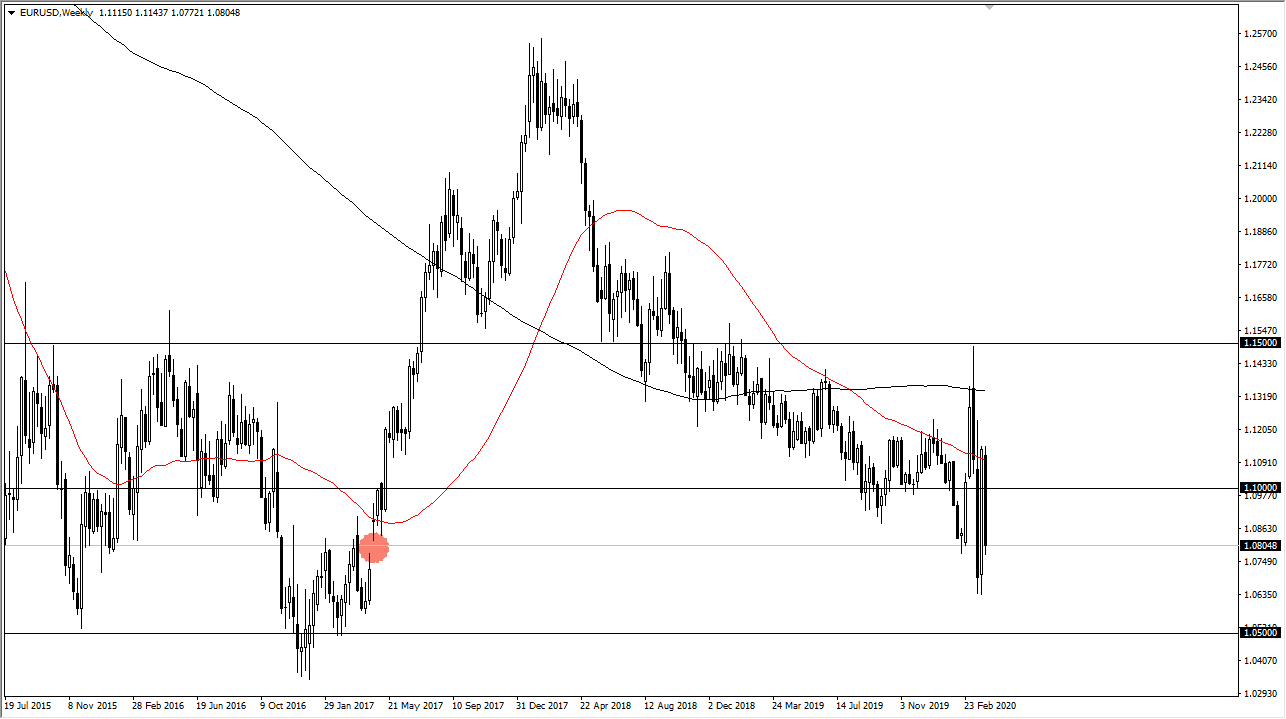

EUR/USD

The Euro broke down a bit during the course of the week, slicing through the 1.10 level. This was a very negative candlestick and it’s very likely that we continue to see sellers on short-term rallies. The Euro continues to struggle overall, and of course the US dollar has the benefit of having the US treasury markets behind it. Ultimately, I believe that we revisit the bottom of the recent couple of candles, meaning somewhere near the 1.0650 level. If we can break down below there, the market then goes looking towards 1.05 handle. I have no interest in trying to buy this pair right now.

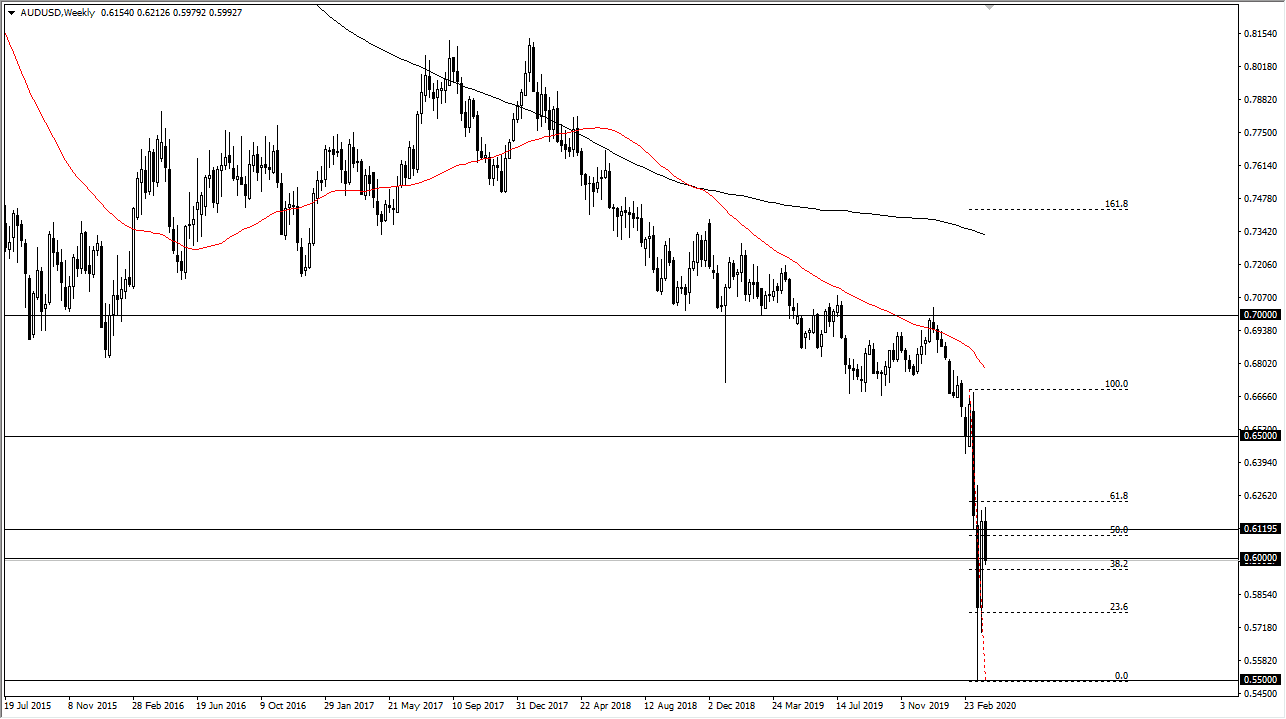

AUD/USD

The Australian dollar fell during the week after initially trying to rally as well, and it does have a pretty high correlation to the EUR/USD. Because of this, I think that both pairs will move in the same direction, grinding their way to the downside. We closed just below the 0.60 level, and it’s likely that the market could go down to the 0.58 level. We could go even further than that, but you can see that there has been a lot of buying pressure underneath. At this point, the Australian dollar doesn’t seem very likely to rally from the longer-term concept as the global economy is at a standstill. I like fading rallies.

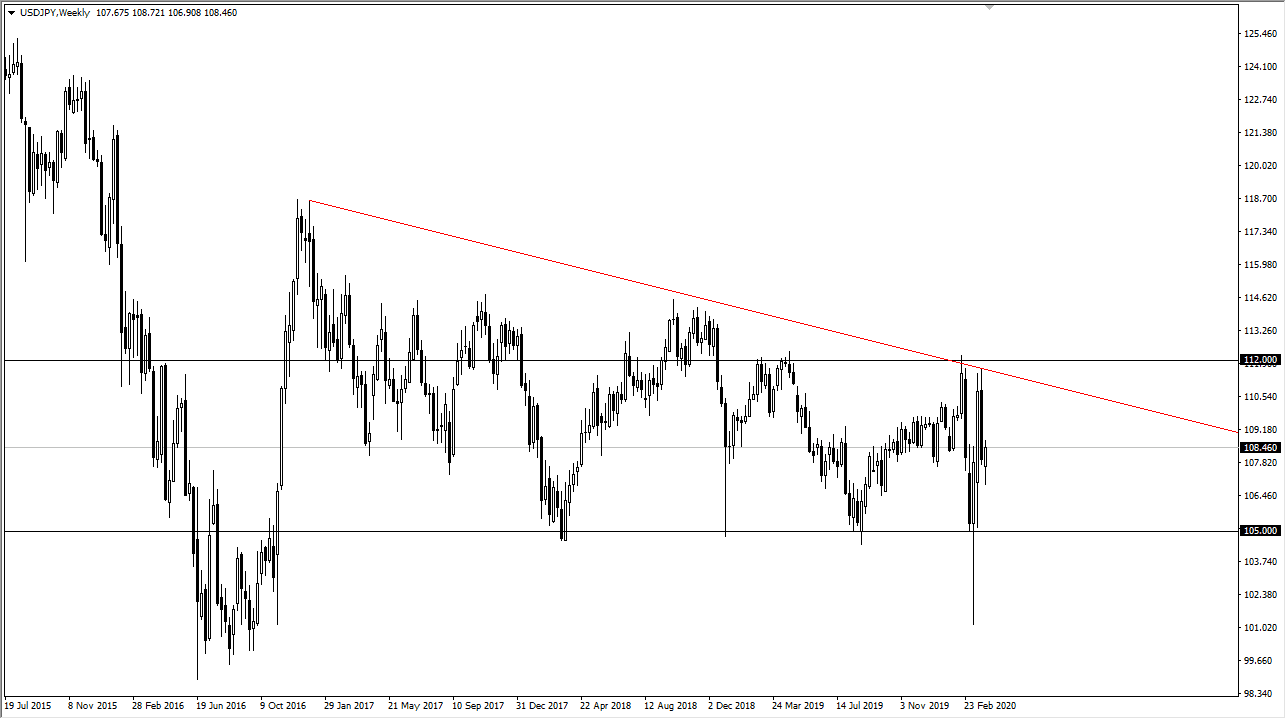

USD/JPY

The US dollar is currently hanging around the ¥108 level. This is a market that is essentially in the middle of the overall range, with the ¥105 level underneath being supported and the ¥112 level above been resistance. At this point in time, the market looks to be essentially in the range of “fair value”, so I’m pretty neutron this market but if we get to the outer ranges of this consolidation area, then I would fade that move. Keep in mind that the market is highly sensitive to risk appetite so that could come into play as well.

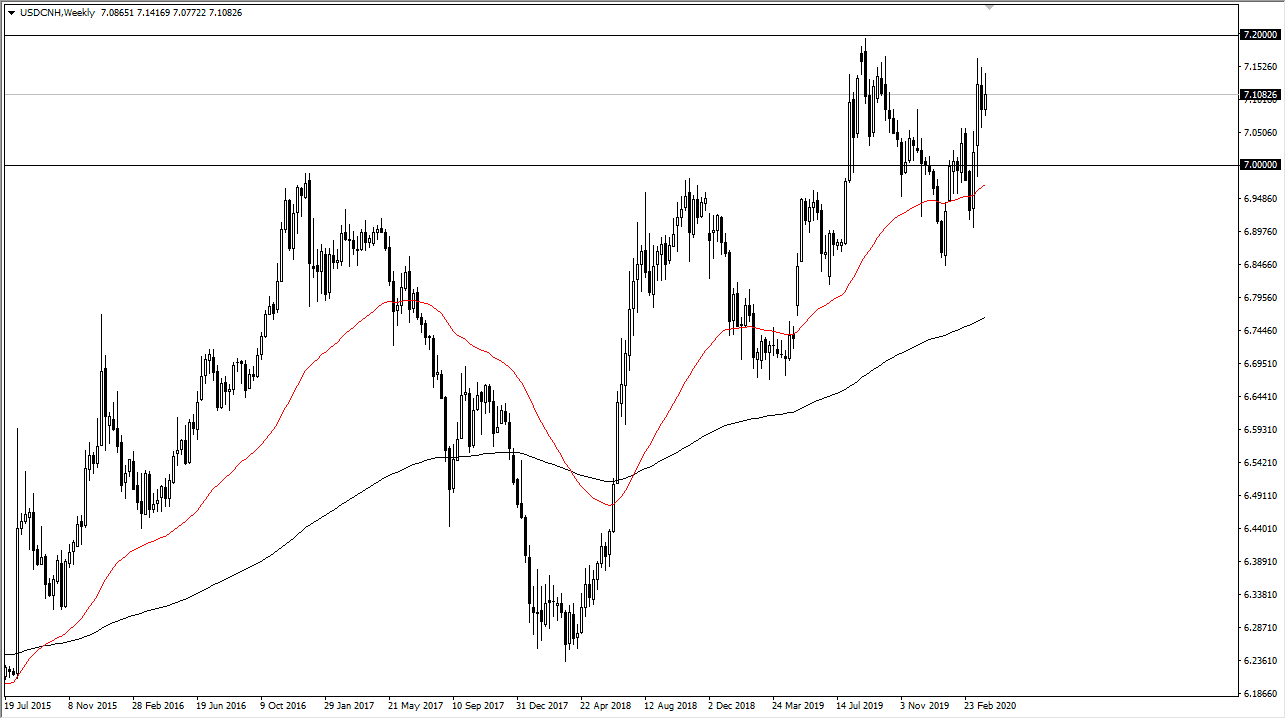

USD/CNH

The US dollar initially tried to rally against the Chinese Yuan during the week but ended up forming a bit of a shooting star. The market clearly doesn’t want to go much higher than 7.15, so it’ll be interesting to see how this plays out. If it drops, that could be a good sign for risk appetite but at this point we are still very highly elevated in this pair, showing just how much concern there is with the global economy as money floods into the US dollar.