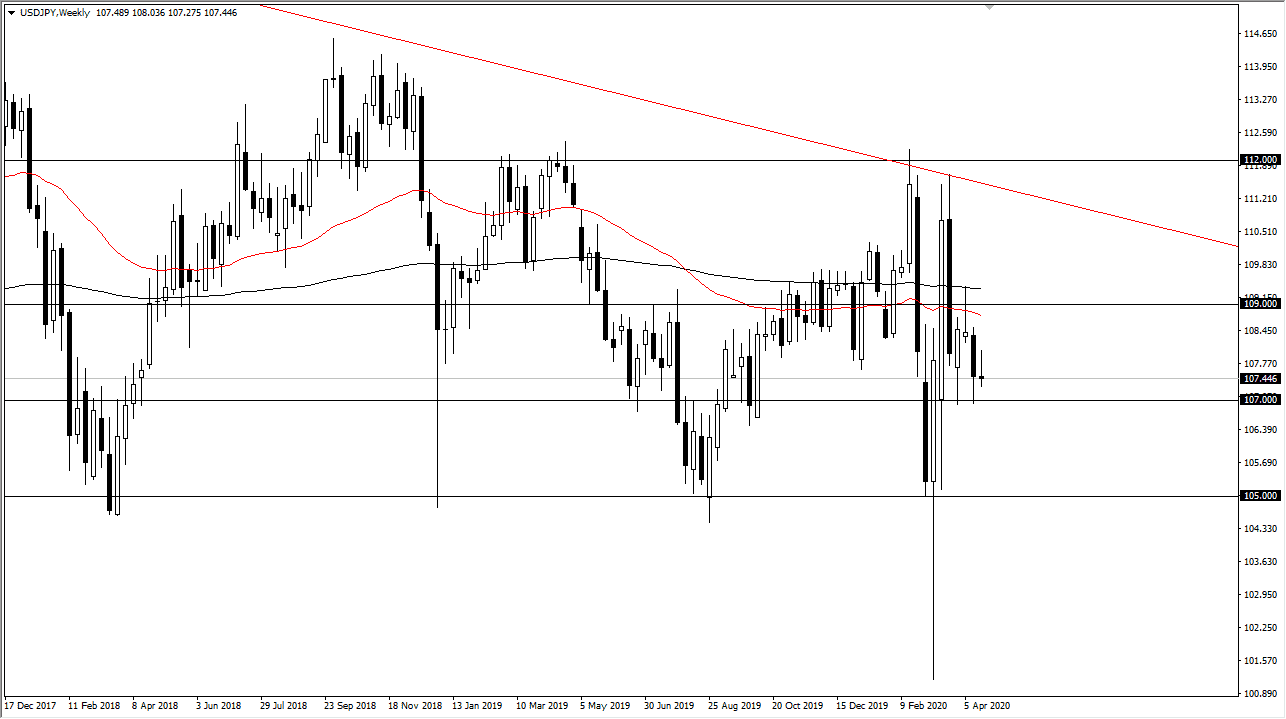

USD/JPY

The US dollar spent most of the week trying to rally against the Japanese yen, but you can see that we have pulled back to show signs of weakness. I recognize that there is a lot of support underneath at the ¥107 level, so I think what we are probably going to see is more of a “fading the rallies” type of marketplace until we get down below that ¥107 level. If we can get a daily close below that level, then I think we are going to accelerate to the downside and go looking towards the ¥105 level. I am slightly bearish, drifting from neutral.

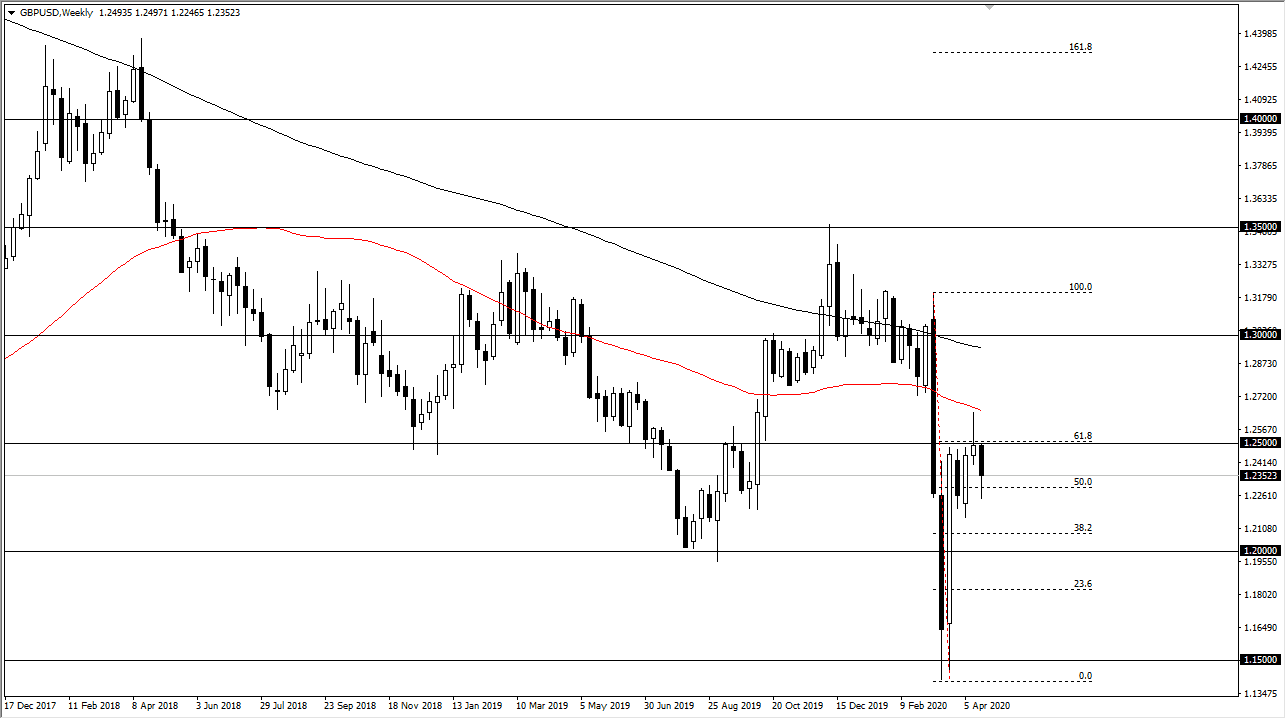

GBP/USD

The British pound fell during most of the week but spent Wednesday, Thursday, and Friday trying to recover from the lows. At this point, the market has stalled on the daily chart and it looks like we are more likely to see downward pressure than up. I look at this as a market that is one you should be fading when it rallies, and I have no scenario in which a willing to buy this market until we break above the highs of the previous week, closer to the 1.27 handle. I remain bearish of this pair in general.

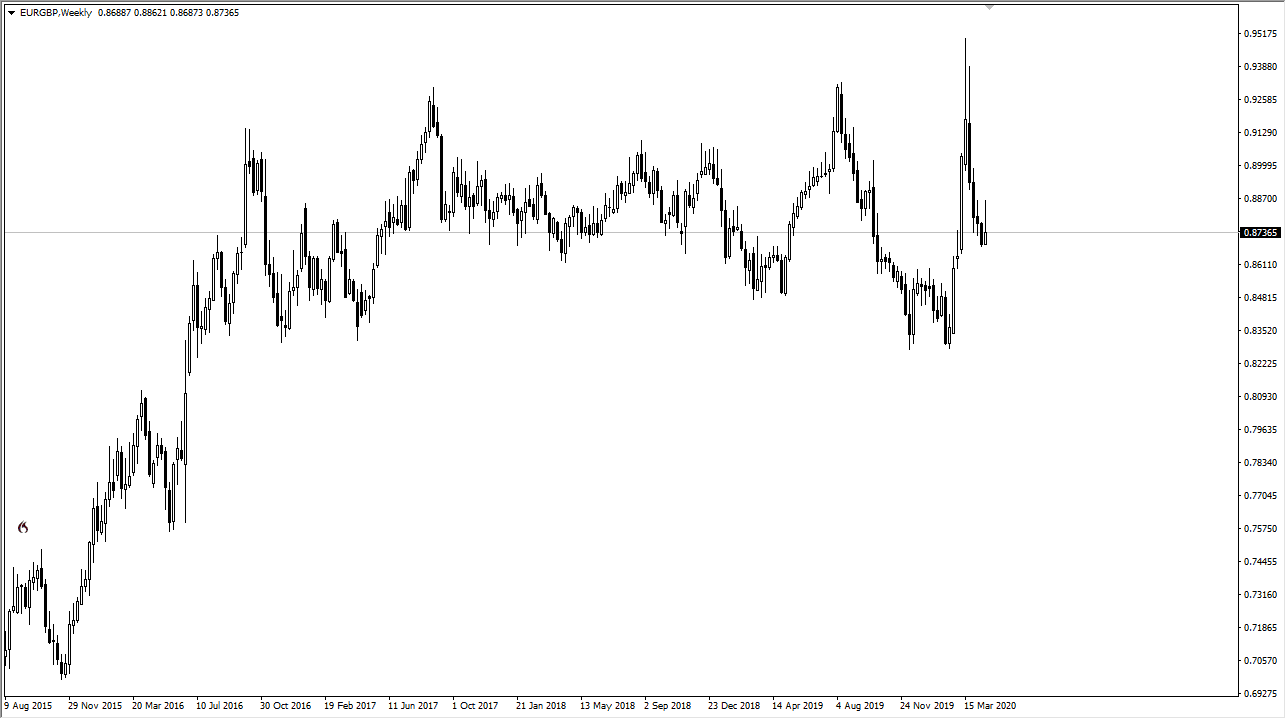

EUR/GBP

The Euro originally tried to rally against the British pound during most of the week but found enough resistance above the turn around and form a rather ugly looking candlestick. For me, it is a simple selling opportunity if we break down below the 0.8675 handle. If we do break down below that level then I think it is only a matter of time before we go looking towards the 0.86 handle, and then possibly than the 0.84 handle. If we break above the 0.89 handle, then we resume the bullish pressure. That being said, the candlestick for the week was rather ugly.

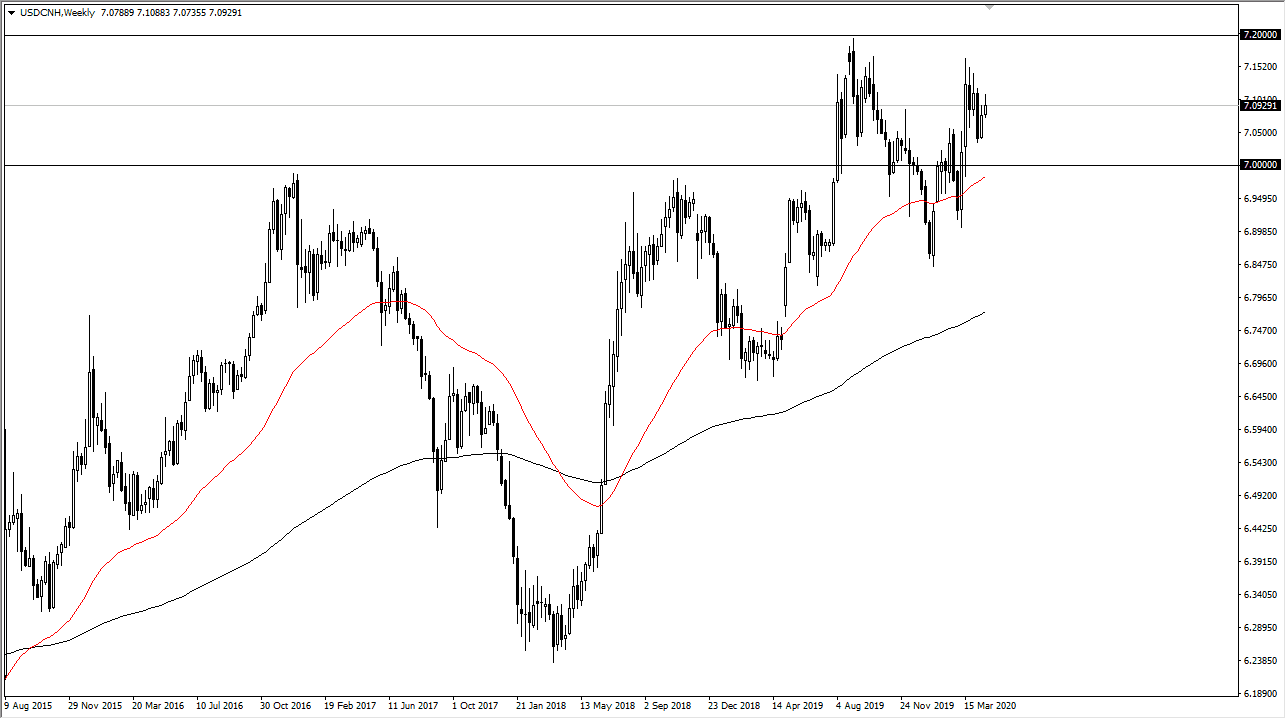

USD/CNH

The US dollar gained against the Chinese Yuan during the week but did give back about half the gains. With this looks like to me is a rocket that is trying to grind its way higher but there is obviously a significant amount of resistance above that could continue to cause some issues. While I do not necessarily trade this pair very often, what I do use it for is a risk sentiment indicator. The higher it goes, the less risk appetite there is. Currently, it looks like there are a lot of issues under the surface and we may see some of the riskier assets out there suffer a bit.