The Bitcoin market initially pulled back just a bit during the trading session on Tuesday after the long-awaited halving on Monday. That being said, the market did recover a bit but has a long way to go to recapture all of the losses from the Monday session. Because of this, I think it will be more of a grind higher because of the obvious headline interest in Bitcoin. Remember, there is a lot of new money that flows into this market every time the headline start increasing again.

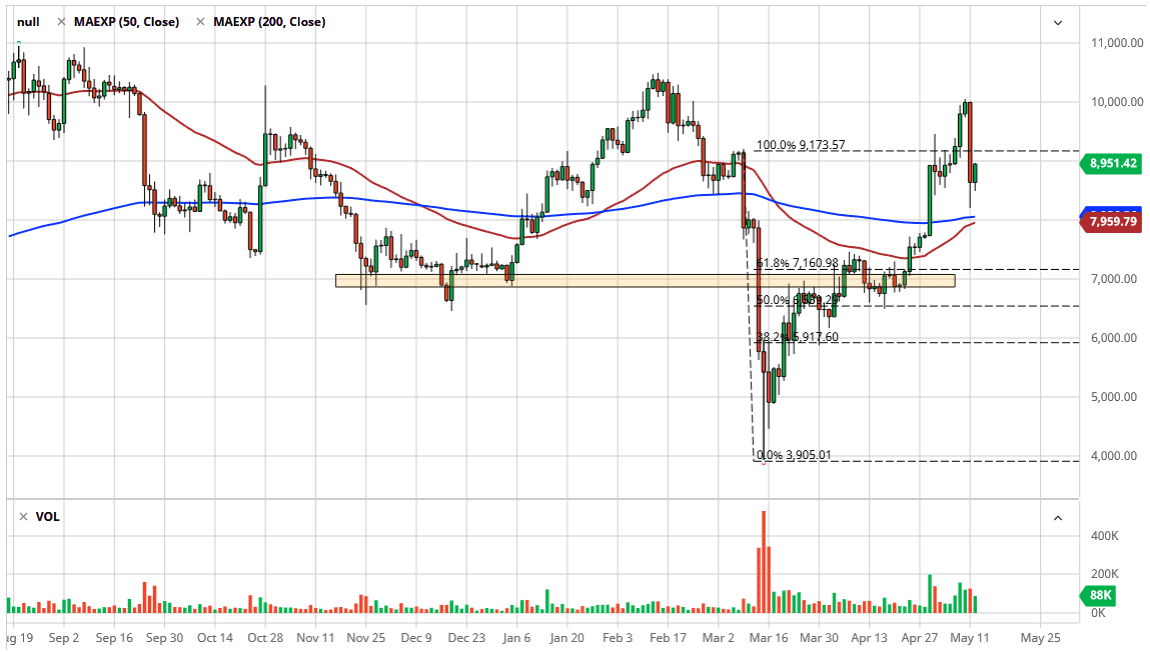

Looking at the technical picture, the 200 day EMA sits just below and starts to slope a little bit higher. At this point, a lot of longer-term traders will look at this as a potential opportunity. Ultimately, we should also look at the fact that the 50 day EMA is starting to turn higher just below there and is ready to do the so-called “golden cross” that we see from time to time. This is a strong technical indicator and it should be noted furthermore that we have seen volume pick up over the last couple of days as well, which certainly helps momentum.

To the downside, even if the market were to break down below that level, it is likely that we go looking towards the $7000 level. However, this is a long shot at this point considering just how strong this market has been. The question now is whether or not fresh money comes into support this market, or if we get some type of major sell off again. So far, it does look like people are willing to step in and pick up a little bit of Bitcoin, so nothing has changed so far to suggest that the trend is going to rollover. To the downside, that $7000 level will of course be crucial and if we were to break down below it would obviously be an extraordinarily negative turn of events. So far though, it looks like traders are willing to step in and pick up a little bit and add when the position works out in your favor. If the market can break above the $10,000 level that would be a very bullish sign, sending this market looking towards the $11,000 level. At this point in time I think the one thing you can probably count on is a lot of noise and choppy volatility, so remember to be cautious with your position sizing.