Gold markets rallied a bit during the trading session on Friday after initially pulling back. The jobs number ended up being a loss of 701,000 jobs in the month of March, and that had people running for a bit of safety. That being said, the momentum during the day was very sluggish and therefore I don’t know that I would look at the next move to the upside as one that probably will fail to break out as well.

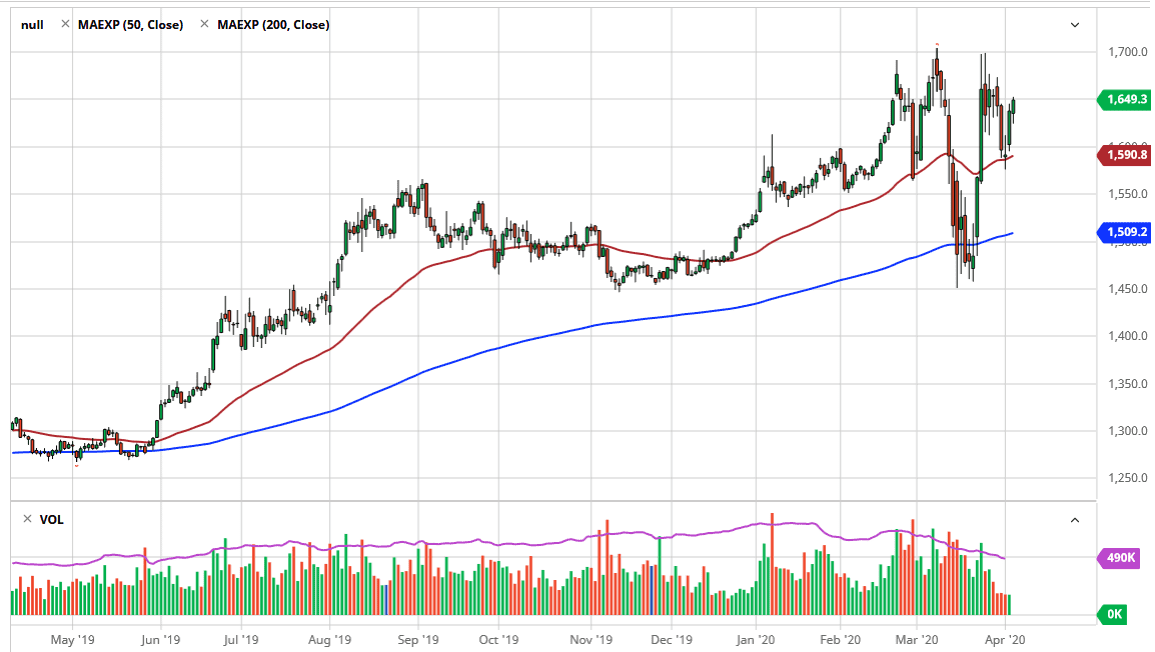

Ultimately, if we do pull back from here, I do think that there is plenty of support near the 50 day EMA. That is just below the $1600 level, and therefore I think that the buyers will probably continue to jump into this market on dips. Even if we were to break down below that level it’s likely that the market could go down to the 200 day EMA level underneath, which is closer to the $1500 level. Ultimately, I think that the market will find plenty of reasons to support gold, not the least of which would be based upon central banks around the world. They continue to loosen monetary policy and that is normally one of the biggest drivers of gold to the upside. That being said, if we do break above the $1700 level it should be noted that we will have just formed an inverted head and shoulders that we break out of.

Ultimately, this is a market that I think it’s only a matter of time before we take off, because we have the safety and the monetary policy situation. At this point, the market is in an uptrend and there’s no reason to fade it, and it’s likely that we will continue to see buyers on dips looking for value. Ultimately, this is a market that I think continues to see a lot of choppiness, and therefore it’s probably going to be messy enough to keep your position size small if you are smart. You can add once the market starts to work out in your favor, but until then you want to keep your position size small due to the fact that there are so many moving pieces and potential headlines out there that could cause all kinds of chaos with your trading situation. Longer-term I like it, but I also recognize it can be very dangerous as we continue to see so much volatility.