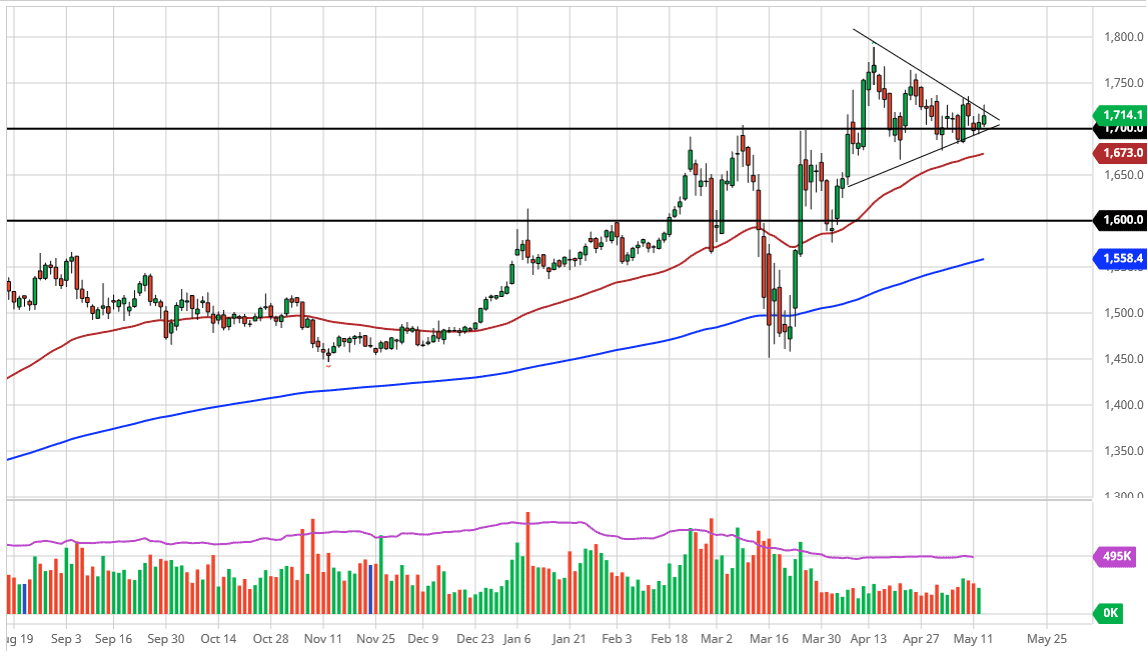

Gold markets are trying to break out above the top of the symmetrical triangle, and therefore if we can break above the highs of the trading session on Wednesday, then the market is to continue to go higher, perhaps reaching towards the $1750 level. After that, the market is likely to go looking towards the $1800 level. Having said that, I think that short-term pullbacks will continue to offer plenty of buying opportunities as gold continues to strengthen based upon a lot of global fear, and of course the coronavirus headlines a continue to cause major issues.

The triangle of course is clearly marked on the chart and therefore it shows that price is compressing. The compression of price should send markets into a quick move, but we are not quite ready to do so. That being said though, we are getting close to the apex of the triangle and if we do slide right through the end of it, that will essentially be a sign that the market simply is not ready to move. Ultimately, the fact that the market broke above the inverted hammer’s from both Monday and Tuesday suggests that the market is starting to pick up a little bit of momentum. This does not mean that we just simply take off to the upside easily, just that the upward momentum should continue.

Even if we were to break down from here, the market could very well find itself testing the 50 day EMA where there should be plenty of support as well. At this point in time, I like the idea of buying gold due to the fact that central banks around the world continue to print money and of course we have to worry about whether or not economies ever open back up. The market participants continue to see a lot of reasons for this market go higher but now is the time that we will make some type of longer-term decision. The fact that $1700 has been so “sticky” is worth paying attention to, and therefore we will need to pay attention to the level, and the fact that the buyers continue to pick up value down at it. All things being equal, believe that gold will eventually go looking towards the $2000 level but it is going to take quite a while to get there. I have no interest in shorting this market.