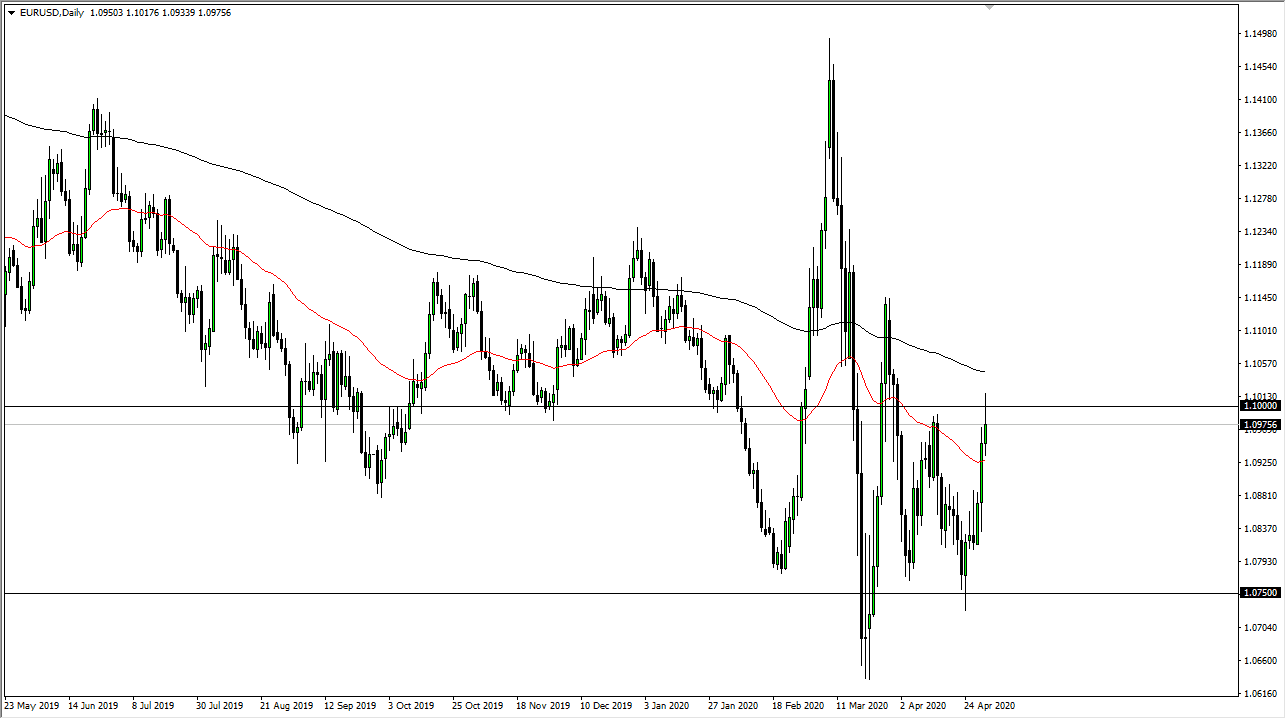

The Euro rallied initially during the trading session on Friday, reaching slightly above the 1.10 level before pulling back. The daily candlestick ended up forming a massive shooting star, which of course is a negative sign. At this point, the market looks likely to pull back from this area, and if we break down below the bottom of the candlestick, I think it is time to start reaching towards the 1.08 level again. This being said, the 200 day EMA of course offers resistance and as we reached towards that level, we started to see selling pressure escalate.

The Euro has benefited over the last couple of days due to the fact that the Federal Reserve is printing more money, while the European Union failed to come out with all guns blazing as people had anticipated. With that being the case, we have had a nice bounce, but it is only a matter of time before we have a rush back into the US dollar for safety. I anticipate seeing some pressure on Monday, and I recognize that even if we did break higher from here, we need to close above the 200 day EMA on a daily close in order to get overly bullish.

We have been in a range between roughly 1.10 and 1.0750, and although we did pierce the top of it during the day, it looks as if we could pull back into that range rather quickly. This will be especially true if we get some type of negativity of the weekend, which let us be honest here: we could. Furthermore, we get the jobs number at the end of the week so traders may start to hedge their bets between now and then as the Non-Farm Payroll announcement should be an absolute disaster.

There has been some headway made in the European Union when it comes to the coronavirus numbers in the European Union, so that might be one of the things that is pushing up the Euro temporarily, but I do believe that the keyword here of course is “temporarily. The US dollar of course is still extraordinarily strong, despite the fact that we have seen a little bit of a rally in this market. I do not necessarily think that we are going to break down below underneath, so range bound trading probably continues going forward.