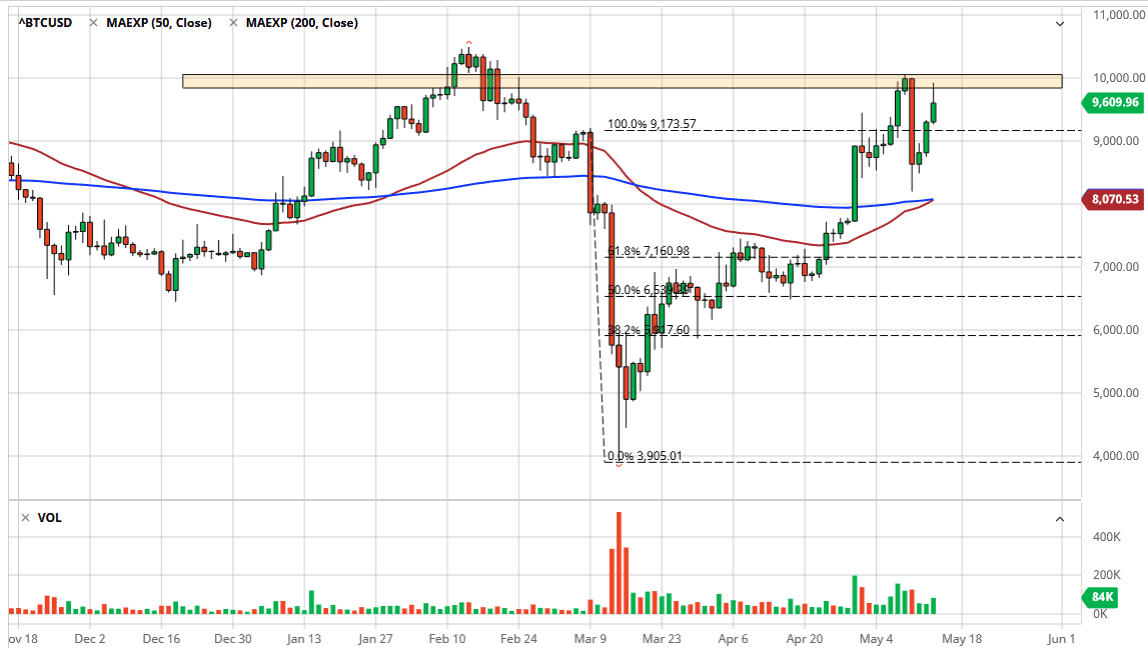

Based upon the action that we have seen during the trading session on Thursday in Bitcoin, it looks as if we are trying to carve out a new range. The resistance above at $10,000 is an area that of course will be interesting for traders as it is a large, round, psychologically significant figure, and an area that has caused resistance more than once.

The Thursday session had seen the Bitcoin market reached towards the $10,000 level before pulling back, an area where we had seen a lot of selling pressure previously, and at this point the candlestick for the session on Thursday has shown quite a bit of exhaustion, perhaps forming something akin to a shooting star. This does not mean that the market is certainly going to be extraordinarily bearish, but what it does suggest is that we simply do not have the momentum available to break above the 10,000 level.

A breakdown from the $10,000 level suggests that perhaps we are going to continue to see a bit of selling pressure appear and that there is not enough momentum to finally overcome that level. At this point in time, it also looks as if there is plenty of support underneath. Because of this, it is obvious that there are buyers underneath and I suspect that it is somewhere near the 200 day EMA which is sitting just above the $8000 region. In other words, I believe that the market is going to continue to go back and forth between the $8000 level and the $10,000 level above. This is typical of Bitcoin; it will make a significant move and then simply grind back and forth in a range for long periods of time. I believe that we are going to use this area as a way to consolidate gains, but obviously a break above the $10,000 level or a break below the $8000 level could be rather significant. Most short-term traders will probably be looking to play the market back and forth in this range as it looks to be relatively well established already. That being said, we have the halving behind us, so the next catalyst needs to happen before we see some type of significant movement. Right now, it is a little unknown as to what that could be, but it will certainly happen. At this point in time, the Bitcoin market is probably best thought of as being neutral.