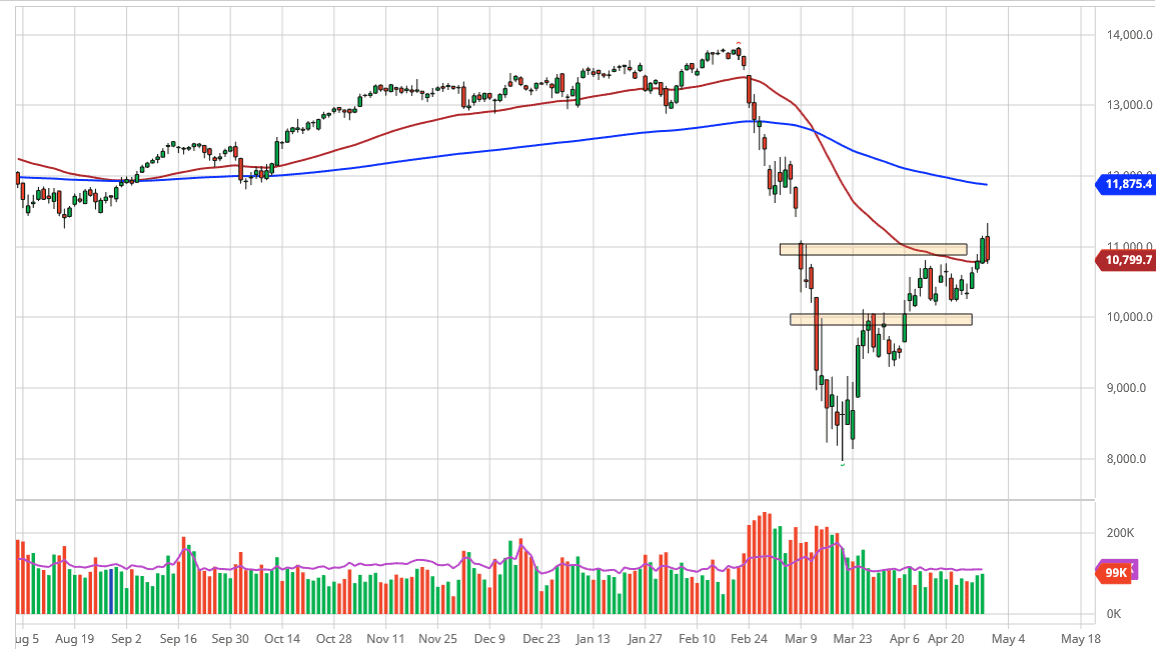

The DAX initially trying to rally a bit during the trading session on Thursday but gave back the gains as we headed into the gap that has been formed on the daily chart. Because of this, it is not a huge surprise to see that the market pulled back a bit on Thursday. Furthermore, it is May Day celebrations on Friday, so that of course will have an effect on trading in the European Union. Nonetheless, the market is currently trading right around the 11,000 level, which of course is a large, round, psychologically significant figure.

If the market can break down below the 50 day EMA, it is highly likely that the DAX will try to get down towards the bottom of the range which is closer to the 10,100 level. That is most likely of scenarios if we do get a breakdown, simply because there is a lot of support down there. Typically, markets will try to go back and forth between these areas, but there is also the possibility that we turn right back around and use at 50 day EMA as a springboard. If we do, and of course break above the highs from the session on Thursday, then the market is sent to go looking towards the top of the gap which is closer to the 11,500 level. That would coincide quite nicely with the 200 day EMA which is trying to get there as well.

While the DAX has been a bit of a laggard when it comes to major indices that I follow, they do tend to move in the same direction over the longer term. With that being said, the German index does have some catching up to do and it is likely that if the S&P 500 can overcome the 200 day EMA that it pulled back from during the session on Thursday, that will probably drag the DAX right along with it. A lot of this comes down to coronavirus numbers, so that of course can continue to have a major influence on what happens next. Ultimately, I believe that this is a market that continues to see an overall interest to the upside, but we may need to grind sideways for a little bit and perhaps get a little bit of a catalyst to have more people bullish in order to push not only the DAX higher, but indices around the world.