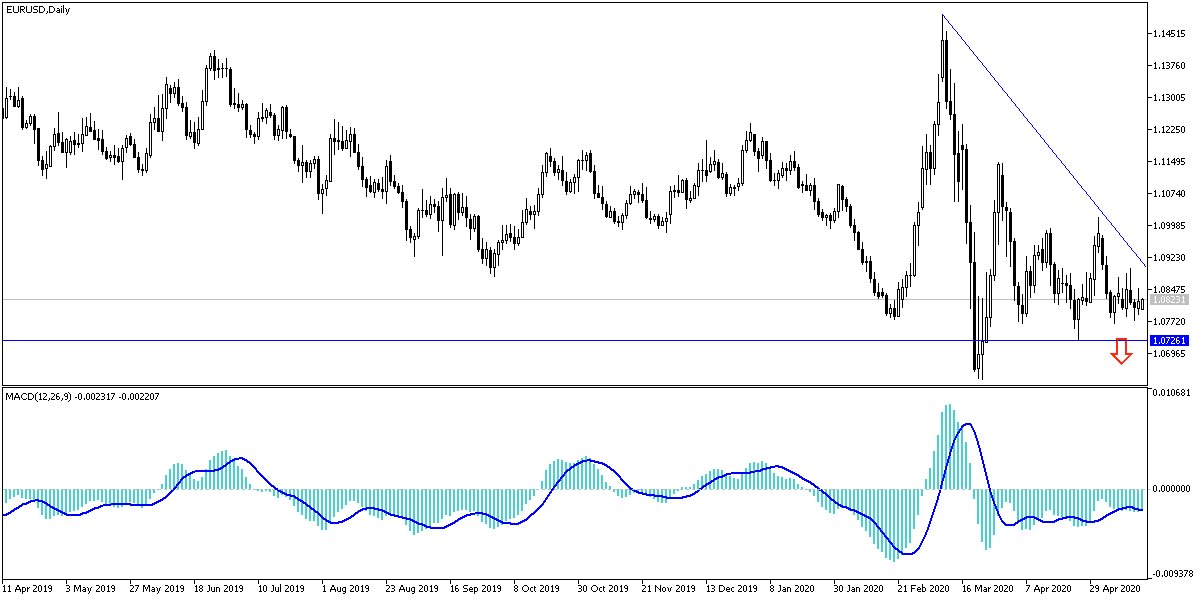

Throughout last week's trading, the price of the EUR/USD pair was trying to avoid a breakdown below the 1.08 psychological support in order not add to losses, especially with the continued strength of the US dollar as a safe haven. Losses reached the 1.0775 support before attempting to rebound and closing trading around the 1.0820. Pressure on the single European currency increased after Germany slid into recession earlier than expected, while new tensions between the United States and China threaten a global economic recovery, which could dominate expectations for both the dollar and the single European currency in the future.

The Euro was cautiously trying to take advantage of the decline in previous progress of the dollar, but failed again after the German statistics agency, Destatis, announced that the German economy had shrunk by -2.2% in the last quarter, in line with expectations, before adjusting its growth previous estimates for the last quarter of 2019. The last quarter achieved the biggest drop in German GDP since 2008. Investors were well prepared for that, although it is not to reveal that the economy also contracted in the last quarter of 2019. Destatis believes that production from Europe's largest economy fell -0.1% late last year when they expected previously a no change in the value of the GDP, which means that Germany has entered a recession before the worst blow that is still looming on the horizon for a period of three months until the end of June.

“The German economy has been on the verge of launching on the brink of recession since the beginning of 2019, but it can no longer hide,” said Klaus Weststein, chief Euro zone economist at Pantheon Macro Economics. And with the revision for the fourth quarter, indicating that the economy entered into a technical recession at the beginning of the year, and before the imminent collapse in the activity of the second quarter. The main story is like the story elsewhere in the Eurozone. The Covid 19 epidemic did not affect activity in January and February, but the strike in March was more than sufficient to destroy the quarter as a whole.

Germany's figures came just before Eurostat confirmed the European Statistics Agency with a -3.8% contraction of the broader Eurozone economy which is widely expected to be followed by larger declines for both in the second quarter. Therefore, the size of the declines is important because it dictates the depth of the hole that must be filled in the global economic recovery, which was threatened last week and continues to be threatened by the possibility of another round of trade tensions between the United States and China.

On the US/China conflict: US President Donald Trump told Fox News on Thursday that "we can cut the entire relationship" with China, as the two sides seek to implement the "Phase 1 of the deal" that ended the trade war between them while also exchanging accusations over who is responsible for the spread of Coronary virus. China is said to be seeking to renegotiate the agreement, which was rejected by the White House, while President Trump appears to be coving to calculating the origins of the virus and the government's treatment of it. Last Thursday's comments came with lawmakers and citizens demanding court litigation over allegations that the Chinese government tried to cover up the coronavirus when it first appeared in Wuhan, and instead of acknowledging the problem only international bodies were notified.

According to the technical analysis of the pair: On the daily chart, the downward path remains the most certain for the future price of the EUR/USD as long as it remains stable around and below the 1.0800 psychological support. Continued divergent economic performance and monetary policy between the United States and the Eurozone, and the flight of investors to the US currency as a safe haven, will be in favor of continuing bear control, and accordingly, the pair may move downward towards support levels at 1.0765, 1.0690 and 1.0600, respectively. Gains will remain in the future new selling opportunities.

The pair may witness a quiet move today, as the economic calendar lacks important data, whether from the Eurozone or the United States of America.