Gold markets gapped higher during the trading session on Monday to kick off the week, but then pulled back to fill that gap. By doing so it suggests that the market is trying to take off to the upside and clearly it would be a continuation of what we have seen previously. The major sell off that we had seen before was due to forced liquidation due to margin calls forced upon hedge funds. At this point, it is very unlikely that we are going to see that move again without some type of obvious situation in the stock markets or the like.

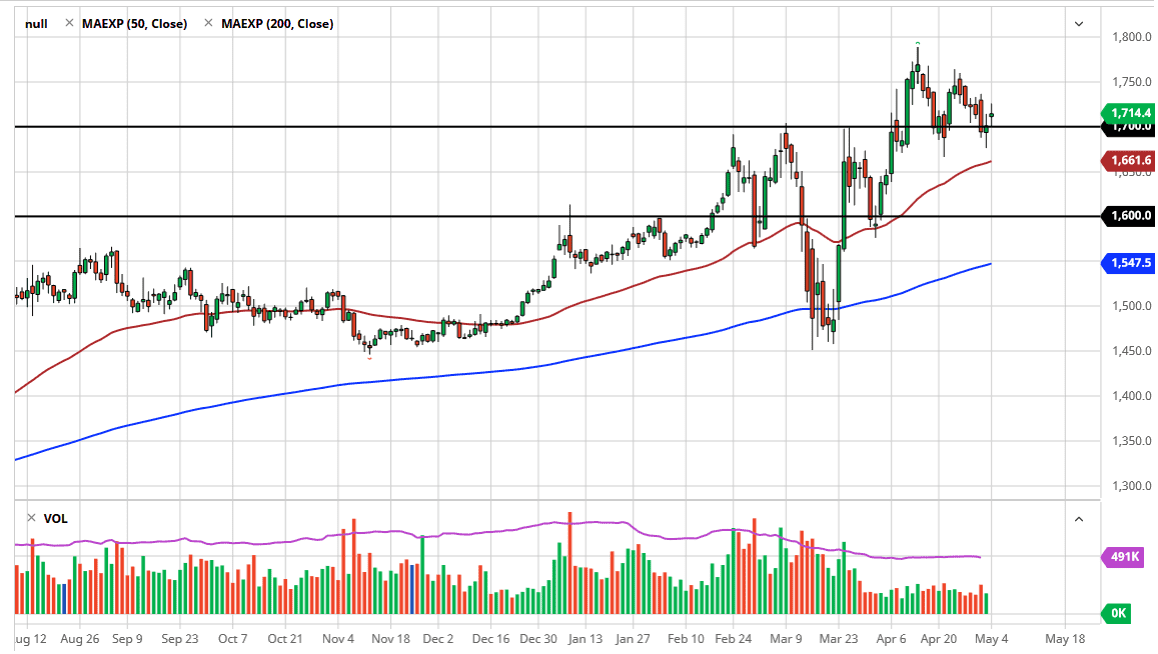

Looking at the chart, you can see that the 50 day EMA sits at the $1660 level, which is a very bullish sign. The 50 day EMA is starting to slope to the upside, showing signs of strength. At this point, it is possible that we are trying to form some type of symmetrical triangle, and that of course could cause some issues as well. The jobs number comes out on Friday, and that of course will have a lot of people looking to the markets for some type of safety eventually. This will be especially true on Friday if we get some type of horrifically bad number. Ultimately, if the jobs number is better than anticipated we could see a lot of selling in this market. At this point in time though, it seems to be very unlikely that changes the trend though, unless of course it is something drastic. After all, there are a lot of global concerns, not the least of which will be the fact that the economy is falling apart. Furthermore, the gold markets are a way to fight back fear and protect wealth. We are clearly in an uptrend and it is difficult to fight against that type of move. That being said, I believe that the $1750 level is the next target, and then eventually the $1800 level.

I have no interest in shorting gold, at least not until the entire outlook looks completely different, and that is not something that is going to happen this week. We are in an uptrend, and that is going to continue to be the case as we continue to see a big “risk off” market ahead of us. In fact, gold is one of the few strong bullish move markets that we see.