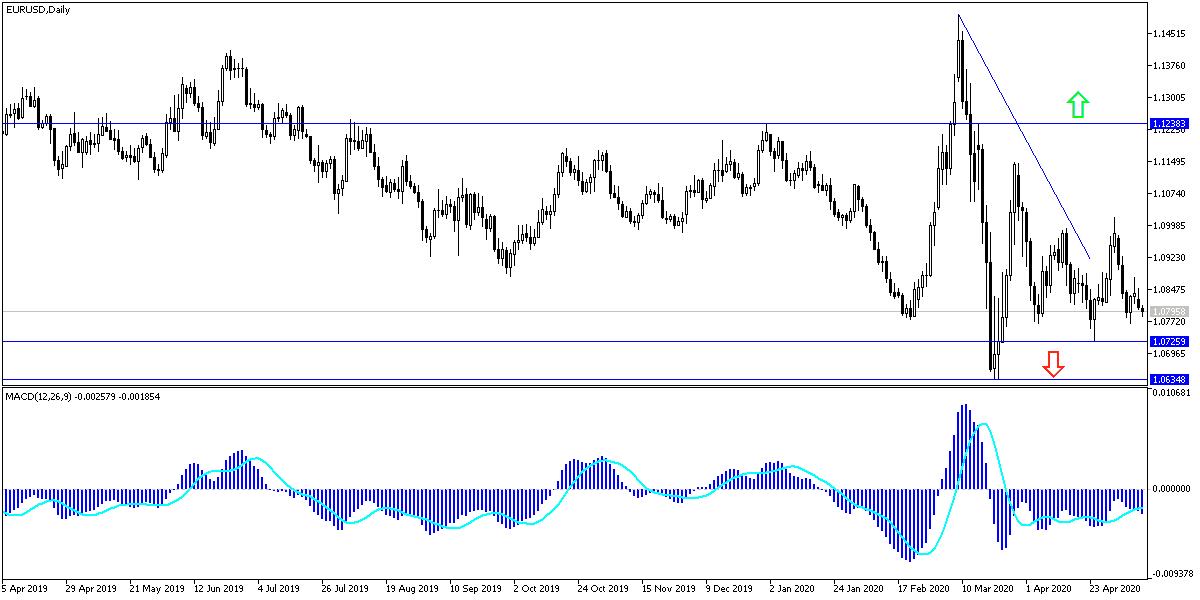

At the beginning of this week’s trading, despite the gloomy US job numbers, the price of the EUR/USD currency pair fell back to the 1.0800 psychological support area again. After attempts for a bullish correction at the end of last week, it reached the 1.0875 resistance, the bears’ control over performance is still the strongest. The pair is holding around the 1.0805 level in the beginning of trading today, Tuesday, before the announcement of important US inflation figures. The European single currency, Euro, lacks the necessary momentum to take advantage of the weak results of recent US economic releases. The European stimulus is still much lower than those of the United States by the government and the Federal Reserve.

European economies as well as some US states are reopening business to factories, companies and offices to prevent further bleeding in labor markets and stopping the severe recession of the global economy, as the continuation of current situation until a coronavirus vaccine is found, will eliminate the trillion dollar stimulus plans approved by global governments and central banks in the Coronavirus era. The reopening coincides with fears of a second wave of infections and deaths, with millions leaving their homes daily.

After the announcement of US job numbers, markets are awaiting the release of US inflation figures today. Economists expect the main gauge of consumer prices in the United States to show the smallest annual gains in nearly five years. Where it is expected that the consumer price index issued by the Ministry of Labor today will show an annual increase of 0.5% for the month of April. Consumer prices fell 0.4% from February to March, the biggest drop in five years, reflecting the downward pressure that the coronavirus pandemic is having on the cost of gasoline, airline tickets, hotel rooms, and other goods and services.

Tens of millions of Americans have lost their jobs in the past seven weeks since the Coved 19 epidemic closed most of the nation's economy. The epidemic brought the unemployment rate in the United States to 14.7%, the level that was last seen when the country was in the midst of the Great Depression. About 33.5 million workers have applied for unemployment benefits over the past seven weeks. Economists expect 2.6 million Americans to apply for assistance in the first week of May. The Ministry of Labor will release its weekly share of applications on Thursday.

By the end of this week, the US Commerce Department will release retail sales data for April. More than 60% of US retailers have closed temporarily since March, as government officials ordered companies to close their doors. Accordingly, US retail sales fell by -8.4% in March. Economists expect the slide to accelerate since then, they expect retail sales to drop by -10% in April.

According to technical analysis of the pair: There is no change to my technical view of the EUR/USD performance, as stability around and below the 1.0800 psychological support will increase the pair bearish momentum, and thus prepare to test stronger and closer support levels, currently 1.0755 and 1.0680 respectively. The 1.1000 psychological resistance will remain the key of the long awaited bullish correction.

As for the economic calendar data today: All focus will be on the announcement of US inflation figures through the consumer price index and the statements of some members of the US Federal Reserve Bank.