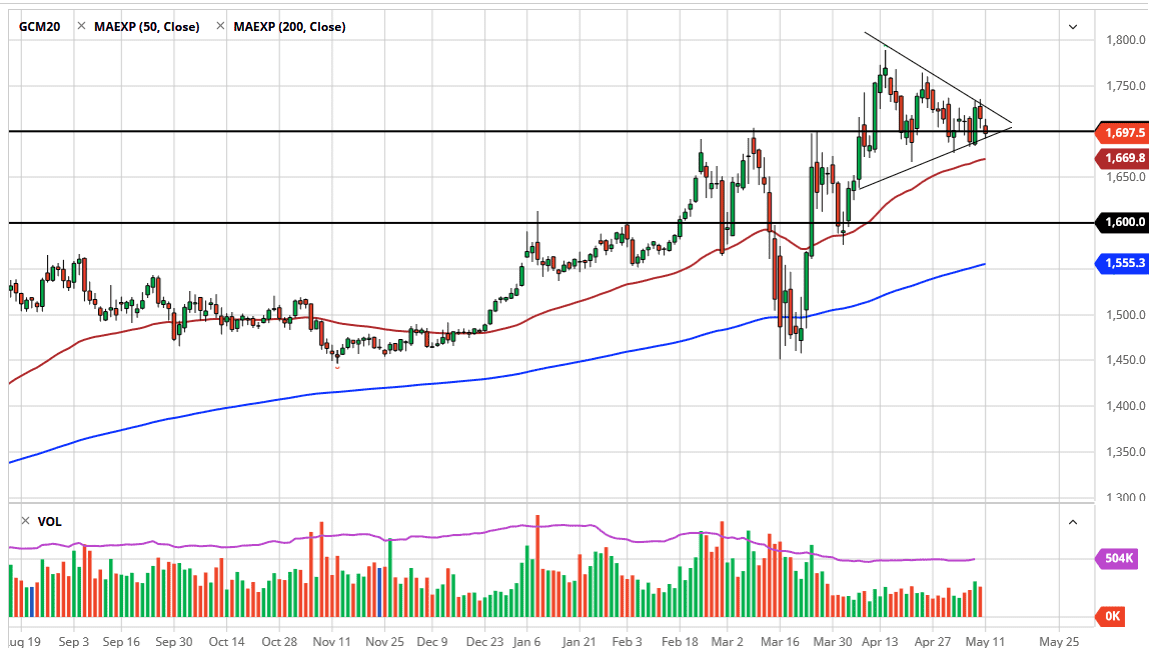

Gold markets have been somewhat choppy during the trading session on Monday, as we continue to see a lot of back-and-forth trading within the larger symmetrical triangle. The larger symmetrical triangle of course represents a tightening of the market, and it should be noted that we are sitting right at the $1700 level. This is an area that should be paid attention to due to the fact that it is previous resistance and should now be thought of as potential massive support.

Looking at the symmetrical triangle, it suggests that we are going to be making an explosive move somewhat soon, which looking at the overall trend I would suspect should be to the upside. With the global concerns out there it makes quite a bit of sense that the market will continue to see gold as a potential refuge, as it will simply extend the overall uptrend. A break above the downtrend line should send the market towards the $1750 level, and then eventually the $1800 level. At this point, pullbacks would be thought of as potential buying opportunities and certainly a lot of traders who have missed the move to the upside would be more than willing to get involved to take advantage of perceived value.

To the downside, the market is likely to reach towards the 50 day EMA if we slice through the uptrend line, and the 50 day EMA could offer support as one would expect. The market should have plenty of support all the way down to the $1600 level, but it is a bit difficult to imagine that we get down there anytime soon unless we get a major “risk on” type of rally. That would take some type of news event, so at this point it is one of those things that “you will know it when you see it.” I do not see that happening anytime soon though, and with central banks around the world continuing to loosen monetary policy, it should offer plenty of reason for gold to get a bit of a boost as well. The debasing of currency eventually tends to have money looking to gold to preserve wealth, which is what we have seen. I do not have any interest in shorting this market but am interested in buying a breakout. That being said, the triangle needs to be broken soon or it will be a completely busted pattern.