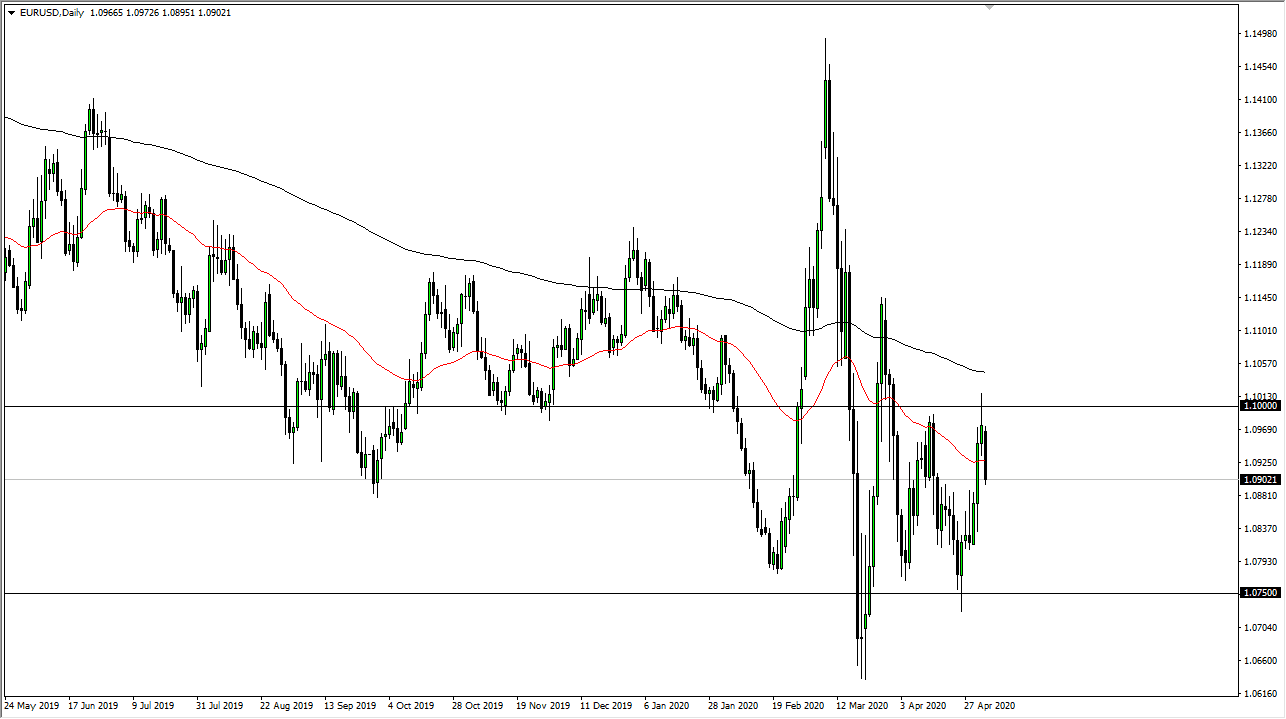

The Euro initially gapped lower at the open on Monday but then turned around to fill that gap before falling somewhat significantly. The market has been in a range for some time, with the 1.10 level above offering significant resistance. Furthermore, the 1.0750 level underneath offers a significant amount of support as seen previously, so at this point I like the idea of fading rallies. The Euro has been very choppy, and erratic to say the least. This is a very choppy currency pair, and as a result it is not a huge surprise that we may see a little bit of a bounce in the short term, only to see the market fall again. That being said, the market has shown itself to be rather negative in general but trading in a short-term range.

The Euro is a market that will put you to sleep if you are a longer-term trader, but short-term traders like the idea of selling exhaustion as we have over the last several years. The job summer comes out on Friday, so between now and then we will probably see the volatility compress even further. All things being equal though, this is a market that has been negative, and the fundamentals do not really change the idea of where we could go going forward.

I like fading rallies on short-term charts like I said and have no interest in buying this pair. If we were to break out above the top of the shooting star from the Friday session, that would be a very bullish sign, especially if we manage to clear the 200 day EMA which is just above there. I do not expect that to happen, but you should always keep the alternate scenario in the back of your mind. At this point though, I think we are much more likely to see the 1.08 level tested before the 1.10 level, as we continue to see a lot of “risk off” in general. That favors the US dollar as it drives more money into the treasury markets. That of course drives up the demand for US dollars in general. At this point, there is a lot of concerns out there when it comes to the global economy, so therefore the US dollar continues to lead the rest of the G 10 currencies overall. The candlestick does look extremely negative, as we are closing towards the bottom 10% of the range.