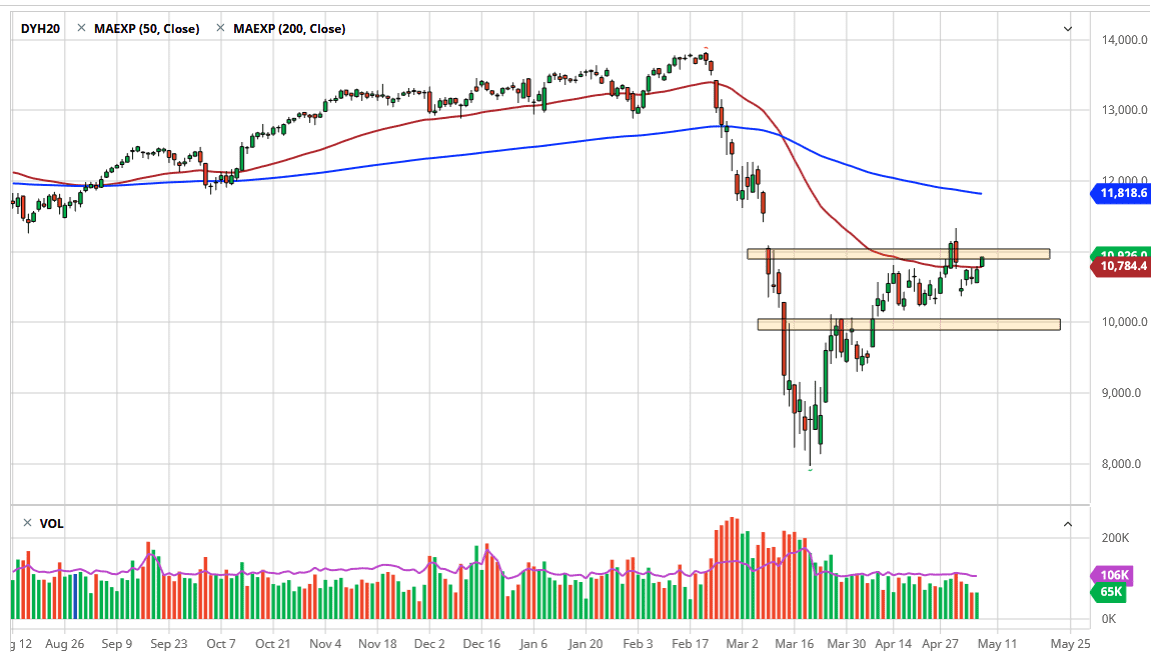

The German index had a bullish session during the day on Friday, as did all stock markets that I follow. At this point, the DAX looks as if it is trying to break out above the 11,000 level, and if we can clear that we can have a good shot at trying to fill the gap above. That being said, the market is of course looking at the 200 day EMA just above there, and I think that might be the longer-term play here. After all, the DAX has not only filled the gap down, but it has broken above it. Further making this a bullish scenario as the fact that the market is closing at the very top of the range for the trading session on Friday, which typically means a bit of continuation.

Pullbacks at this point in time should continue to offer buying opportunities, and therefore it is likely that we will find plenty of buyers in that area. Ultimately, this is a market that continues to look very bullish overall, but I do think we may have a little bit of noise ahead of us. At this point in time, if we were to break above the 200 day EMA, then it is highly likely that the market goes much higher. That being said, I think there is a massive floor underneath at the 10,000 handle.

If we were to turn around a break down below the 10,000 level, it would be an extremely negative sign to say the least and could send this market much lower. I doubt that happens though, at least not in the short term. After all, keep in mind that the market will continue to see a lot of volatility, which is quite frankly to be expected considering that the central banks around the world continue to flood the markets with liquidity and of course the European Central Bank is not going to be any different. That being said, expect a lot of choppiness but in general I believe that the easy monetary policy will continue to push the market around. Eventually though, it is highly likely that economic reality does catch up. In the short term though, this is a market that will most certainly continue to go higher based upon the technical analysis and of course the easy money. Remember, stocks move essentially on liquidity anymore instead of fundamentals.