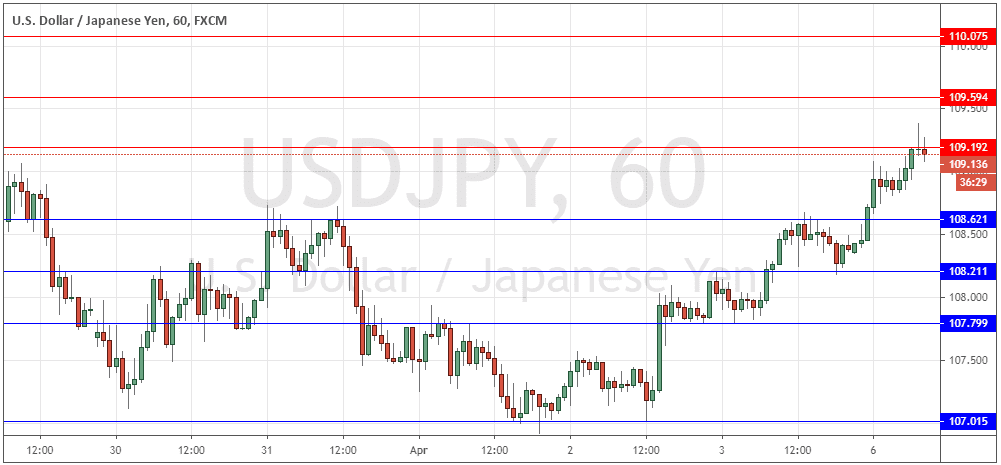

USD/JPY: Pivotal point at 109.19

Last Thursday’s signals produced an excellent and very profitable long trade from the bullish inside bar breakout on the hourly chart from the rejection of the support level identified at 107.02.

Today’s USD/JPY Signals

Risk 0.75%.

Trades may only be taken between 8am New York time Monday until 5pm Tokyo time Tuesday.

Short Trade Ideas

Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 109.19 or 109.59.

Place the stop loss 1 pip above the local swing high.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 108.62 or 108.21.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

I wrote last Thursday that I was keen to go short following a bearish breakdown below 107.00 as the price had plenty of room to fall.

The level held as support and actually produced a great and very profitable long trade, so although I was wrong about the direction of the opportunity, I was correct to see 107.00 as very pivotal.

The picture now is more bullish although the price is still well within its range of recent weeks. Still, there is certainly a short to medium-term bullish trend.

The price is showing signs of rejecting the close resistance level at 109.19 and making a bearish “V”. If this pattern and level holds until the New York open and then starts to fall, that would probably make a good short trade entry signal. Conversely, if the price can get established above 109.19 it would probably continue to rise today to at least 109.59. There is nothing of high importance scheduled for today concerning either the JPY or the USD.

There is nothing of high importance scheduled for today concerning either the JPY or the USD.