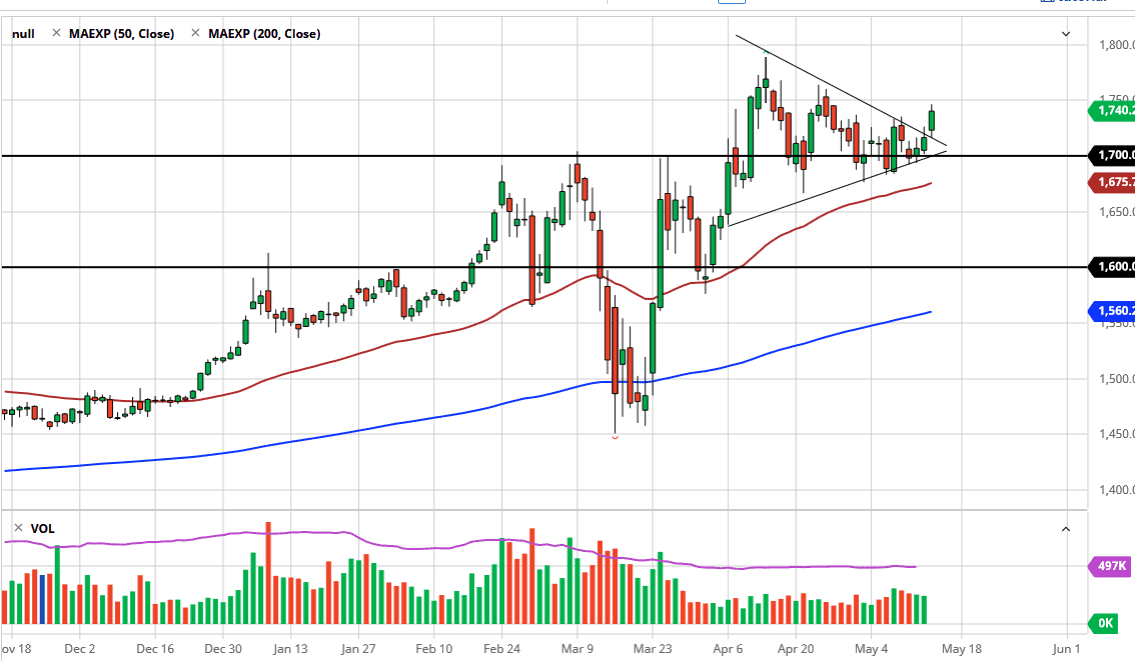

Gold markets broke out during the trading session on Thursday, as we are finally cleared the top of the symmetrical triangle that had been forming for quite some time. At this point, the market is likely to continue to see a lot of upward pressure, but it would not surprise me at all to see a little bit of a pullback in the short term. Then pullback is more than likely going to offer value the people will be willing to take advantage of, as the gold markets have been bought into so much. Ultimately, this is a market that is in a bullish trend, and a break above the downtrend line of course is a very bullish turn of events.

To the downside, we also have the 50 day EMA which sits at the $1675 level, and the psychologically significant support level at the $1700 level. Looking at the candlestick, we are closing in the upper third of the candle, so having said that it looks as if we are more than likely going to find buyers given enough time. If we can clear the $1750 level to the upside, then that would be a very bullish sign. At that point in time, I would anticipate that the market would then trying to make its way back towards the $1800 level.

All things being equal, the market continues to see a lot of volatility, but I do not want to fight the overall uptrend. The uptrend has been based upon a lot of different things, not the least of which is going to be central banks around the world showing the proclivity to continue to print currency. This debases a currency in terms of purchasing power over the longer term, which is what gold moves upon most of the time. Furthermore, there is a lot of fear out there when it comes to economic conditions so people will look to “hard money” in that scenario as well.

Looking at the chart, you can see that we have been rallying for months, even though the last month or so has been a bit choppy but it makes sense that the market needs to digest the major gains that it had recently enjoyed. At this point, it is highly likely that $1800 will be targeted in the short term but I do think that given enough time we may go looking towards the $2000 level above. We will need a certain amount of “risk off” catalysts, but I fear they are coming.