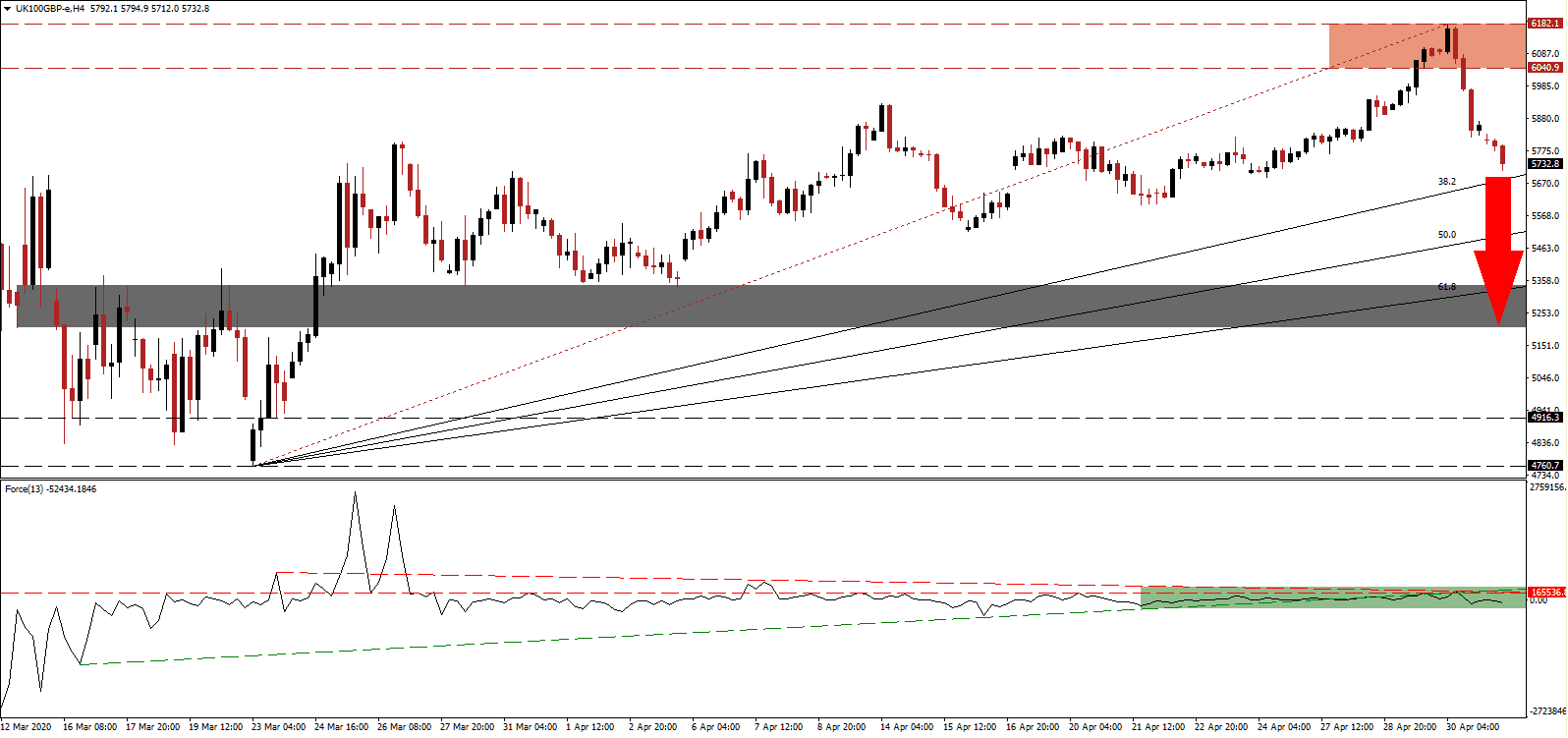

Financial markets embarked on a substantial recovery off of their March lows. A false sense of optimism and detachment from fundamental conditions resulted in a spike in demand by the retail sector. Trading volume remained low as equity markets around the world launched a bear market rally, referring to a robust short-term advance inside a long-term dominant downtrend. Confirming the existence of a bear market is light volume during advances with an increase during contractions, together with the magnitude of moves. The FTSE 100 completed a breakdown below its resistance zone and is well-positioned to maintain its trajectory on the back of institutional selling pressure and portfolio adjustments.

The Force Index, a next-generation technical indicator, was rejected by its horizontal resistance level, as marked by the green rectangle. Adding to bearish developments is the convergence of the ascending support level and the descending resistance level. The latter took control and is applying downside pressure on the Force Index, situated below the 0 center-line. This technical indicator is anticipated to collapse deeper into negative territory, leading the FTSE 100 into an accelerated sell-off.

Governments are pressured to lift lockdown measures, with many ignoring the necessity to address permanent changes to existing supply chains and social life in the absence of treatment. Germany provided a working example of the catastrophic result its rush to normal delivered. No significant economic activity and an increase in new Covid-19 infections. The risk of a second infection wave due to carelessness cannot be excluded, which assisted the breakdown in the FTSE 100 below its resistance zone located between 6,040.90 and 6,182.10, as marked by the red rectangle.

Meaningful economic changes are performed in a slow process, where the transition period is usually painful to businesses and consumers alike. Failure to implement the proper policies after the 2008 global financial crisis is now adding to the list of ignored issues, with the primary response to the virus being debt. The FTSE 100 is on track to enter a breakdown sequence below its ascending Fibonacci Retracement Fan sequence and into its short-term support zone located between 5,205.60 and 5,341.80, as identified by the grey rectangle. More downside cannot be ruled out with new 2020 lows a distinct possibility.

FTSE 100 Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 5,730.00

Take Profit @ 5,205.00

Stop Loss @ 5,825.00

Downside Potential: 52,500 pips

Upside Risk: 9,500 pips

Risk/Reward Ratio: 5.53

A triple breakout in the Force Index, placing it above its ascending support level, can pressure the FTSE 100 into a reversal. The upside potential remains limited to its resistance zone, a potential identifier to the end of the bear market rally. Financial markets are shifting their focus to the costs of nationwide lockdown, stimulus measures, and corporate bailouts on top of what is shaping up to be a devastating earnings season. Traders are advised to consider any advance from current levels as an outstanding selling opportunity.

FTSE 100 Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 5,930.00

Take Profit @ 6,180.00

Stop Loss @ 5,825.00

Upside Potential: 25,000 pips

Downside Risk: 10,500 pips

Risk/Reward Ratio: 2.38