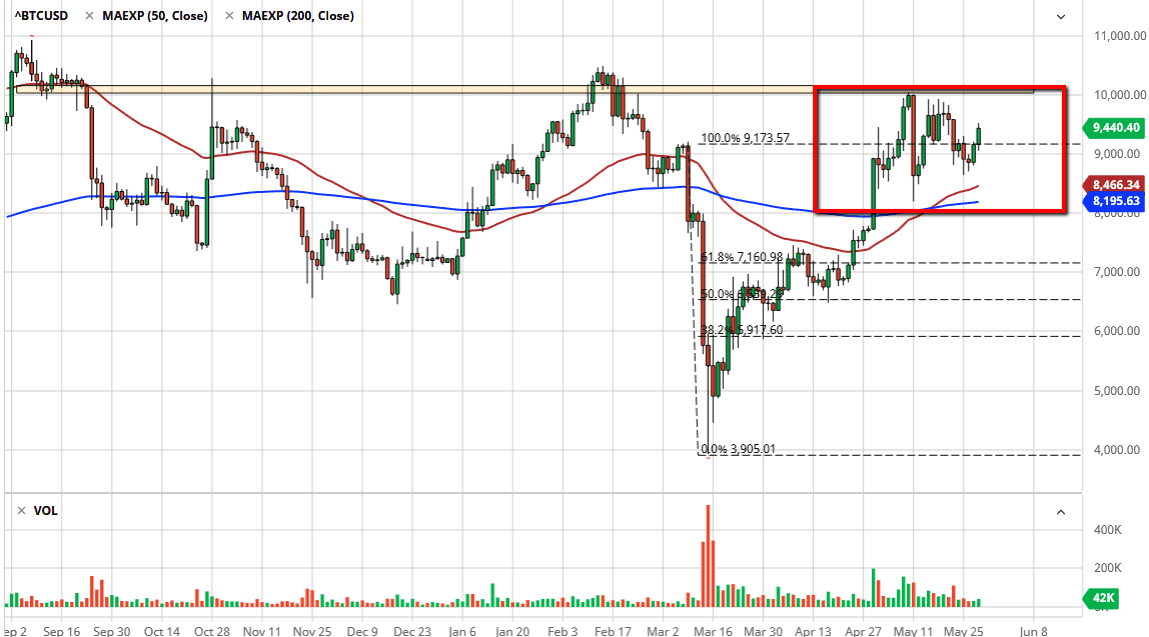

The bitcoin markets have gone back and forth during the last couple of weeks, and during the session on Thursday, the buyers had more to say. At this point, the market is likely to continue going back and forth between the $10,000 level on the top and the $8000 level on the bottom. Unless there some type of catalyst though, I do not see this market breaking out of this $2000 range very easily. After all, we have already had the halving in the rearview mirror, so now we have to see what comes next.

There are lot of concerns when it comes to central bank printing, but remember that currencies are a relative game, meaning that just because the US dollar should be going down does not mean that it will. After all, central banks around the world continue to do the same thing and while this is a bit of a help for the argument of owning Bitcoin, the reality is that Bitcoin is not widely adopted yet. Whether or not it will be is a discussion for another time, but right now the reality is that most people do not use it. For that matter, most people do not even know how to get it.

All of that being said, price is the most important thing to pay attention to and it looks as if we will try to go towards the $9800 region before running into resistance again. We may pull back in the short term, but I think somewhere around the $8600 level there is significant support, and most certainly at the 50 day EMA, the 200 day EMA and then obviously the $8000 level I like buying dips more than anything else right now at least until we break down below the $8000 level, something that I do not see happening in the short term. That being said, you should be overly cautious about Bitcoin though, because the volume is extraordinarily thin right now as per usual. With so few transactions taking place, it is something to pay attention to as the market is simply killing time and looking for some type of catalyst. As I am sure you are aware of buy now though, once the market makes up its mind to go to particular direction, it can be quite drastic. Because of this you need to keep your position size reasonable.