The exchange rate losses of the GBP/USD exacerbated during last week's trading until it reached the 1.2100 support level, the lowest since the end of last March's trading. It was the same as last week's close. The GDP losses in the beginning of this week’s trading extended to the 1.2073 support after an update from the Brexit negotiators, after last week's talks achieved little more than confirming another deadlock between London and Brussels, as the two sides seek to secure their most important goals in trade talks before arranging the details Later .

David Frost, the UK's chief negotiator, commented, “The main obstacle to this is the European Union’s insistence on including a set of new and unbalanced proposals in the so-called “leveling playground” that would link this country to European Union laws or standards, or define our domestic legal systems, and this is unprecedented in free trade agreements and not envisaged in the political declaration. Once the European Union acknowledges that we will not conclude an agreement on this basis, we will be able to make progress”.

His comments came as the European Union made an offer to extend the transitional period, fo "a leveled playground", and that would maintain a lot of influence and control in various areas of politics and settle the current situation on the issue of fishing rights, as the bloc with the 27 countries mostly - landlocked members- are at a disadvantage. Meanwhile, London negotiators have sought to conclude a free trade agreement model which they say should be negotiated as "equal for sovereignty". It seems clear that the opening maneuvers are not compatible and have caused a deadend.

The recent collapse of the sterling price in the currency exchange markets came with the approaching deadline set by the European Council at the end of June to regulate the extension of the Brexit transitional period, which would pave the way for further losses to the pound.

The official deadline for agreeing to future preferential trade relations or the default to a relationship governed by the terms of the World Trade Organization, is December 31, although it can be said that the actual relationship is currently June 30, because Prime Minister Boris Johnson previously said, “The government will need to decide whether The UK should have turned away from the negotiations and focused only on continuing local preparations to exit the transition period in an orderly fashion”.

Britain's chief negotiator David Frost said on Friday: “We urgently need to change the European Union’s approach to the next round, which begins on June 1”. “In order to facilitate these discussions, we intend to publish all drafts of UK legal texts within the next week so that EU member states and interested observers can view our approach in detail”, he added.

June is also the deadline for the extension of the transitional period. And in the absence of an extension request, which the government says it will not submit, markets can begin to worry about something like a no deal Brexit again, and the last time the impact was a drop in the GDP/USD below 1.20. This level was already broken once in the downward price movement of 2020.

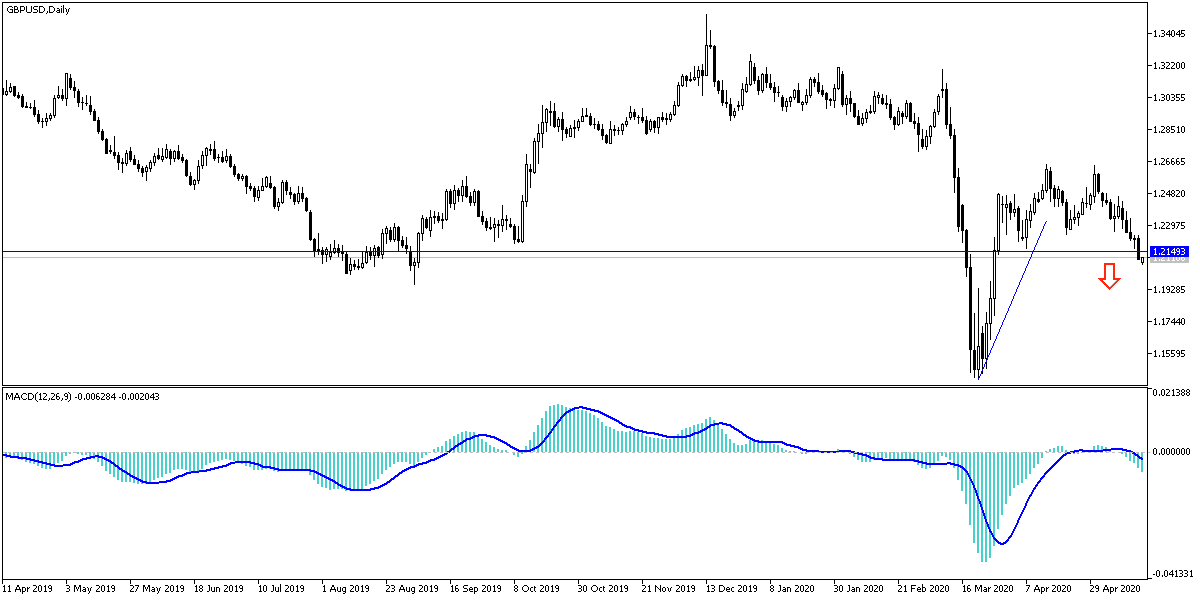

According to the technical analysis of the pair: Referring to our recent technical analyses of the GBP/USD pair, we mentioned a lot about the possibility of the pair tumbling to the 1.2000 psychological support, which is the closest to currently, with renewed fears of a mysterious Brexit future with the receding of time. And with the bearish target reached, we will determine the next support levels. To exit the current bearish channel, the pair will need to return to the 1.2400 resistance as a first stage, taking into account that any gains for the pair under any factor will be a selling target again by currency traders.

It is expected that the pair will move in a limited range, as the economic calendar contains no important and influential data, whether from Britain or the United States of America.