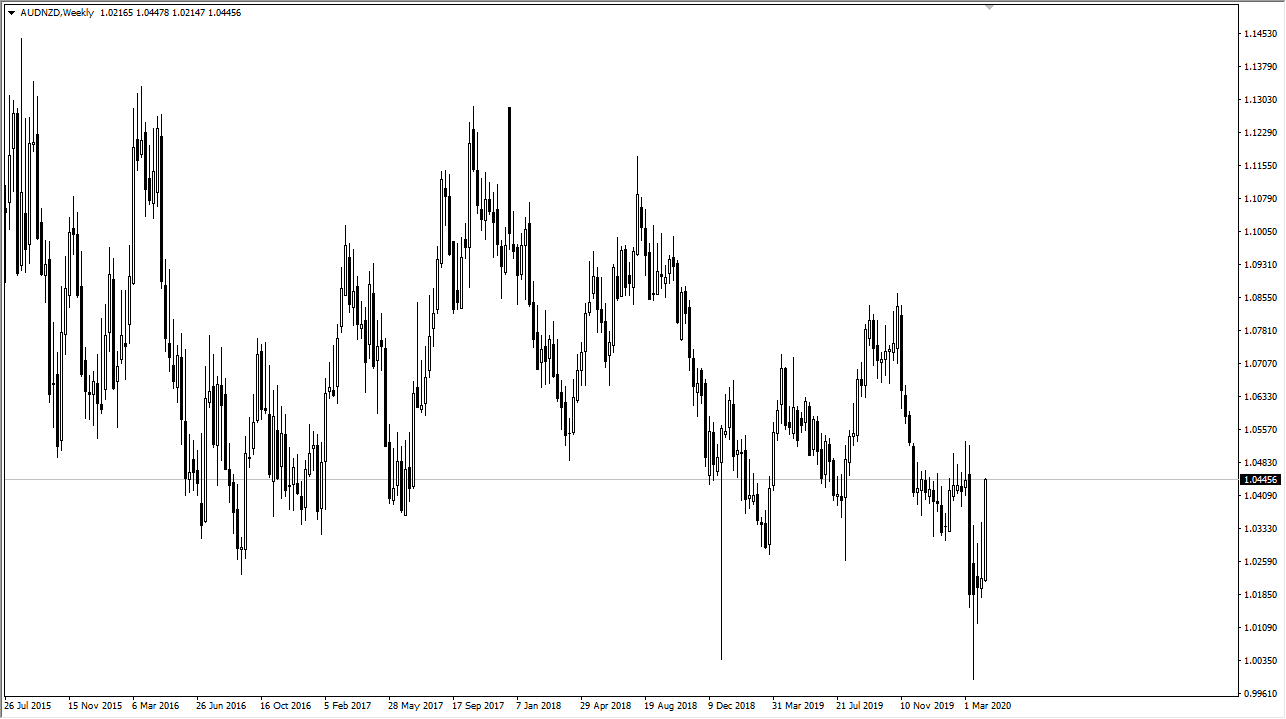

AUD/NZD

The Australian dollar has skyrocketed against the New Zealand dollar during the previous week, reaching towards the 1.0450 level. However, I see a significant amount of resistance just above so I would not be surprised at all to see this pair pull back over the course of the next week. Furthermore, the Australian dollar is a bit overextended against almost everything, and it’s likely that the New Zealand dollar will play a bit of catch-up in other pairs, thereby driving the market lower over here. On the other hand, if we break above the 1.05 handle this could unleash massive pressure to the 1.08 level after that.

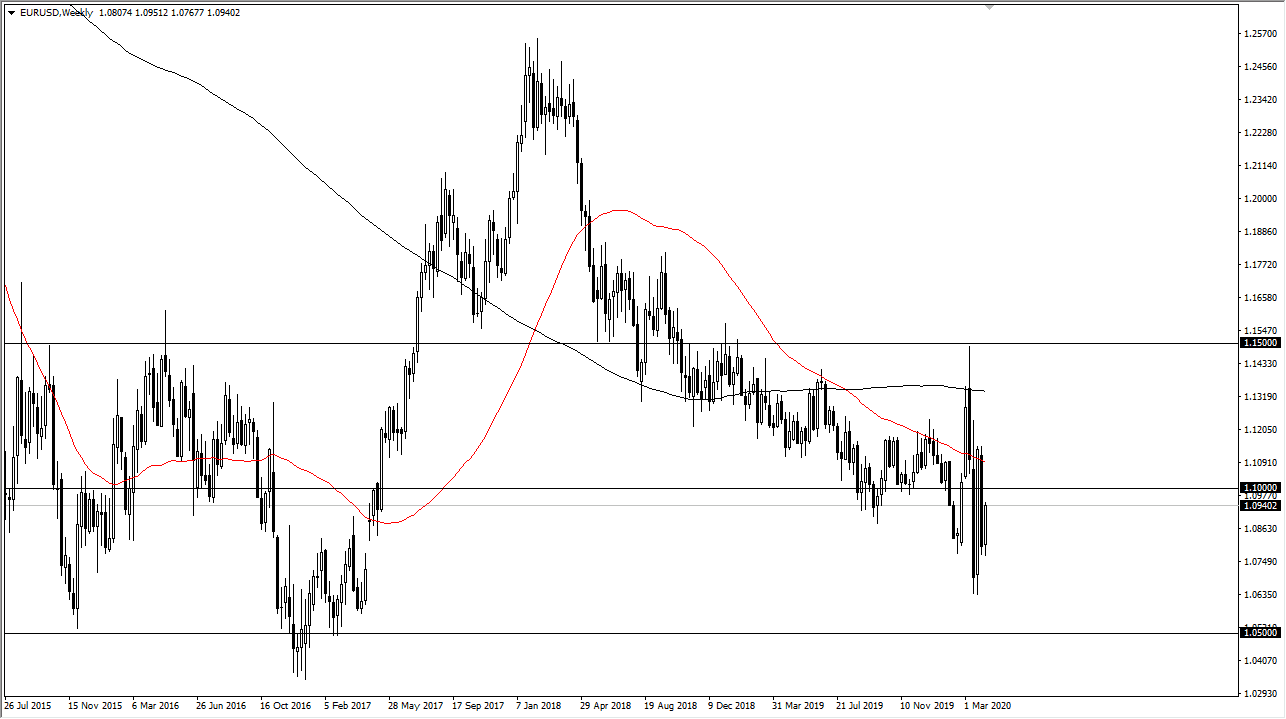

EUR/USD

Euro rallied slightly during the week, reaching towards the 1.0940. Having said that, the 1.10 level above should offer a bit of resistance, and most certainly the 1.11 level will as well. At this point, expect to see a little bit of short-term bullish pressure, perhaps followed by selling later in the week. This of course is going to be contingent on news events, which continue to come fast and furious. At this point though, it looks like we will probably continue the overall choppy attitude that is typical of this pair.

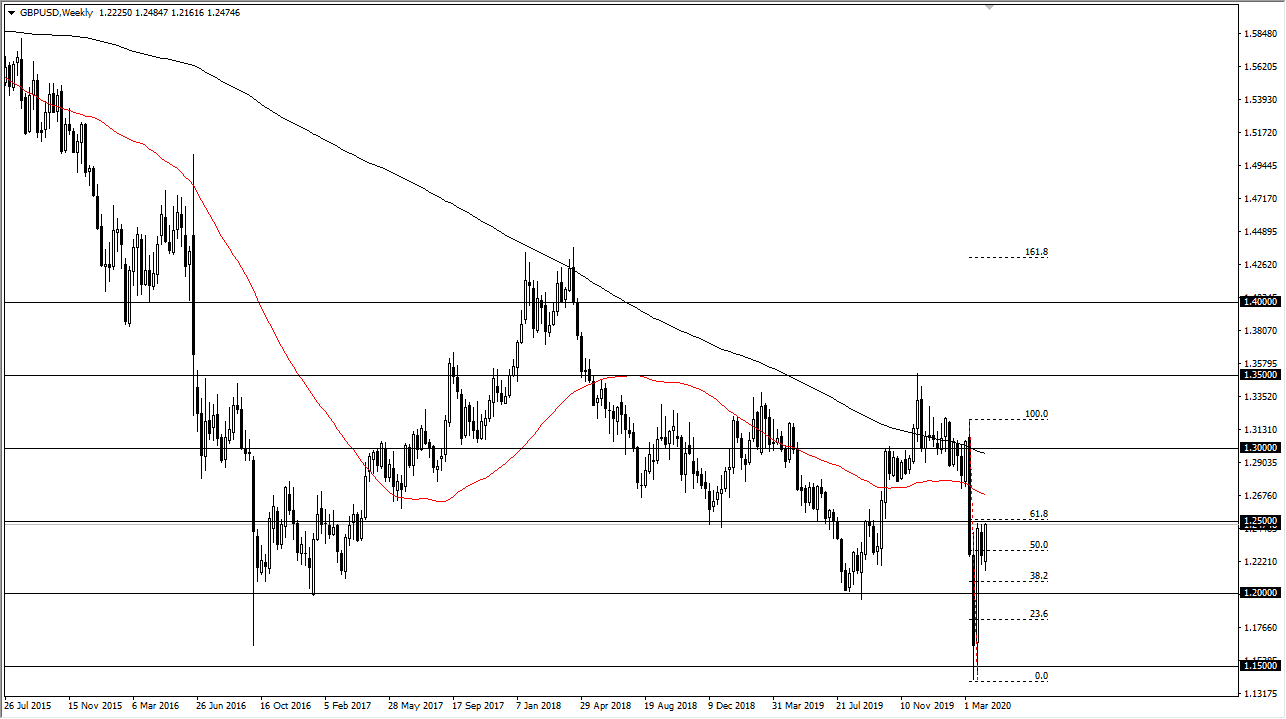

GBP/USD

The British pound has rallied significantly during the week, reaching towards the 1.25 level yet again. Having said that, the 1.25 level has held so far. If we can break above there, then the market is likely to go much higher, heading towards the 1.2750 level rather quickly. On the other hand, if we do pull back from here then it’s going to be more consolidation between the 1.25 level and the 1.22 level underneath that has been so supportive.

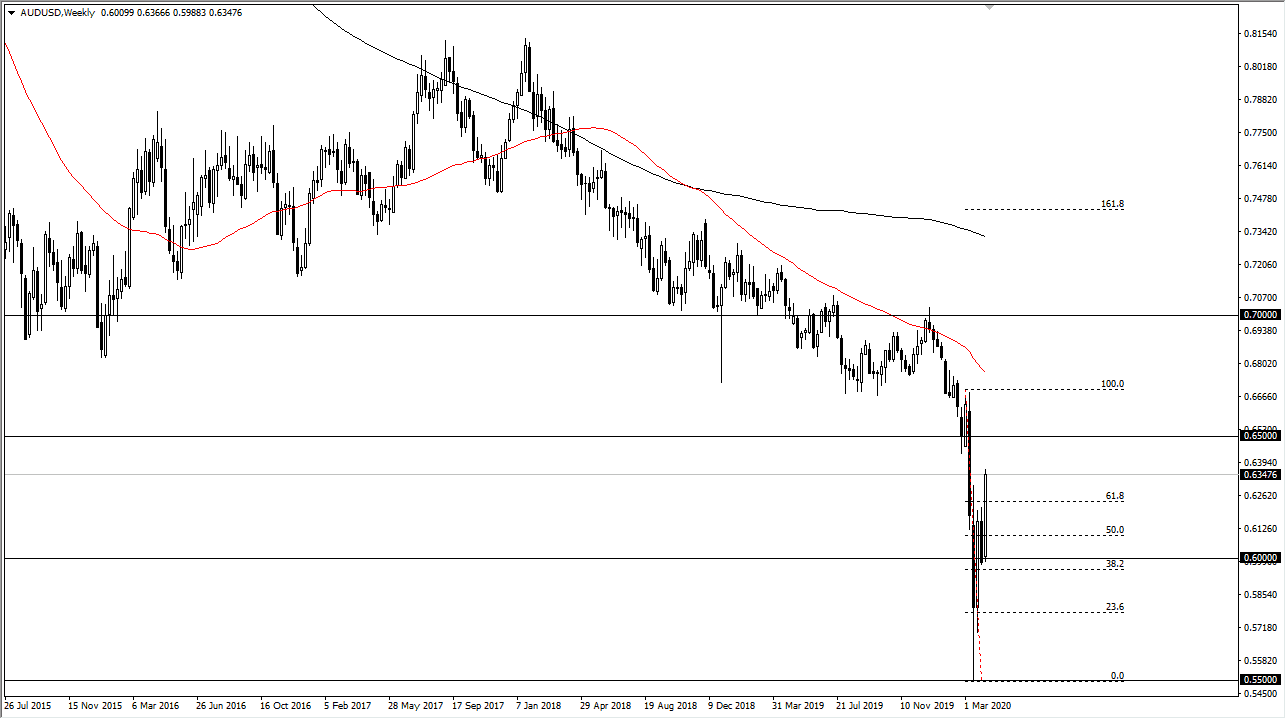

AUD/USD

The Australian dollar continues to flex its muscles, showing extreme strength. Ultimately, this is a market that has led the way against the US dollar, and it does suggest that the market is probably going to try to get to the 0.65 handle, perhaps after having a bit of a dip. It’s possible that the market is extraordinarily noisy during the week.