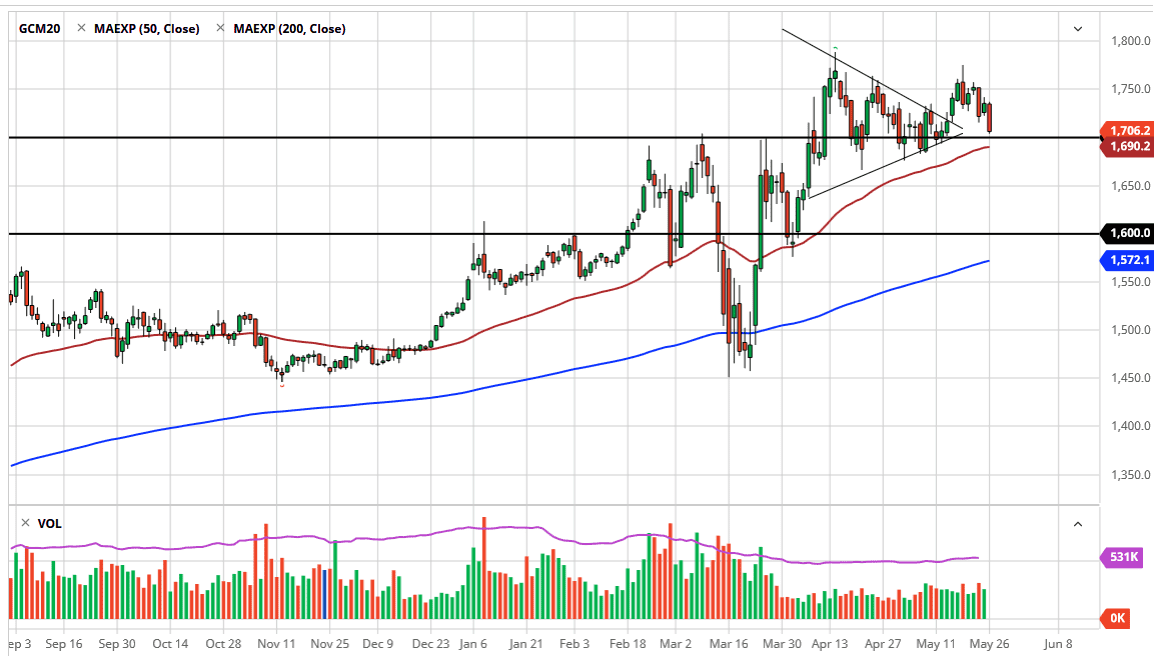

The gold markets fell a bit during the trading session on Tuesday as traders came back to work, in a major “risk on” type of situation. At this point in time, the market looks like it is approaching the $1700 level, an area that will attract a lot of attention as it is a large, round, psychologically significant figure and an area that had previously been massive support. Because of this, I think that buyers will come in and pick up this value, so I am looking to buy gold at the first signs of fear.

The 50 day EMA sits just below the $1700 level, and that of course gives this level even more importance. Ultimately, I think that there are enough issues out there to continue to drive gold higher in a safety trade, but the volatility is clearly going to be off the charts for quite some time. After all, the markets are simply moving on hope in fear at this point, and completely ignoring fundamentals. Because of this, it only takes a headline or two to get things rolling.

All things being equal, the gold market should continue to find plenty of reasons to go long, not the least of which of course is going to be central banks around the world destroying their own currencies with quantitative easing. As central banks around the world continue to print money, that of course makes fiat currency a lot less attractive. If that is going to be the case, then almost by default gold will rally. I like the idea of buying gold on dips in the $1700 level makes quite a bit of sense. The $1600 level underneath is the bottom of the overall support range, and the 200 day EMA is starting to get close to that level.

Ultimately, I do think that this market probably goes looking towards the $1760 level, and then as far as the $1800 level in the intermediate term. Above there, the market then goes looking towards the $2000 level, which of course is a large, round, psychologically significant figure that will attract a lot of attention. Ultimately, this is a market that does offer value occasionally, and it looks as if we are doing so here. On signs of a bounce I would be more than willing to get involved as I think we have plenty of buyers out there waiting