The US dollar rallied a bit against the Japanese yen during the trading session on Friday, despite the fact that the jobs number in America was absolutely miserable. The loss of over 700,000 jobs last month was seven times the consensus, but it should be noted that the initial jobless claims the day before were much worse than anticipated anyway, so that could have taken out some of the sting from that announcement.

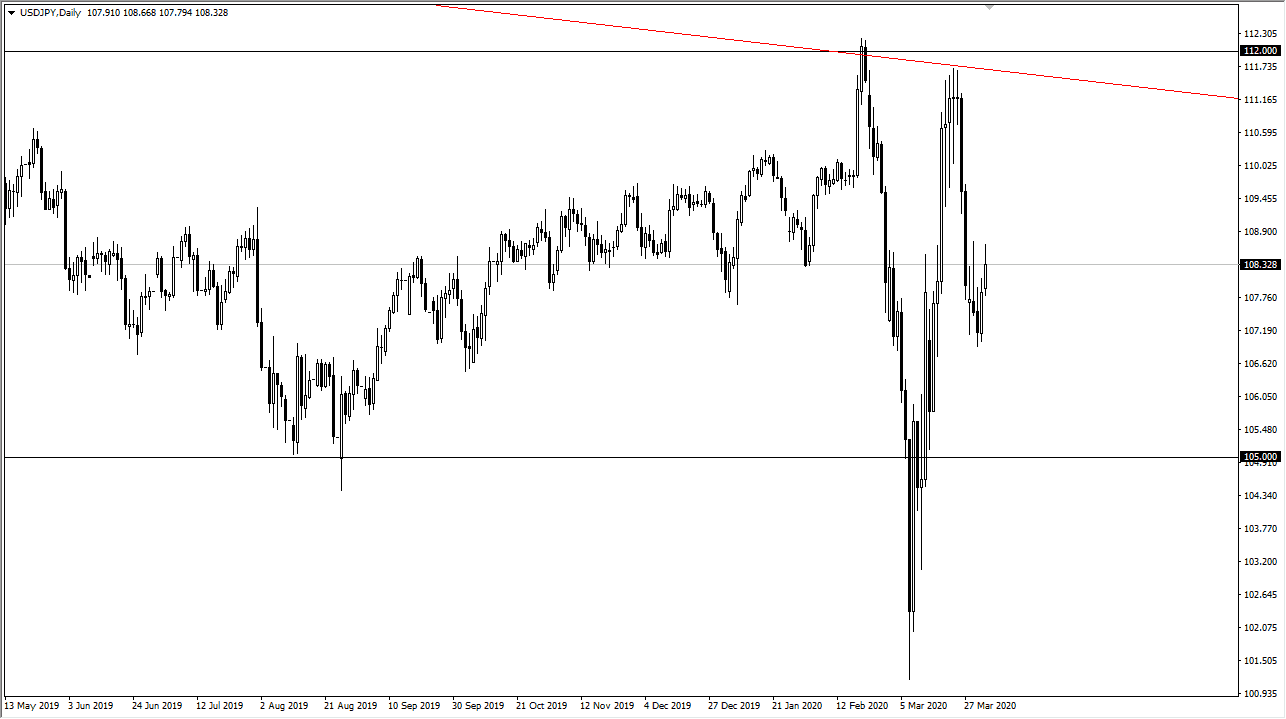

With that being the case, the S&P 500 then try to reach towards the ¥108.75 level, an area that has been resistive a couple of times in the past. You’ll notice that we give back about half of the gains and that suggests that we aren’t quite ready to break out above there. Unfortunately, this is a market that is essentially in “no man’s land” at the moment as we are basically in the middle of the larger consolidation range that the market has been slamming back and forth from. This chart screams of a market that is simply looking for some type of direction and you would think that it makes quite a bit of sense to see that happen due to the fact that the US dollar and the Japanese yen are both considered to be safety currencies.

All things being equal, it should be noted that this pair does tend to move right along with the S&P 500, so if we do break down over there, it’s likely that we break down over here as well. All of that being said, if the USD/JPY pair breaks above the top of the Friday candlestick, then the market is likely to go towards the ¥111 level above. That extends to the next big figure of ¥112 as far as resistance is concerned. To the downside, the ¥107 level offers short-term support, so if we were to break down below there, then it’s likely that the market could go to the ¥105 level given enough time. Essentially, we are in a 200 PIP range right now that could lead to another 200 pips once we break out. This is a pair that is highly sensitive to risk appetite, so it will go back and forth due to the latest headlines, all of which have been rather negative for some time. With this being the case, the market is very likely to be choppy at best going forward.