Despite the losses of the Japanese yen against most other major currencies after the Japanese government announced a "closure" that will affect more than half of the economy at a time when demand for safe haven currencies is declining due to the low prevalence of the coronavirus in other major economies, the USD/JPY pair remained under downward pressure pushing it towards the 108.66 support before settling around the 108.80 at the time of writing. Japanese Prime Minister Shinzo Abe has declared a state of emergency in Tokyo, Kanagawa, Saitama, Chiba, Osaka, Higa, and Fukuoka, in response to a sudden rise in the number of coronavirus cases.

Confirmed cases increased by 515 in Japan to 3906 cases after a week in which the average daily growth rate rose from 6.6% to 10.6%, and both helped to declare a month-long state of emergency as testing and intensification of social separation would take place.

After the latest action, Lee Hardman, currency analyst at MUFG, sees: "The closer is not expected to be as restrictive to economic activity as it is in China and Europe, but it will nonetheless increase the downside risks to Japan's growth in the second quarter." "The developments have had little impact on the yen, which has declined in recent days, along with a temporary improvement in global investor sentiment," he added.

The Japanese government has called for "cooperation" of citizens in implementing social distancing measures aimed at preventing the virus from gaining more momentum in urban areas, although unlike China and Europe, the measures are said to have no legal force. Economic activity will continue to drop sharply in these seven governorates over the coming weeks, but not necessarily to the same degree that we saw in Europe, since Japan only requests volunteer cooperation, while some European capitals have allocated very harsh powers with legal support.

Japan provided significant support to companies and families affected by the emergency, including 300,000 yen (2238 pounds) per month for families and 2,000,000 yen (14.925 pounds) for SMEs. These payments and other announced measures are equal to about 3.1% of GDP, which brings total spending associated with coronavirus by the government and private companies to about 20% of GDP.

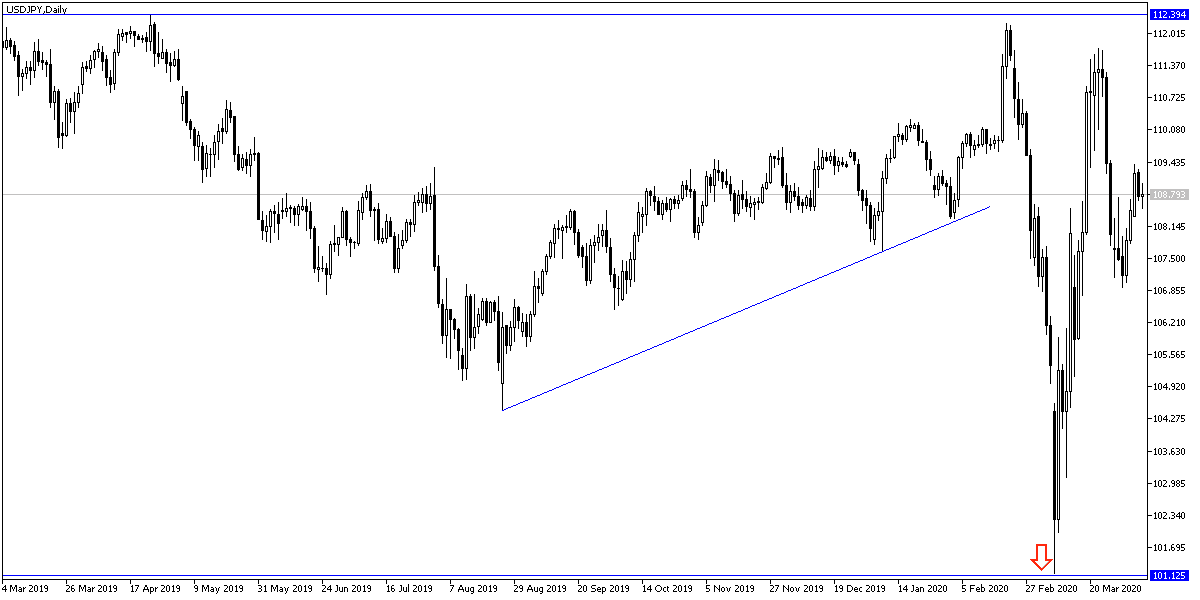

According to the technical analysis: As I mentioned in the recent technical analyzes of this pair, the USD/JPY bears succeeded in moving the pair to the 108.00 psychological. The upward reversal will be stronger if the bulls succeed in moving the pair to the 110.00 psychological. Investor and market sentiment regarding global losses from the Coronavirus will have a direct impact on the performance of the pair.

As for the economic calendar data today: From Japan, the current account and the economic monitoring index for the country will be announced. Later, the Fed Reserve minutes of the latest meeting will be announced.