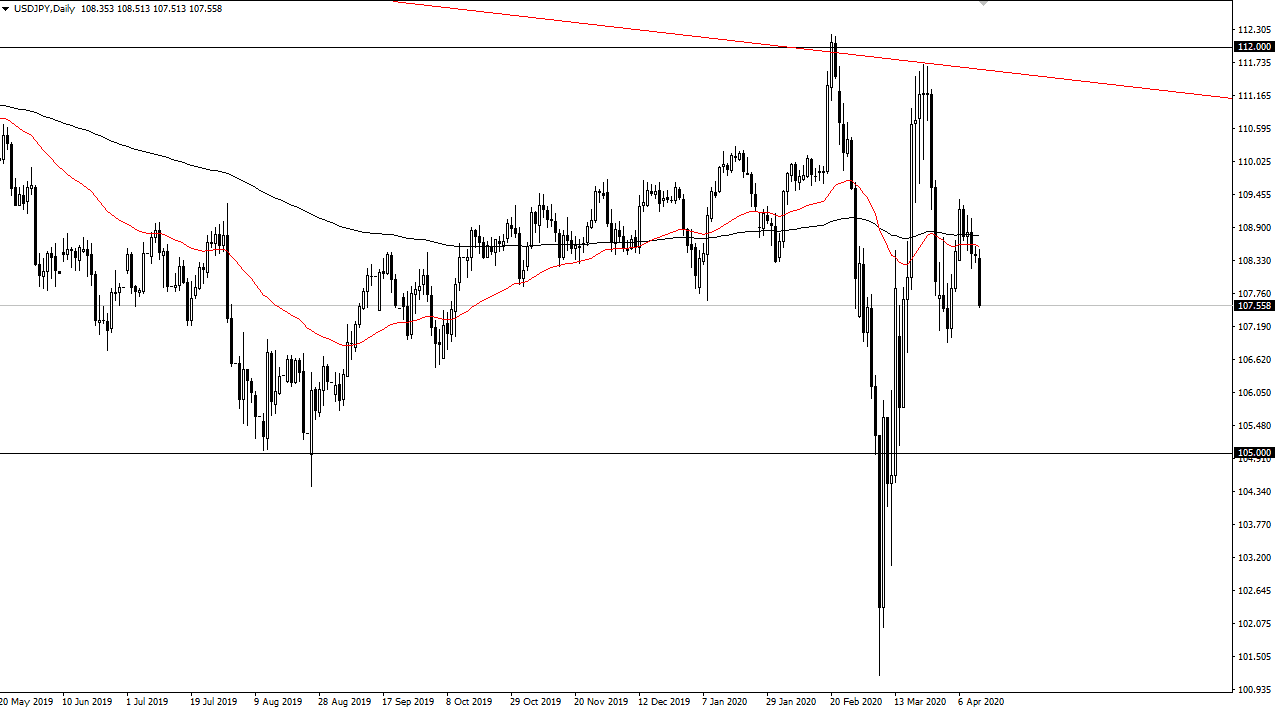

That being said, there is a significant amount of support just below the ¥107 level, so I would pay attention to that area. If we break down below that level, then we could go as low as ¥105 but that area should attract a certain amount of support as well. If we were to break down below there, then the bottom could fall out. On the other side of the equation you could have a bounce back towards the ¥109 level, which is basically where the 200 day EMA is sitting. That is one of the most widely followed trend indicators out there, but what we should pay more attention to is the fact that not only is it there but it’s also flat. That suggests that the market will continue to be a bit lackluster to say the least.

Looking around the Forex world, it’s obvious that there is US dollar weakness, and not necessarily Japanese yen strength. Because of this, all one has to do is look around at the GBP/USD pair, EUR/USD pair, and so on. The currency is against the Japanese yen are holding their own, so this is clearly a “anti-dollar” move. With that being the case, I do think that we continue to see a lot of back and forth, but I think that the US dollar probably drifts a bit lower against the Japanese yen in general, because if we do get a sudden shift into a major run towards safety, that should help the Japanese yen as well. Ultimately, I think we are simply trying to carve out a bigger range to start trading from again now that we aren’t necessarily in a panic mode anymore.