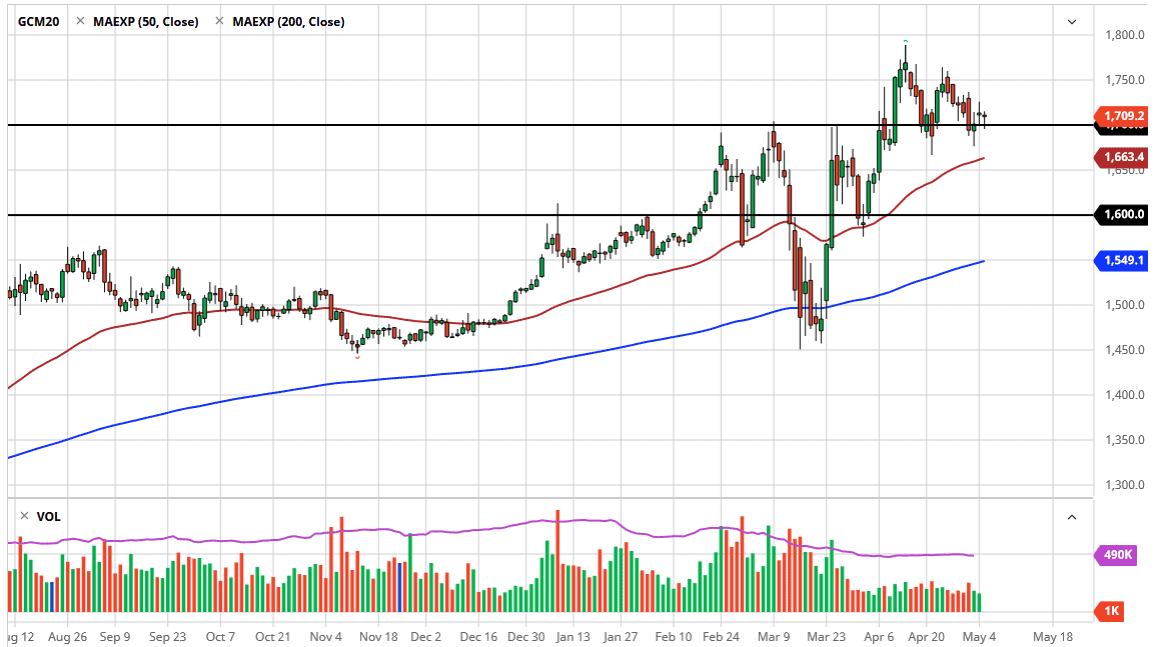

Gold markets have spent most of the day on Tuesday bouncing back and forth around the $1700 level, an area that will of course attract a lot of attention due to the fact that it is a large, round, psychologically significant figure. That being said, I do believe it is only a matter of time before the buyers look at this as a massive “floor” in the market and use it as a springboard to higher prices. In fact, we continue to see buyers in that general vicinity that are more than willing to get involved. To the downside, if we did break down below there, I think there are plenty of places to expect support anyway, not the least of which would be the $1680 level.

Further looking at the downside, the 50 day EMA underneath is just below that level but rising over time. That is a bullish sign and should continue to support the market in and of itself. Beyond that, the candlestick for the Tuesday session ended up forming a bit of a hammer, which of course is bullish as well. That being said, if we broke above the top of the candlestick for the trading session on Tuesday, then allows the market to go looking towards the $1725 level over the longer term, perhaps even higher than that. If we do break above that level, then the next obvious target would be the $1750 level. That area has caused a bit of resistance recently, so breaking above there of course would allow the longer-term trend to continue.

Assuming that the longer-term trend does in fact continue, then I believe that we are going to go looking towards the $1800 level, and then the $2000 level over the next several weeks, if not months. I do not have any interest in shorting gold at the moment, because quite frankly it seems as if we are only a headline or two away from finding enough fear to have the markets freak out. Gold is a great way to hedge against fear, and right now there seems to be plenty of reasons to think that fear will become a major factor in the marketplace going forward. Because of this, I do believe that we are looking at a scenario where you will see a lot of “buying on the dips”, as there is without a doubt a whole slew of problems just waiting to happen.