The Euro rallied significantly during the trading session on Wednesday, and even broke above the 200 day EMA at one point. This was in reaction to the Europeans agreeing to offer bonds that are “shared liability” in a first for the EU. This could potentially be a turning point in the history of the European Union, because one of the biggest concerns in the area of course has been that the countries do not operate in a Federation like the United States does. For example, there are bigger concerns when it comes to grease then there is Germany, and therefore it makes it a bit “uneven” when it comes to risk appetite.

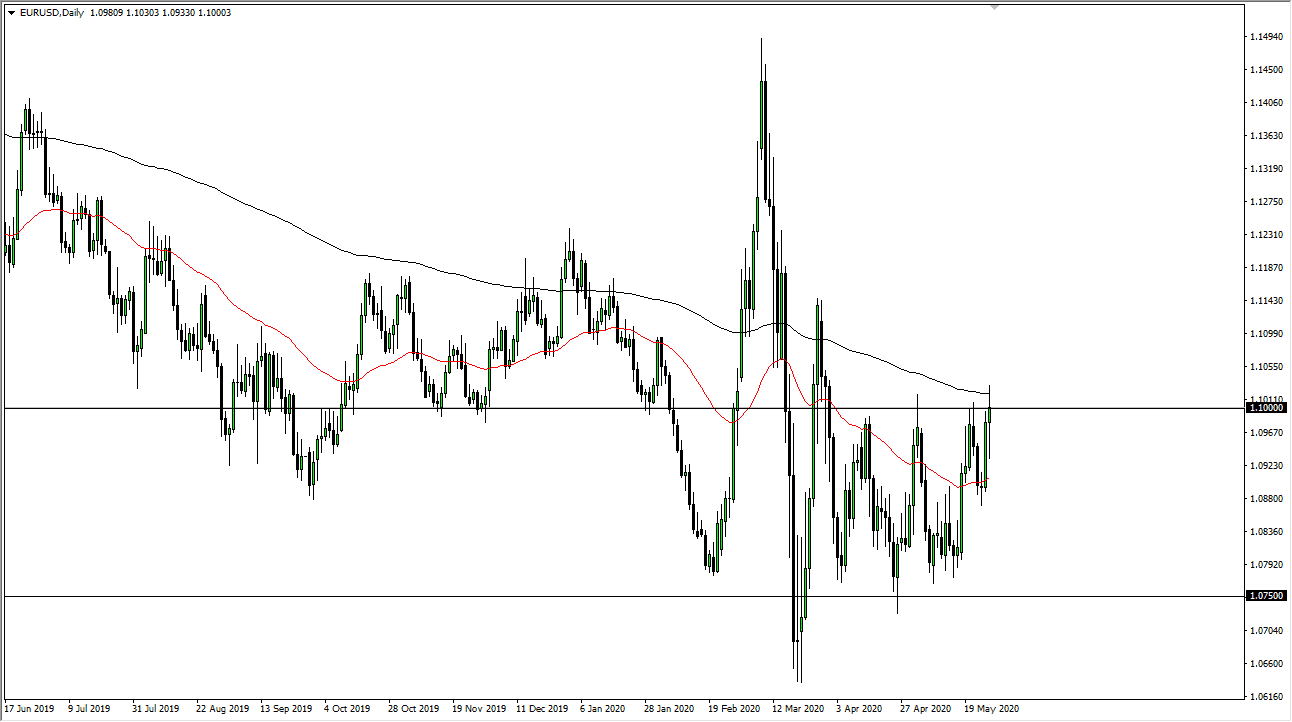

That being said, what I look at the chart from a longer-term standpoint it is remarkably interesting to see that the monthly candlesticks are forming hammers, which of course is a very bullish sign. Having said that, one of the monthly candlesticks includes that massive noise that we have seen in the recent past, so although this would normally be an extraordinarily bullish sign, the reality is that it is not going to be an easy turnaround if that is the case. Ultimately, the markets are still highly bullish on US dollar from a longer-term standpoint, so this could simply be a short-term rally even if it does kick off.

Looking at shorter-term charts, mainly the daily time frame, if we can break above the highs of the trading session on Wednesday, the market then is likely to go looking towards 1.1150 level. That was the most recent high before we dropped down into this consolidation area. On the other hand, if we break down below the bottom of the candlestick for the trading session on Wednesday, then it is likely we go looking towards 1.09 level. At this point, the Euro is all over the place and chopping around, essentially breaking accounts along the way as we cannot seem to get directionality in one way or the other. Ultimately, this is a market that tends to be very sideways overall, so keep that in mind. It is likely what we will see is a sudden change in attitude one way or the other, and then perhaps we can get involved for a longer-term move. Until then, I think we are simply going to go back and forth offering 20 to 30 pips in each direction, depending on when you start. In other words, choppy will continue to be the main attitude of the currency pair.