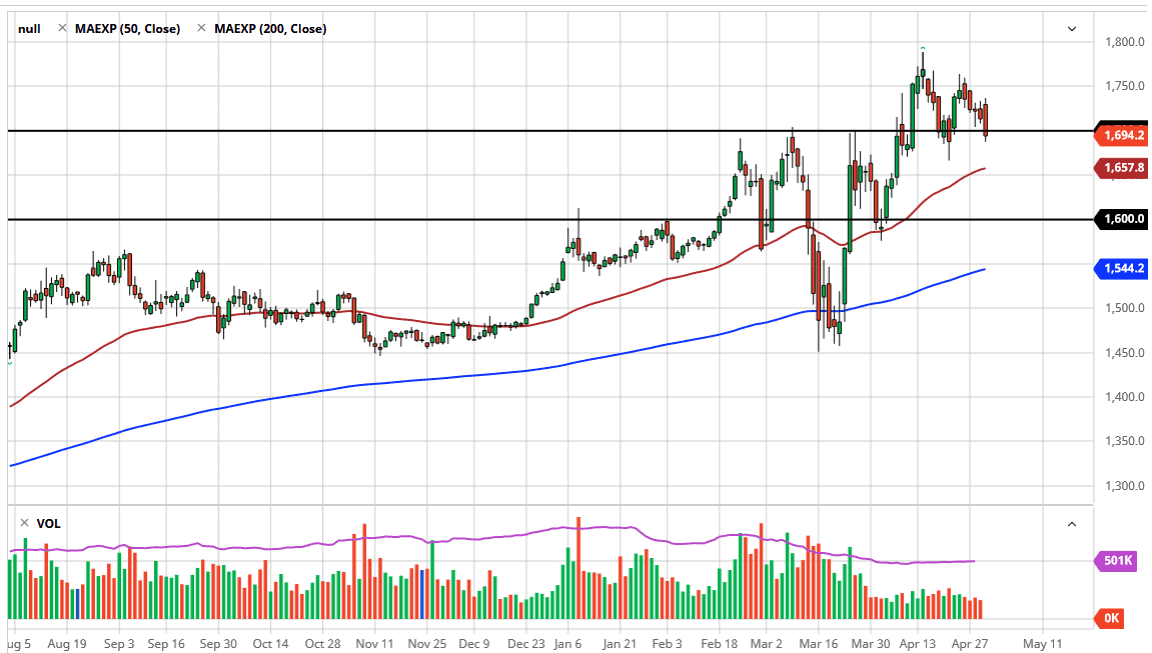

Gold markets have fallen quite hard during the trading session on Thursday, breaking below the crucial $1700 level. However, there is a lot of support extending all the way down to the $1680 level, and therefore it is likely that we will see buyers coming in and supporting this market. Furthermore, this is an area that has already seen a lot of interest, so it would make sense that buyers would continue to be attracted to it as a lot of people may have missed out on the initial push above $1700.

The 50 day EMA is just below and it should also offer support as it is sloping higher and of course is positive in that sense. A lot of traders will look to the 50 day EMA to define the trend, and therefore it will attract a lot of money managers. At this point, gold has quite a few reasons to go higher, not the least of which is that the Federal Reserve is in the process of single-handedly destroying the value of the US dollar. By doing so, it makes gold much more attractive, as central bank liquidity means printing currency. By the natural turn of things, gold rallies as a result. Furthermore, the world is full of all kinds of concerns, and that of course is good for gold as well. Ultimately, I believe that the market is probably going to bounce sooner rather than later.

Another thing that is worth paying attention to is that Friday is the first day of the month, so traders will be looking to buy things. This could cause a little bit of negativity and gold as we should get positivity in stocks, but I look at any move towards $1680 as an opportunity to pick up gold “on the cheap.” It is also possible they may simply go to start buying gold. In other words, I do not have a scenario in which I am looking to sell gold over the next 24 hours, or for that matter, over the next several weeks. We are in an uptrend for quite a few different reasons, and I think we are going to go looking towards the $1800 level again rather soon. It is almost as if it is simply waiting for some type of catalyst to take off to the upside. It is possible that a lot of the selling on Thursday was due to traders collecting gains for the month.