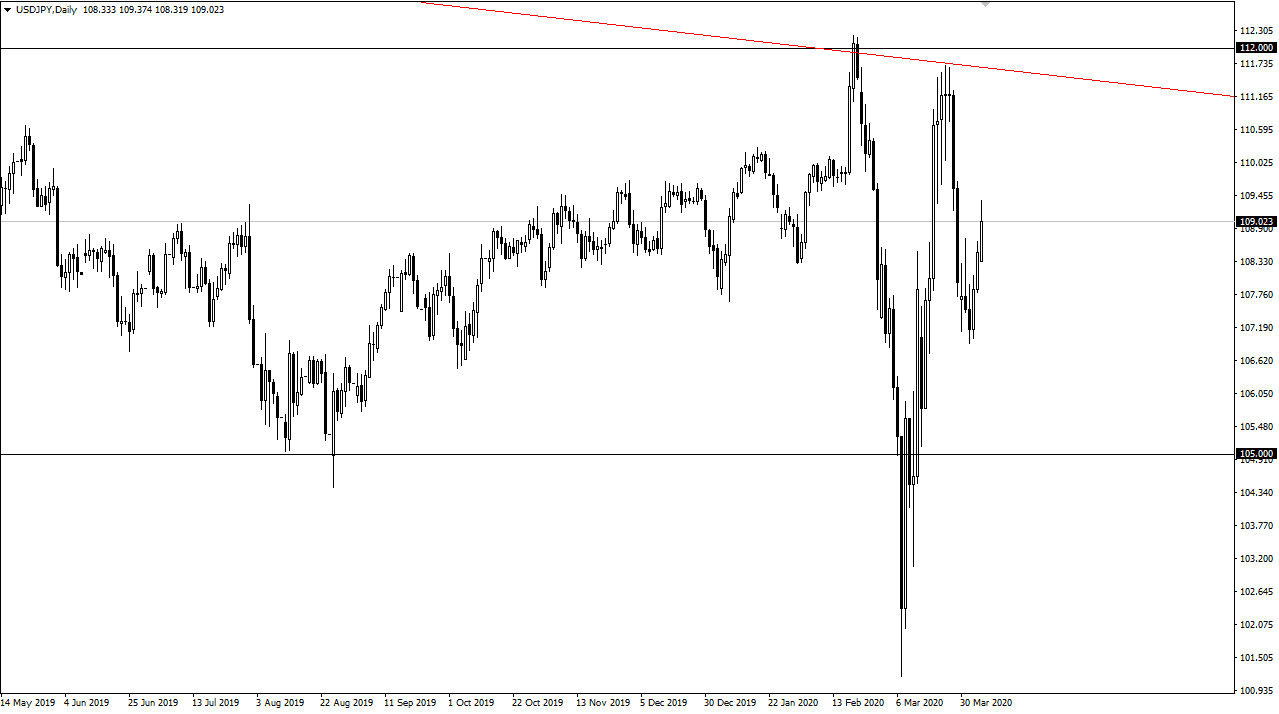

The US dollar has rallied a bit against the Japanese yen, breaking significantly above the resistance that we had seen over the last couple of days. Having said that, we did see a bit of a pullback late in the session and it appears that the ¥109 level continues to cause major issues. Beyond that, the ¥110 level and the ¥111 level both will cause significant problems also. That being said, I believe that the market is going to continue to see sellers above, which makes sense considering that the Japanese yen is considered to be a “safety currency.”

If we were to break down below the ¥108.50 level, it’s likely that the market would then break down rather significantly. At that point in time, I would anticipate a move to the ¥107 level. A breakdown below that level then opens up the door to the ¥105 level. It’s difficult to figure which way we go though, because the pair features to safety currencies. There is a bit of a “push/pull” aspect of what’s going on right now as this pair typically rallies right along with stock markets, specifically the S&P 500. However, stock markets are extraordinarily unstable and therefore it makes sense that you can’t truly trust all of the rallies.

For myself, I am much more interested in fading rallies near the ¥111 level, as well as buying pullbacks closer to the ¥102 area. Between those two levels we will see a lot of noisy trading, especially considering how the risk appetite is going to be all over the place. In the short term, as long as we can keep above the ¥108.50 level, it’s likely that the market will then go looking towards ¥110 level.

At this point, you can see just how volatile the market has been over the last couple of weeks, and therefore it determines that a certain amount of caution will be needed as there is a lot of trouble just waiting to happen. The stock market will probably lead the way in this pair, so keep an eye on the S&P 500 as it gives you an idea where we are going in this pair. All things being equal, I have been using this currency pair as a secondary indicator to other trades that I make in market such as the AUD/JPY, GBP/JPY, and EUR/JPY pairs.