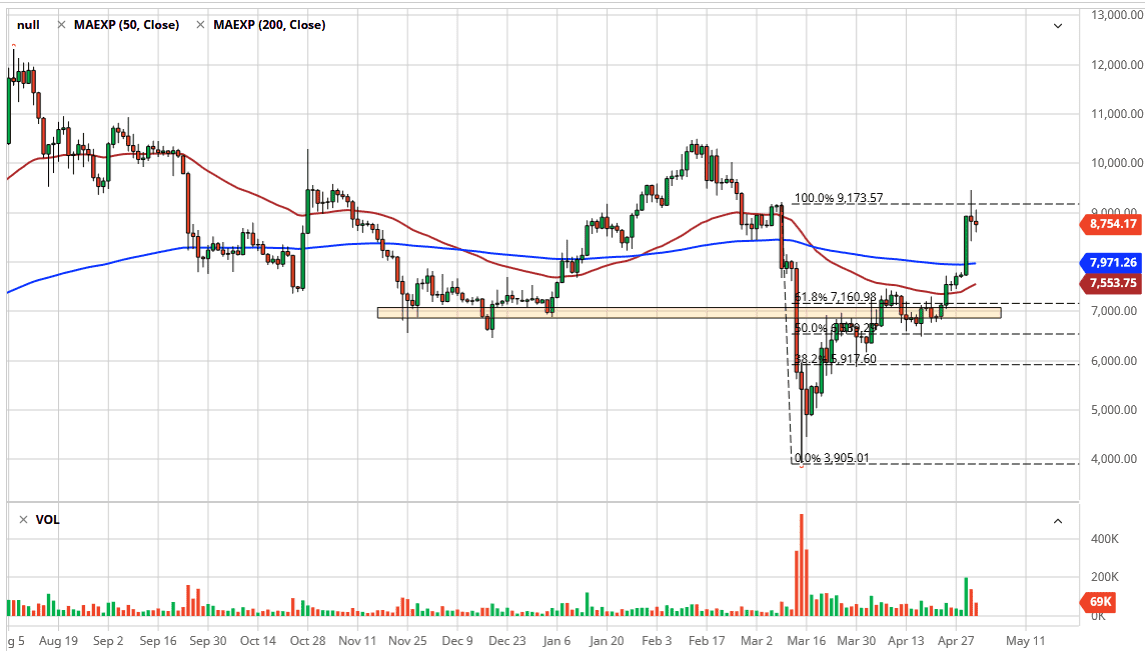

Bitcoin has gone back and forth during the session on Friday, just as it had done on Thursday, albeit in a much less volatile range. Because of this, it is likely that we are going to see a little bit of a pullback, simply because we may have gotten a bit ahead of ourselves. It should be noted that the market is paying close attention to the $9000 level, an area that I suggest that could be a target if we broke out previously. Since we did break out and shoot straight up in the air like that, it makes sense that we would need to at least take a break before going higher.

It seems as if the Bitcoin community is focusing on the halving during the month of May, and perhaps that may be one of the catalyst that had sent this market higher. However, I think it makes much more sense to think in the terms of currency. In other words, the US dollar has gotten hit as central banks around the world continue to flood the market with liquidity. The fact that this was an area where we broke down from rather significantly now shows that we have wiped out all of those losses. This of course has a certain amount of psychological importance to it, but at this point it looks as if the market is going to make a significant attempt to get above there. That being said though, if the market pulls back, I think that the 200 day EMA should offer significant support. The 200 day EMA is currently trading just below the psychologically important $8000 level.

The market may have gotten ahead of itself, so do not necessarily think that a pullback is a death sentence for Bitcoin, just gravity taking hold. If we break above the neutral candlestick from the Thursday session, then it is likely that the market will attack the $10,000 level above which obviously will attract a lot of headlines. While the halving in May is of course something that a lot of people are paying attention to, the fact that the US dollar has lost against most other currencies only adds more fuel to the fire here in this market as the Bitcoin market is measured in the same US dollars. Buying pullbacks should be the way forward as long as the market can stay above the 50 day EMA, pictured in red on the chart.