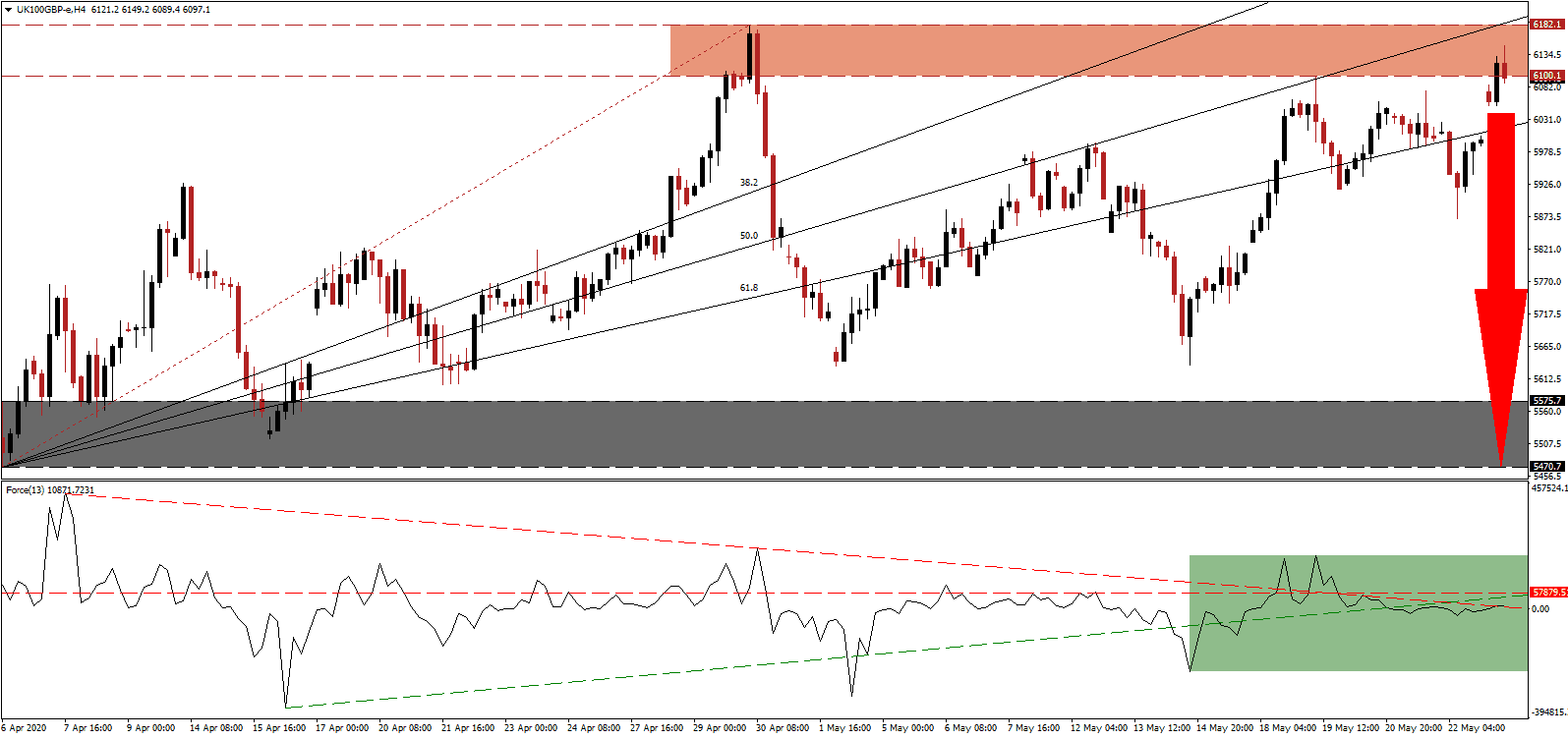

Retail demand pushed equity markets into resistance levels, while institutional activity remains subdued, as evidenced in the lack of volume during this bear market rally. While the overwhelming sentiment favors a second wave of sell orders across the global financial system, it creates conditions for the low-volume advance to extend marginally before collapsing. Confirmed Covid-19 infections accelerate as lockdown measures are eased or lifted altogether, economic reports suggest a long road to recovery at the earliest in 2021, and the spike in debt as a result of the virus severely limits any upside potential. The FTSE 100 is expected to face a breakdown below its resistance zone.

The Force Index, a next-generation technical indicator, failed to confirm the advance and shows the lack of bullish pressures, confirming the bear market rally. It remains well below its horizontal resistance level and is being pressured lower by its descending resistance level, as marked by the green rectangle. The collapse in the Force Index below its ascending support level added to bearish progress. This technical indicator is on track to cross below the 0 center-line, granting bears control of the FTSE 100.

Adding roadblocks to any economic recovery is the swiftly deteriorating relationship between the US and China, potentially derailing an insufficient phase one trade truce. The US contemplates sanctions on China in response to domestic matters after a new security law for Hong Kong was proposed. Global trade is already under pressure to the Covid-19 pandemic and faces permanent changes to the supply chain, which are a slow-moving process. It increases breakdown pressures in the FTSE 100 inside of its resistance zone located between 6,100.1 and 6,182.1, as marked by the red rectangle.

One essential level to monitor is the ascending 61.8 Fibonacci Retracement Fan Support Level, the last support within the sequence. A collapse in the FTSE 100 below it is favored to initiate the next wave of net sell orders, while a spike in volume to the downside is likely to accompany it. Institutional selling will then provide the final push for this equity index to accelerate into its next support zone located between 5,470.7 and 5,575.7, as identified by the grey rectangle. A breakdown extension is probable but will require a new catalyst.

FTSE 100 Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 6,115.00

Take Profit @ 5,470.00

Stop Loss @ 6,235.00

Downside Potential: 64,500 pips

Upside Risk: 22,000 pips

Risk/Reward Ratio: 5.38

A breakout in the Force Index above its ascending resistance level, serving as resistance, may pressure the FTSE 100 to the upside. Traders are recommended to take advantage of any price spike with new net sell orders, given the increasingly bearish global economic outlook. The next resistance zone awaits price action between 6,401.0 and 6,523.7, which includes a previous price gap to the downside.

FTSE 100 Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 6,285.00

Take Profit @ 6,515.00

Stop Loss @ 6,180.00

Upside Potential: 23,000 pips

Downside Risk: 10,500 pips

Risk/Reward Ratio: 2.19