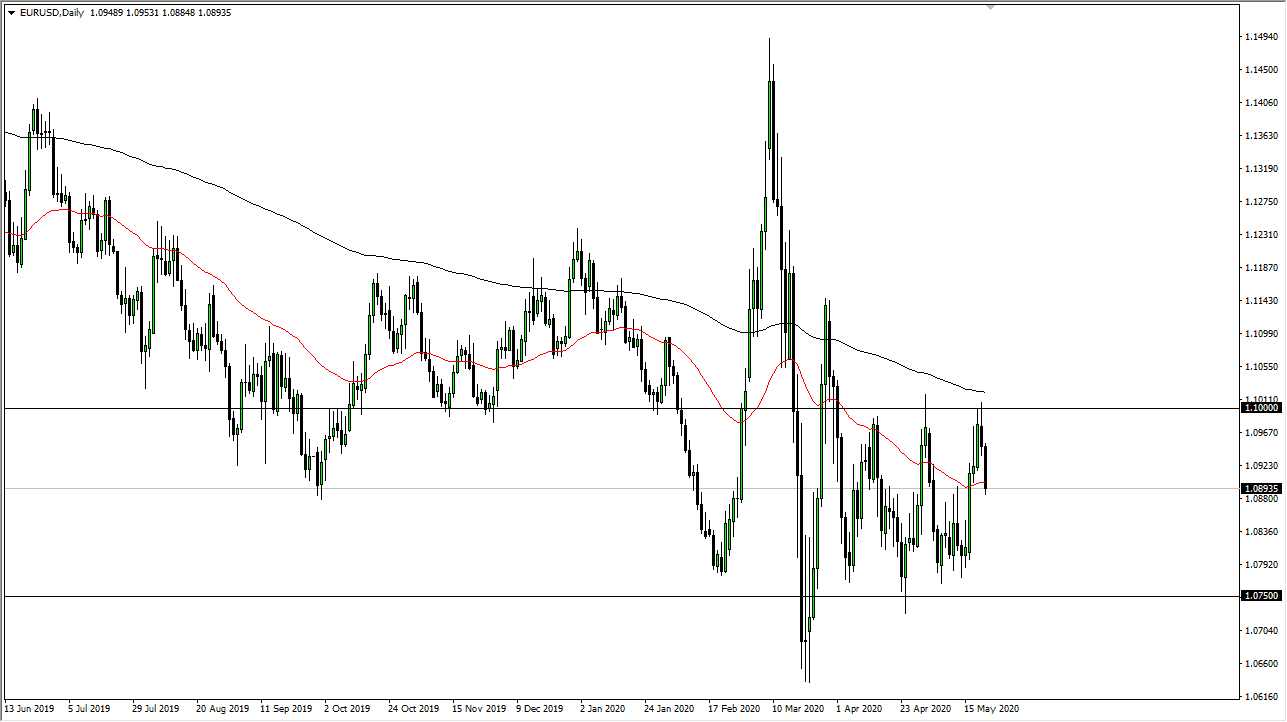

The Euro has continued its downward plunge from the top of the range that started on Thursday, in what is starting to become somewhat of a familiar pattern. The market continues to simply go back and forth from 1.0750 level to the 1.10 level and then back. That is what has happened yet again as both of the central banks are looking to do plenty of quantitative easing. This of course works against the value of their respective currencies, and as a result it is likely that we will continue to see choppy and erratic short-term behavior. The pair does tend to chop back and forth under the best of circumstances, so considering everything that is going on in the world right now, this is simply more of the same.

The 1.0750 level underneath is massive support, and even caused a bit of a hammer from the previous monthly candle. That is something to pay attention to because if we break down below the bottom of the range, that is a serious breach of support. At that point, I believe that the Euro would go looking for an exchange rate at the 1.0650 level, followed by the 1.05 level. Below that level would be an absolute collapse of the Euro, based upon not only the actual price itself but also historical charts. Remember, you can look at a synthetic euro in the sense of combining all of the currencies in the same weighting as they are represented in the Euro. By that measurement, a break down below the 1.05 level could have ramifications for the market to fall the way down to the 0.80 below. Obviously, that is an extraordinarily long term call if that happens.

However, if we were to break above the 1.10 level, it could send buyers back into the market. This would be a breach of the 200 day EMA, something that is generally thought of as a bullish sign. However, it is a bit difficult to think that the Euro is suddenly going to crush the dollar without some type of meaningful event coming out of the EU. After all, the economy in the EU is on life support and of course the ECB is extraordinarily loose with its monetary policy, although in all fairness you can see that same thing about their counterparts in Washington DC. This of course is the main reason we just cannot seem to go anywhere.