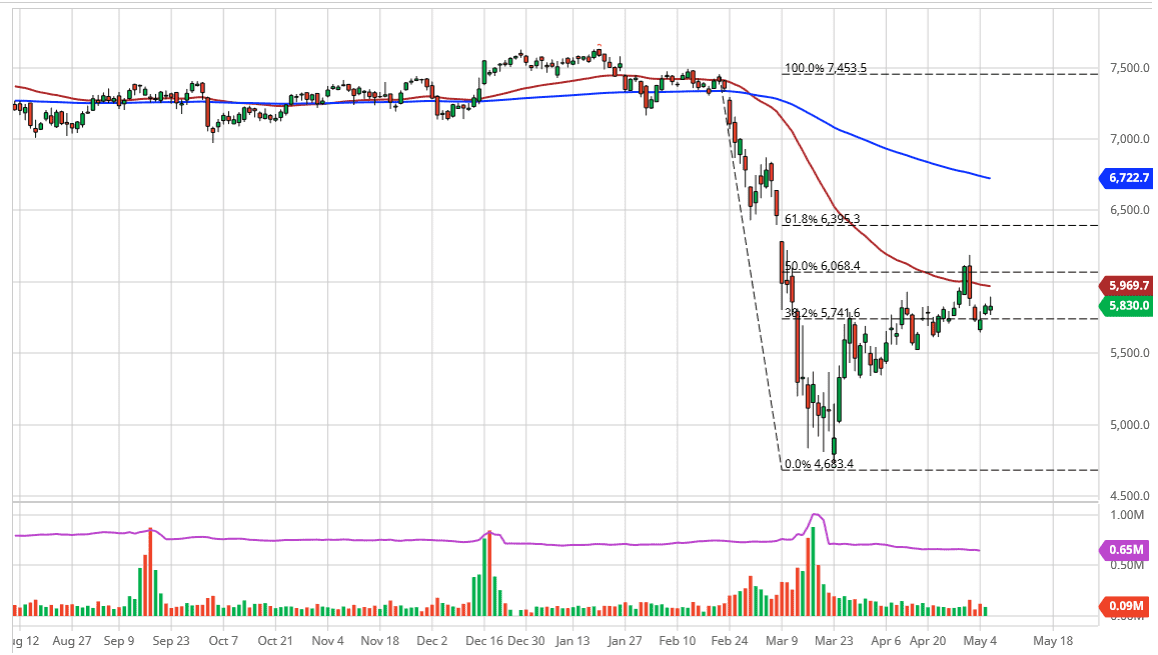

The FTSE 100 initially tried to rally somewhat significantly in the futures market on Wednesday but gave back most of the gains to form a bit of a shooting star. Keep in mind that the FTSE 100 just filled a gap so that is something to pay attention to as well, because it should be a natural resistance barrier. If we were to break above the candlestick for the trading session on Wednesday, it opens up the door to the 50 day EMA, currently sitting just below the 6000 level. It should also be noted that the 50% Fibonacci retracement level is in the same area and it is where we have pulled back previously.

If we break down below the bottom of the candlestick, it is highly likely that the market tries to get to the bottom of the range for the week, heading towards the 5656 level. A breakdown below that then opens up the possibility of a move to the 5500 level. All things being equal, this is a market that can continue to struggle a bit, right along with the British pound. In fact, the two charts do look similar, as the United Kingdom prepares to lock down even further as far as time is concerned. It is also not lost on me that the United Kingdom is overcoming the Italians as far as coronavirus infections are concerned, and that of course does not bode well for the economy.

Beyond all of that, we also have to worry about the Brexit negotiations, as there is still no deal between the UK and the EU. The bickering between the two economies continues as we have seen through the headlines, and that is not going to help traders feel confident about buying stocks in London. Do not be wrong, I do not necessarily think that we break down significantly in the short term, but it does look like we are running out of momentum and we are simply going to “roll over.” I expect a grind from here, perhaps trying to get down to test the lows or at least close to it. This is a stark difference between the United States and the United Kingdom, as the S&P 500, NASDAQ 100, and the like have recovered so much in comparison. At this point, the FTSE 100 looks sluggish and heavy, perhaps heading to much lower levels. The alternate scenario would be a break of the high from last week, which would open up the possibility of reaching towards the 6460 level, the scene of a gap.