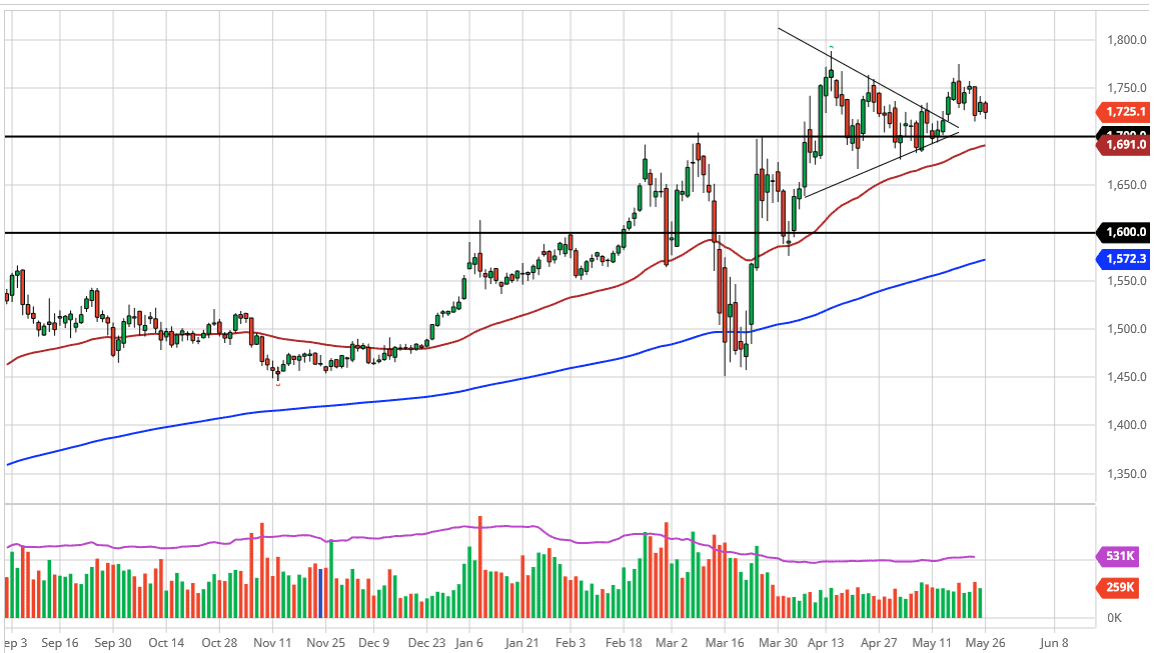

Gold markets pulled back a bit during the trading session on Monday, as Memorial Day trading is of course thin. That being said, the market looks as if it is trying to reach down towards the $1700 level, an area that I think will be rather supportive over the longer term. With that being the case, the market is likely to see a lot of noise in general, as there are multitudes of issues out there that could continue to push gold higher, due to the fact that there is a lot of concern from a global standpoint, not only due to the fact that the pandemic is going on, but there are also multiple political concerns as well.

Furthermore, the technical analysis is very bullish with the 50 day EMA underneath offering support just below the $1700 level, and of course we have recently broken out of a symmetrical triangle that was based upon the $1700 level. The $1750 level above is a short-term bullish target, but I think it extends another $10 at the very least. If we can break above there, then the market is likely to go looking towards the $1800 level, followed by the $2000 level.

If we turn around a break down below the 50 day EMA, then it is likely that the market goes looking towards the $1650 level, followed by the $1600 level after that. I think at this point it is likely that we will see more back-and-forth trading than anything else, I do think that selling gold is all but impossible at this point, simply due to the entire situation around the world, as there are a lot of concerns and therefore it does drive up the demand for the safety of gold.

At this point, I believe that we will eventually get a nice opportunity to pick up value and that traders will continue to look at this market as a “buy on the dips” scenario. About the only thing that is going to work against the value of gold from a longer-term standpoint is going to be the US dollar, which sometimes can cause pressure on gold if it starts to rise. However, it is not impossible or even uncommon for both the rise of the same time in times of fear or concern about wealth preservation. I believe that the latter of the two situations are going to be the way this plays out.