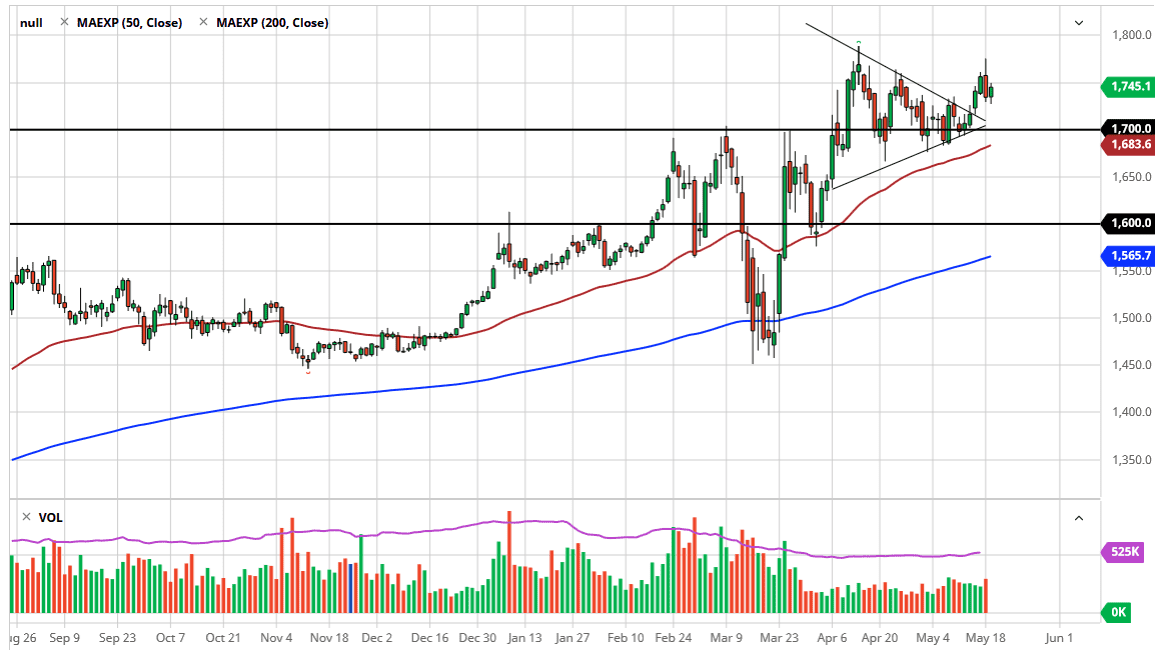

The gold markets initially dropped a bit during the trading session on Tuesday but found buyers underneath the turn things around and show signs of life again. The market is approaching the $1750 level, which is an area that is significant due to the fact that we have seen it offer resistance several times before. Furthermore, the “midcentury marks” tend to attract a lot of attention as well. Ultimately, there is much more support underneath, as the $1700 level underneath is a large, round, psychologically significant figure, and the scene of a significant break out previously.

Underneath there, the 50 day EMA of course offers quite a bit of support and therefore should be paid close attention to. The 50 day EMA is turning to the upside, and it looks as if we are going to break above the $1700 level. The 50 day EMA has been reliable over the longer term, and therefore it makes quite a bit of sense that the market is going to simply continue to grind higher on these dips. In fact, the dips should be thought of as buying opportunities, in order to build up a bit of value and a larger position that you can hang onto for the longer-term move.

On a breakout to the upside I expect the market to go looking towards $1800 level. That is an area that will cause a significant amount of resistance, and perhaps in the market back down towards the $1760 level. Having said all that, the market breaking above the $1800 level would open up the door to the $2000 level which is my longer-term target here. I have no interest in shorting gold whatsoever, because quite frankly there are a whole plethora of reasons to suspect that gold will continue to see buying pressure. Central banks around the world continue to print money like it is going out of style, and of course we have a lot of concerns when it comes to risk appetite, coronavirus numbers, and global growth - or perhaps better put, the lack of. Ultimately, there are far too many reasons to think that gold will go higher to think about shorting it anytime soon. That does not mean you have to jump in with both feet, but it is an incredibly significant long-term trend that is still in its infancy, and I think has quite a bit further to go before we reach the end.