The West Texas Intermediate Crude Oil market has rallied again to close out the week on Friday, but most of that rally is probably do more to short covering than anything else. After all, the market has been sold off roughly 65% since the highs and heading into a weekend where we could see an announcement of a production cut, it makes quite a bit of sense that short sellers might be taking profit and getting out of the way. After all, you could wake up Monday morning to a huge gap higher. Having said that, it can work in the other direction as well.

As for myself, I believe that the market is setting up for a nice move. While I do think that we have further to go to the upside, the one thing that a production cut can’t change is the lack of demand. It looks like we are going to see a significant lack of demand for quite some time, and then of course there is a glut of crude oil out there. Furthermore, the market is literally running out of storage space, and although we are starting to see murmurs of a potential production cut, the reality is that almost as soon as Trump tweeted about the possibility of a production cut, Russia suggested that there wasn’t much to the story. This is why I think it’s only a matter of time before we rolled right back over. Having said that, I don’t want to jump in and start shorting randomly.

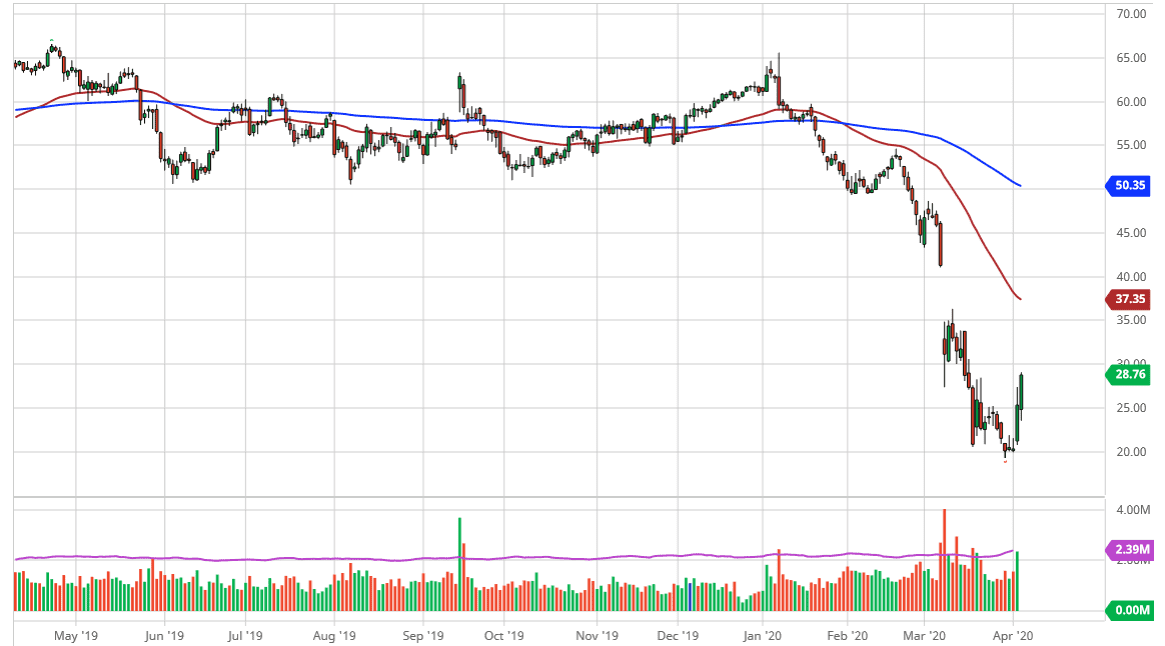

I see the 50 day EMA which is racing towards the $35 level as the first truly resistive level above the $30 level which we did try to get to during the Friday session. At this point, I think there are a couple of scenarios that could play out. The first one is that either Saudi Arabia or Russia blows of the deal, and that of course will have crude oil falling apart. On the other hand, we could also see them do some type of production cuts, and then we could see the market go racing towards the gap above. Having said that, we eventually then have to focus on the fact that there aren’t that many people out there trying to buy crude oil from a structural standpoint. Because of this, it’s very unlikely that the rally that we are seeing will last more than a couple more days.