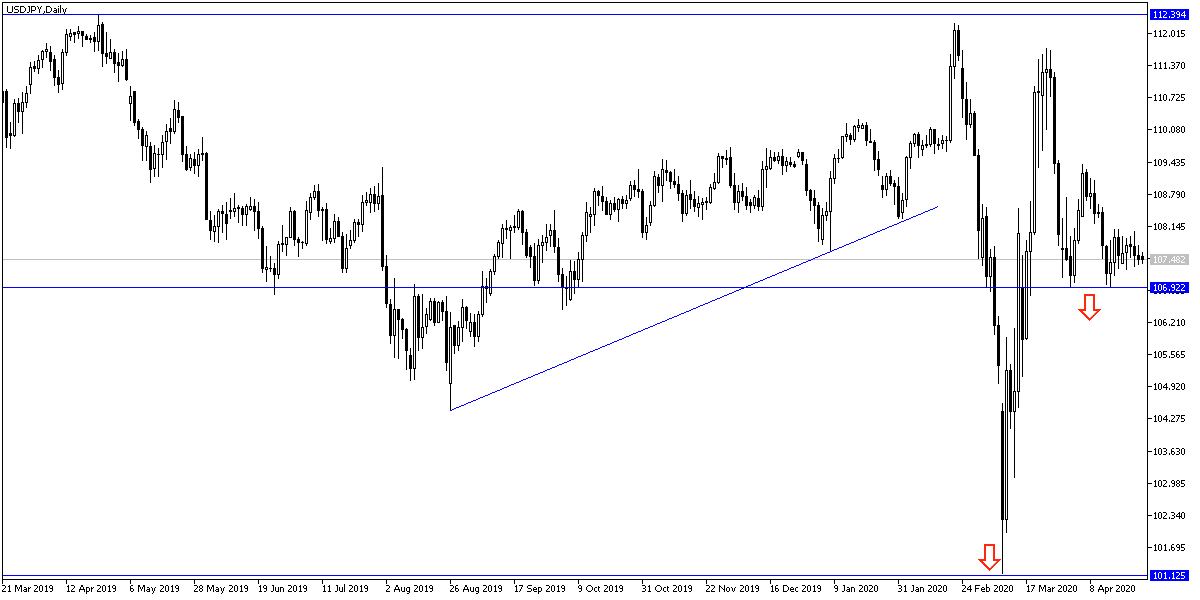

The recent downward trajectory pushed the USD/JPY towards the 106.55 support, its lowest in more than a month, before returning to stability around the 106.85 level in the beginning of trading today, and before the announcement of a package of important US economic data, led by the rate of GDP growth and the aggregate and US Federal Reserve monetary policy decisions. Currency traders are also waiting for the move of the European Central Bank policy on Thursday, as well as interaction on the news about the coronavirus pandemic and the reopening of companies and factories in many epidemic hot spots in Europe and some US states.

The data showed a sharp deterioration in US consumer sentiment in April, which also affected the dollar. A number of US states such as George, South Carolina and Colorado have already announced the reopening, while other states such as New York have announced plans to start reopening in the coming weeks. U.S. President Donald Trump has also unveiled a plan to increase tests, which experts say is the most important step toward reopening the economy.

The Conference Board report showed consumer confidence deteriorated significantly in April. The report said that the consumer confidence index fell to 86.9 in April after falling to 118.8 which was revised down in March. Economists had expected the index to drop to a reading of 90.0 from 120.0 that was announced in the previous month. The decline in confidence was in the shadow of millions of Americans losing their jobs.

Commenting on that, Cathy Postianchik, chief US economist at Oxford Economics, said the decline in confidence was worrying because "pessimistic consumer opinions about future income prospects could limit consumer spending and the economy in general." As is well known, consumer spending represents about 70% of all economic activities in the United States of America. Many economists believe that the world's largest economy has already entered a recession and it will be the biggest economic turmoil since the Great Depression of the 1930s.

To increase confidence in reopening, US President said his administration is considering requiring travelers on some upcoming international flights to undergo temperature and virus testing to help stem the spread of the coronavirus. Trump said at the White House: “We look forward to doing this towards international flights coming from the severely affected areas. We will consider this in the near future”. Trump has not yet decided whether the federal government or airlines will take this test, but he said, "It might be a combination of both sides."

According to technical analysis of the pair: As expected, stability below the 108.00 psychological support still supports the strength of the USD/JPY downtrend, and breaching the 106.00 support will increase the bear's control over the performance and at the same time, push technical indicators to oversold areas, and making profit by going long into bounces. I still hold onto 110.00 psychological resistance as it supports bulls controlling performance and thus changing the current bearish outlook.

As for economic calendar data today: Today is a holiday in Japan. The main focus is on the US session data, the US GDP growth rate, pending home sales, then Federal Reserve monetary policy decisions and statements by Governor Jerome Powell.