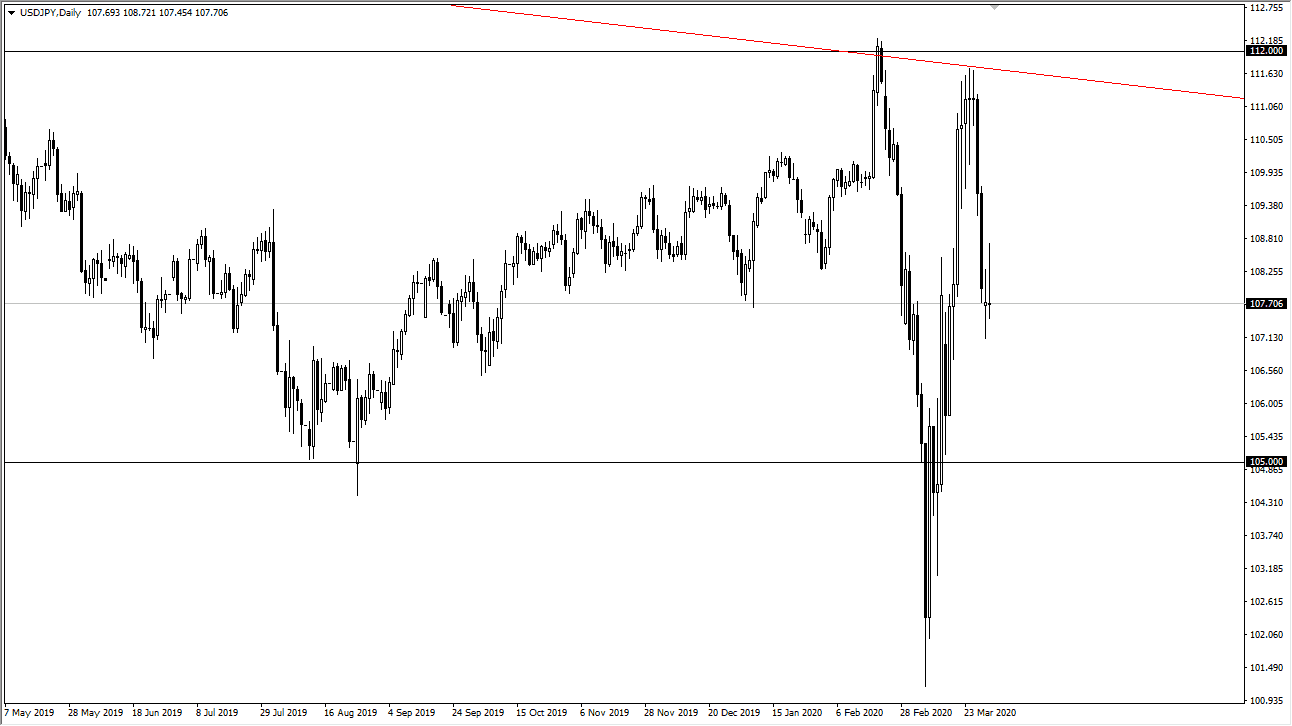

The US dollar has initially tried to rally during the trading session on Tuesday but gave back a huge amount of gains to form a less than impressive candlestick. In fact, this looks pretty bad and if we break down below the lows of the Monday session it’s likely that the USD/JPY pair then goes looking towards the ¥105 level. That’s an area where I would expect to see a certain amount of support, based upon the fact that it is a large, round, psychologically significant figure. Having said that, if we were to break above the highs of the trading session on Tuesday it would show a certain amount of resiliency that should continue to reach towards the ¥111 level.

Keep in mind that this pair does tend to move with risk appetite, rising when people are willing to go out on the risk spectrum, and closing while people are more skittish. Clearly, there are about a million things to worry about right now, and that will continue to keep this market all over the place. With that being the scenario, we find ourselves and, to me it looks like we probably have more risk to the downside than anything else. This doesn’t mean that we can’t break to the upside, but it tells me that the weight of the market is certainly pointing in a lower direction. I think it likely at this point that we will have a bit of a “risk off” move in general, which not only translates into this pair going lower but anything else with the Japanese yen involved.

All things being equal, it looks like we are simply going back and forth in large ranges, which means we could drop all the way down to the ¥102 level given a hard enough push. If we were to somehow break above the ¥112 level it would be an explosive move just waiting to happen in this pair to the upside, but obviously it would take a lot of bullish sentiment to suddenly find this market doing that. I believe that you we are more likely than not to see more of a “fade the rally” type of sentiment during the trading session on Wednesday. Keep in mind that the jobs report comes out on Friday which is typically quite influential on where this pair goes.