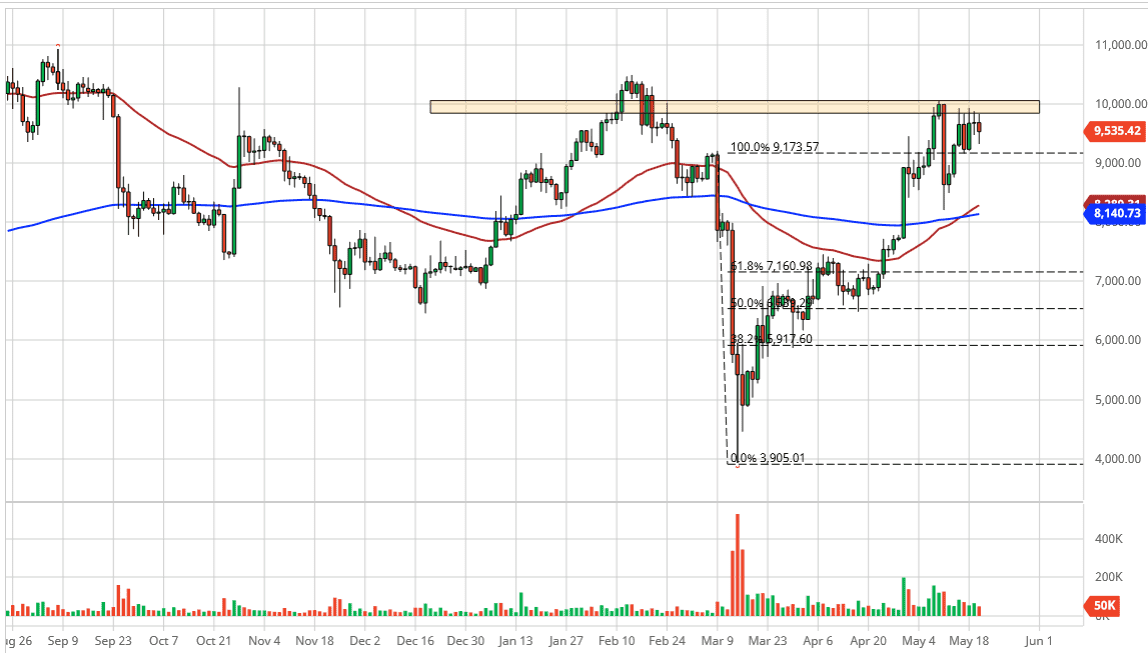

Bitcoin markets have gone back and forth during trading again on Wednesday as the $10,000 level above continues offer significant resistance. At this point, it is quite interesting to watch how the market has swung back and forth in a relatively tight range, about $800 or so. At this point in time, the $10,000 level will continue to attract a lot of attention, as it has created a major sell off recently. Ultimately, I think that the market is trying to figure out where it is going next, and with the recent halving of rewards, the theory is that Bitcoin should go higher.

That being said, it is likely that we are going to continue to go back and forth in order to make a move. If we can break above the $10,000 level, then we will probably try to break out towards the $11,000 level, just as a break down below the $9000 level opens up the possibility of a move to the 50 day EMA. At that point, I suspect that the buyers are still going to be rather aggressive on dips, especially as we just had the longer-term “golden cross” signal with the 50 day EMA breaking above the 200 day EMA.

The markets will continue to chop around cause headaches for everybody, so at this point it is likely that you are best served to look at Bitcoin from a longer-term perspective. Simply put if we can break the $10,000 level it should continue to go much higher. On the other hand, if the market were to break down below the 50 day EMA, it is likely that we will continue to go much lower. The problem with Bitcoin is that it does not necessarily move on anything in particular, as it is a “moving target.” What I mean by this is that sometimes it will move higher due to US dollar weakness, but at other times it will come down to some type of central bank headlines. Furthermore, it will sometimes track right along with gold, but other times will completely ignore it. At this point, it looks like we are running out of momentum, and that is something that Bitcoin is highly susceptible to as it is essentially a “fear of missing out” type of market. In other words, everybody jumped in at the same time and in waves it seems. At this point, the market is simply hanging out trying to figure out what it wants to do next.