Gold is trying to recover recent losses, which during the past week's trading, extended to the $1717 support, bouncing back to the $1740 resistance and settled at the $1733 at the beginning of this week's trading. The recent rebound gains were supported by increased tensions between the United States and China, the main cause this time was the COVID-19 and its devastating repercussions on the global economy and for the future of US President Trump as president for a second term. The Covid-19 pandemic has caused 5.24 million cases worldwide and more than 338762 thousand deaths, and in the United States, the death toll has exceeded 98,000, which is close to Trump's latest forecast that deaths may reach 100,000 in the U.S alone.

In general, the US government's exceptional financial and monetary stimulus did not contribute to higher inflation and a greater increase in the price of gold.

In general, investors will continue to prefer the yellow metal as a safe haven as long as the Corona epidemic threatens the future of the global economy. And as the US economy faces a severe recession, with more than 38 million people out of work, Trump is increasingly talking about a future recovery that may not happen until after the November elections. Trump is asking voters to take a look at the pain he feels across the nation and give him another four years on a promise of economic return in 2021.

Trump says again and again: "It is a transition to greatness," expecting the economy to flourish. By saying, "We will see some impressive numbers in the fourth quarter of 2020, and we will end up with the strongest recovery in the coming year 2021." In the same context, Larry Kudlow, his chief economic adviser, echoed the feelings of waiting until next year, which bodes for the hope of a "big explosion 2021". Trump has already pledged to announce the Republican healthcare plan finally after the polls close - although he has spent more than three years in office - along with post-election tax cuts and a "Phase 2" trade agreement with China.

Recent poll results indicate that Trump has some work to do to convince Americans that everything will be fine next year. Americans are divided over whether they believe the economy will either improve (41%) or increase (40%) over the next year, according to a survey by the Associated Press and the NorC Center for Public Affairs Research.

Opinions differ based on their policies. A majority of Republicans (62%) believes the economy will improve in the next year, while a majority of Democrats (56%) think it will get worse. The poll found that only 49% of Americans now agree with how Trump handled the economy, compared to 56% in March, and while the majority of Americans in families who have lost a job think it is possible that at least the job will return, 70% now describe the status of country's economy as poor, against only 29% who say it is good - down from 67% in January.

Trump was encouraging countries to start loosening restrictions and reopening their economies. But this does not necessarily mean the return of jobs as they were before the epidemic.

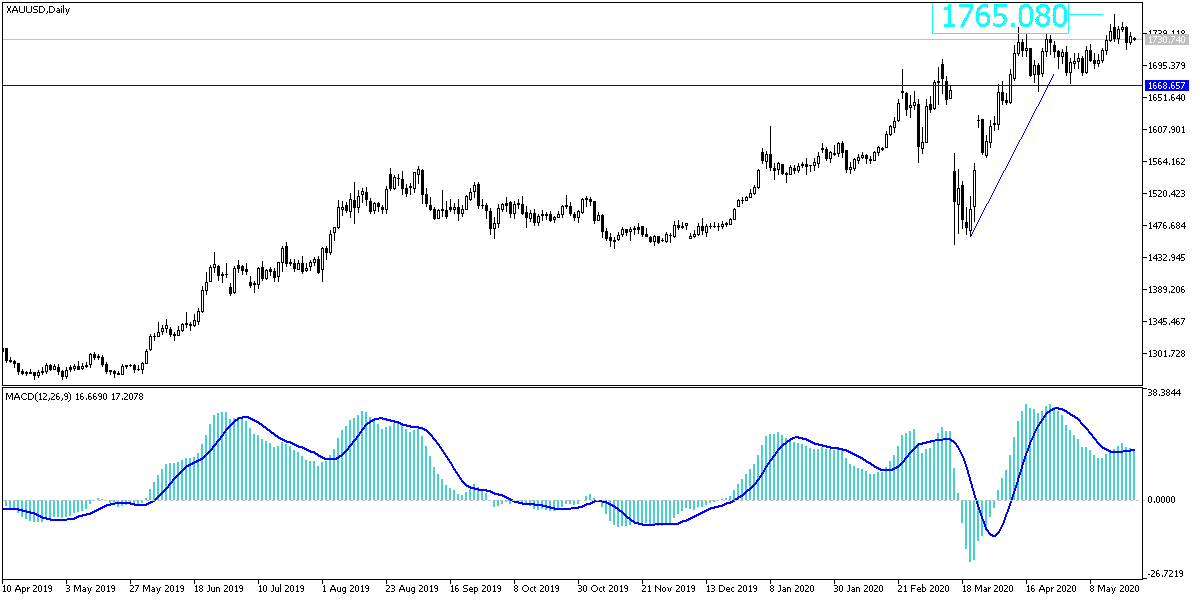

According to gold technical analysis: Stopping the gold gains does not mean stopping its upward trajectory, as the general trend remains bullish supported by the $1700 psychological resistance and the trend is ready to choose higher levels, especially with continued pessimism that dominates the financial markets and investor sentiment from the future of relations between the two largest economies In the world. The trend has the opportunity to return to the resistance levels at 1740, 1755 and 1770, respectively. I still prefer to buy from each lower level and the closest support levels for gold are currently 1725, 1715 and 1690 respectively.

I expect quiet moves in gold during Monday's trading session in light of the American and British holidays. Investor sentiment will be a strong response to performance.