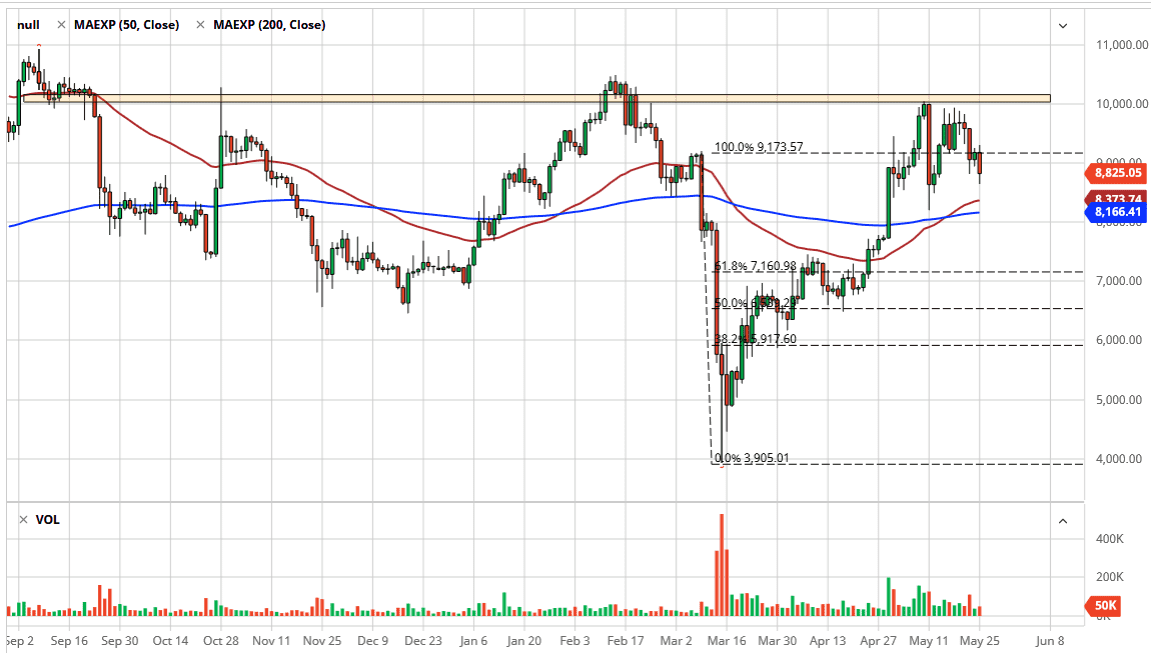

The Bitcoin markets fell a bit during the trading session on Monday, which of course was Memorial Day in the United States as well as a banking holiday in the United Kingdom and several other places around the world. With that being the case, the market will have been a little bit more thin than usual. The candlestick of course is rather negative, but it does seem like the $8800 level is trying to offer a little bit of support as we have seen of the last couple of weeks. This is minor support though, so it is very unlikely that the level holds without some type of positive catalyst.

That being said though, the 50 day EMA underneath offers support, and it is likely that we will continue to see a lot of back and forth. If we do break down below there then the 200 day EMA sits at the 8166 level, which could come into play, but I think the real support is probably closer to the $8000 level. After all, it is a large, round, psychologically significant figure, and as a result will attract a certain amount of attention.

I think that Bitcoin remain somewhat bullish, but it of course has gotten a bit overdone and therefore a little bit of back-and-forth trading makes sense as traders are trying to figure out whether or not we can finally break above the $10,000 level. That is an area that has seen a lot of selling pressure in the past, so if we do break out above there it is going to take some type of big catalyst. I do not think that happens in the short term, so between $8000 and $10,000 will be where this market goes back and forth over the next several trading sessions. If we do break down below the 200 day EMA and the $8000 level though, then it is possible we could go down to the $7000 level but ultimately, I think that is going to take a bit of effort as well. Quite frankly, I think we simply go back and forth in order to build up enough momentum to go one direction or the other. Ultimately, the market continues to be noisy in general, and I think that makes sense as there are a lot of questions as to whether or not Bitcoin can break this barrier, and of course nobody really knows what is going on with the economy right now from what I have seen looking at various markets.