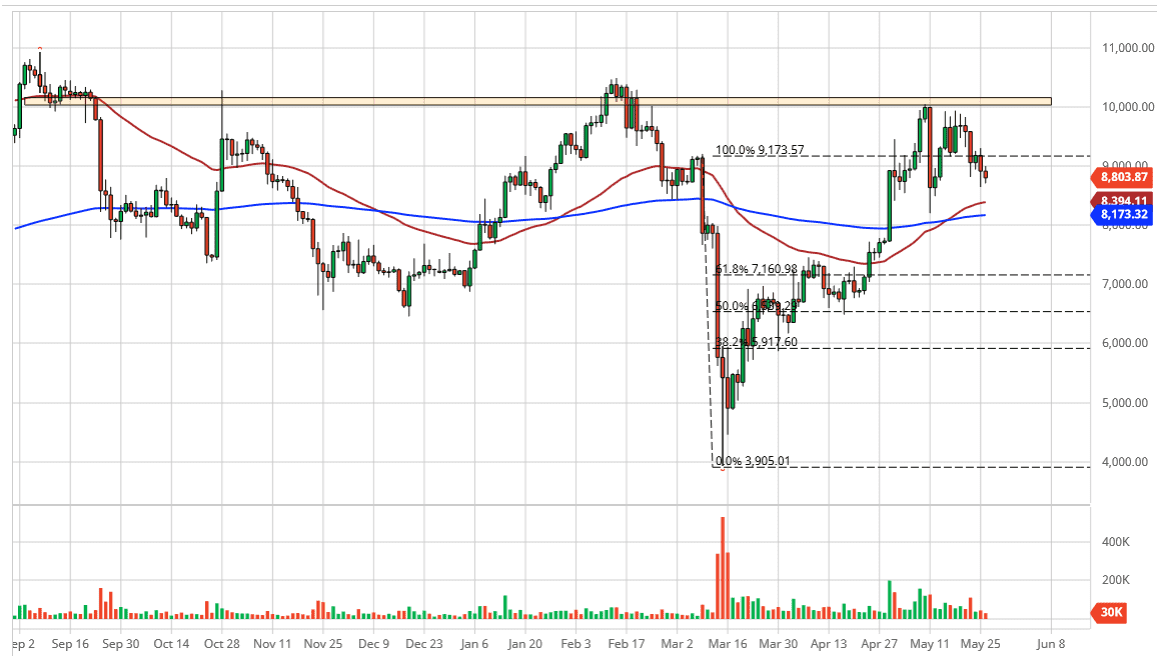

The bitcoin markets have fallen just a bit during the trading session on Tuesday, as we have seen quite a bit of noise as of late. The 8800 level is significant in the short term, extending down to the 50 day EMA. The 50 day EMA is an area that does tend to attract a lot of attention when it comes to Bitcoin. The 200 day EMA underneath there is just waiting to happen for support as well, so having said that it is likely that the market will continue to find buyers underneath, and as a result I believe that Bitcoin will find buyers eventually.

Looking at the chart, we have been bouncing around between the $8000 level on the bottom and the $10,000 level as consolidation. I think the market is trying to figure out where it wants to go given enough time, but in the meantime we are trying to see where we are going to go next, so if you can find some type of impulsive candlestick to trade off up, that might give you a heads up as the where we go next. All things being equal, the $10,000 level has been a major resistance barrier that is been exceedingly difficult to crack. I think that will continue to be the case, so do not be surprised at all to see this market continue to find plenty of sellers in that region. However, if we were to break above that level it is likely that the $11,000 level would be targeted next.

To the downside, if we clear the $8000 level, I will anticipate that sellers start looking to aim towards the $7000 level. This is a market that seems to be rather noisy to say the least, and it looks to me as if we are either trying to digest gains, or perhaps distribute for an eventual breakdown. Once we break out of this $2000 region, then we could get some follow-through. In the short term, it is likely that the market simply goes back and forth, trying to chop up as many trading accounts as potential. That is what a lot of these thin markets are good for, so yet to be overly cautious about trying to pile and at one point. That being said, it looks like we are simply going to go back and forth and take advantage of short-term trading opportunities going forward.