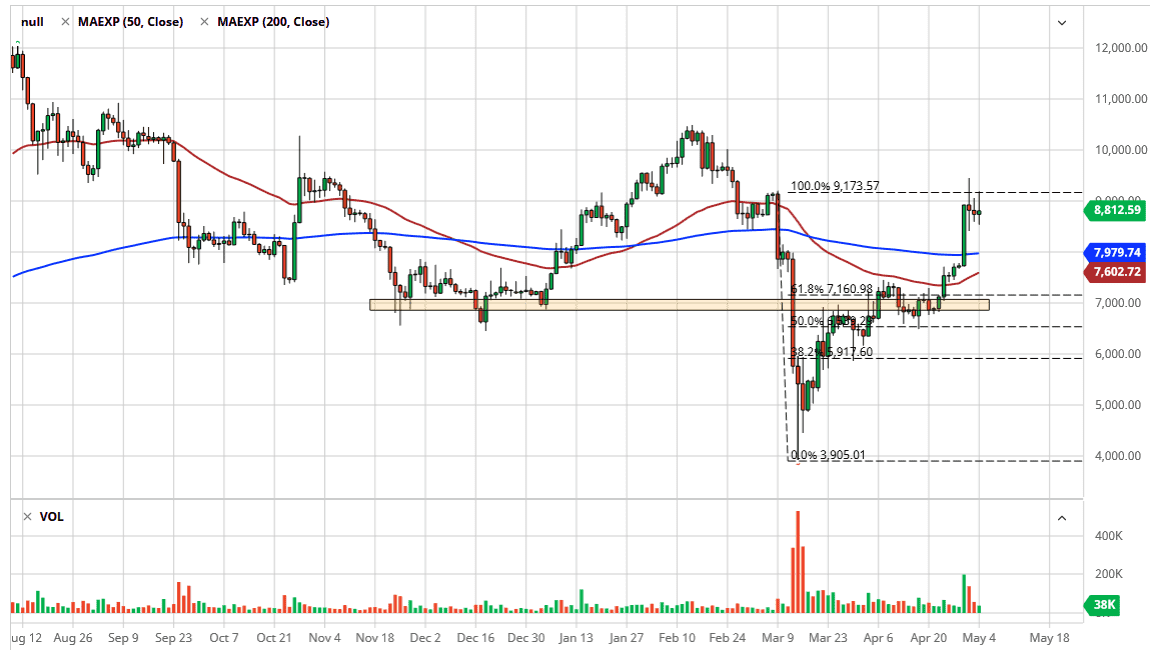

Bitcoin markets did nothing during the trading session on Monday for the third day in a row, which makes quite a bit of sense considering that the market is currently testing the $9000 level, an area that offer a lot of supply. While a lot of traders are chirping about the halving this month, the reality is that everybody already knows this is the case. In other words, the idea of the halving has already been priced into the market. However, a lot of retail traders seem to think that as soon as it actually happens, Bitcoin is going to suddenly explode straight up in the air.

That being said, the market looks likely to continue to see a lot of noise in this general vicinity, and although it does look bullish in general, the reality is that the market is probably going to need to pullback in order to build up the necessary movement to the upside. At the very least, the market is likely to see sideways choppiness in order to feel comfortable at this high level. If that is going to be the case, then the one thing that I will be doing is suggesting that selling Bitcoin makes any sense at this point. If any of you have been following me here at Daily Forex, you know that I do not necessarily believe in Bitcoin longer-term, but price is price, and I do not argue with the markets.

That being said, it is likely that any pullback towards the 200 day EMA, the $8000 level essentially, should find buyers based upon offering a bit of value in of course the fact that the 50 day EMA is ready to reach towards the upside. If the market does in fact cross above the 200 day EMA via the 50 day EMA, then it features the so-called “golden cross.” However, that is normally a signal that lags what is going on in the markets, so I do not pay too much attention to it.

The last couple of candlesticks on the daily chart have shown a lot of hesitancy, so it does make quite a bit of sense that we may pull back based upon that alone. Having said that, if we can break above the massive shooting star from last week, then the market is likely to go looking towards the next round figure, the $10,000 level.