The gold markets were closed on Good Friday obviously, but when we look at the Thursday candlestick the clothes was rather impressive. In fact, we closed above the psychologically important $1750 level, which is in fact a huge victory for gold buyers. After all, a couple of days ago we had formed a shooting star and now that we have broken the top of that shooting star, that means that anybody who was a seller from three days ago is now underwater and losing money. They will have to buy gold in order to close out the short positions.

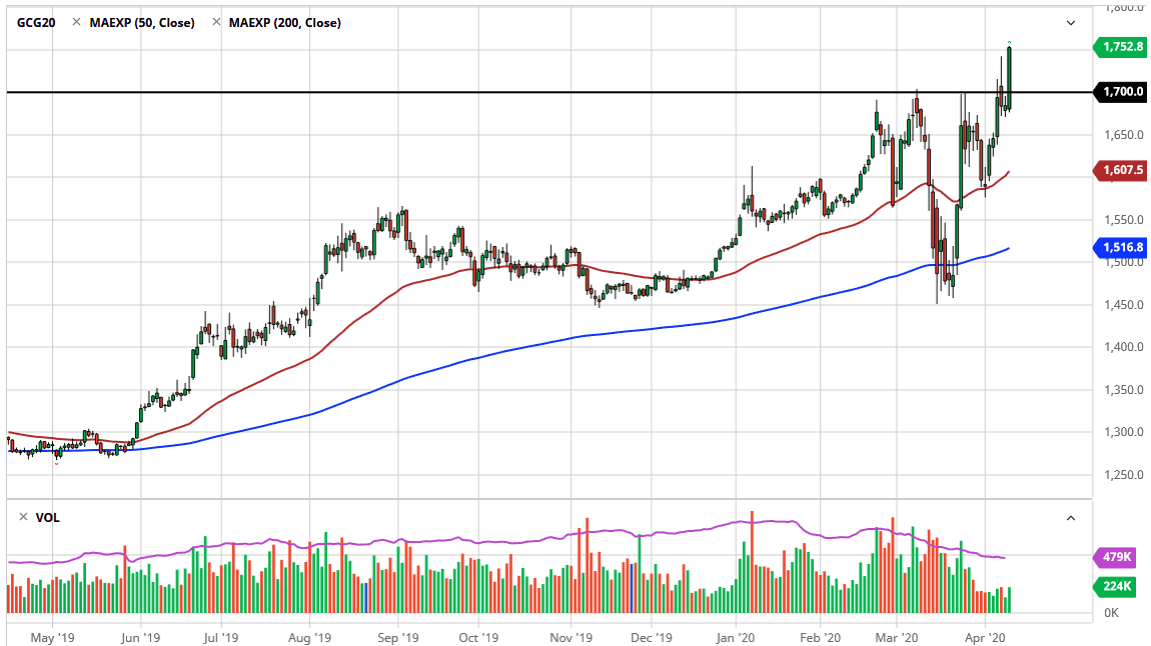

Looking at the chart, we are obviously in an uptrend and it shows that you should be buying gold, not selling it. While we closed the very top of the range that is a very bullish sign, but I also recognize that we might be a little bit overextended in this market. If that’s the case, then a pullback is coming but I think that somewhere around the $1700 level, perhaps extending down to the $1680 region. I think every time we pull back; you should be looking for an opportunity about gold because it is so obviously bullish and furthermore there should be plenty of fundamental reasons for gold to continue to go higher.

Keep in mind that the world has plenty of fear right now, and this of course has people looking towards gold as it typically will do. Furthermore, the Federal Reserve has decided to throw out $2 trillion worth of more stimulus as central banks around the world continue to flood the market with money. If that’s going to be the case, then precious metals will of course continue to perform very well. In fact, I believe that the market is still massively supportive all the way down to at least the $1600 level where I see the 50 EMA on the daily chart. In the near term, I look at pullbacks as a gift, and not a reason to sell. I would add to my position slowly, but I am aiming for $1800, followed by $2000 over the even longer term. With the close where it was on Thursday, I would not be a buyer here because obviously there will be a pullback eventually, because the last thing you want to do is to “chase the trade”, as it is a great way to find yourself under financial pressure.