The prospect of new trade skirmishes between the United States and China, at a time when the global economy itself needs intensive care, has prompted the return of investors’ appetite for safe havens, which gave the yellow metal the opportunity to bounce back up to the $1705 resistance after sales that pushed the price of gold to $1670 level, and closed trading last week around the $1700 resistance, awaiting the reaction of investors with the renewed conflict between the two largest economies in the world, especially as the world is still facing Coronavirus consequences.

Fears returned once again after a period of calm and optimism that prevailed in global financial markets from the global economies trend to reopen after a prolonged period of closure to contain the spread of the epidemic, which caused millions of jobs to be lost and pushed the global economy into a severe recession. So far, there has been no announcement of a vaccine that will end the disease once and for all, despite all attempts of countries and drug companies. Unemployment in the United States of America this year may not coincide with the peak of the 25% seen during the Great Depression of the 1930s, but it may come close to it.

The coronavirus pandemic has already cost more than 30 million workers their jobs, at least temporarily, since the United States began shutting down large portions of the economy in mid-March. Job losses are still increasing. Economists estimate that if none of these people return to their jobs, this means that about 18% of the workforce before the crisis was unemployed.

Economists believe that the size of initial jobless claims over the past six weeks indicates that the US unemployment rate is rapidly approaching levels of the Great Depression. In general, it is not certain in any way that the official unemployment rate of the government during the month of April will reach this level, when the official report is published next Friday.

In general, workers who lost their jobs but did not search for another job, for example, are usually not included in the workforce when the government calculates the unemployment rate. The workforce began to contract in March, and is likely to contract again in April, limiting the official increase in unemployment. Regardless of the actual number, unemployment has clearly risen to its highest level since World War II, surpassing the previous record of 10.8% in 1982.

Therefore, the government must step in again, if necessary, to bolster already extended unemployment benefits and help businesses to prevent further job losses, or making them long-term. The higher the unemployment, the more time it takes the American economy to recover and the suffering of millions of Americans will increase

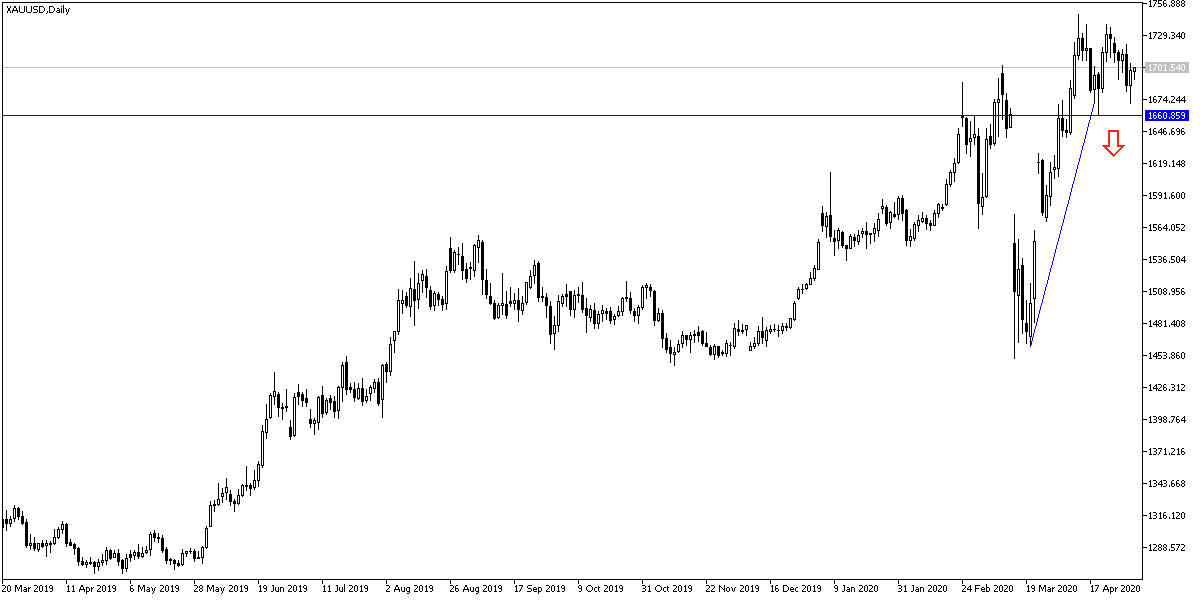

According to gold technical analysis: As I mentioned before, I now confirm the stability of gold around and above the $1700 psychological resistance will remain supportive of bulls’ control, and will pave the way to test higher resistance levels, the closest are 1715, 1732 and 1760, respectively. I still commit to the buying strategy from every lower level, and at the present, the most important buying levels are 1685, 1663 and 1640, respectively.

Global concerns about the continuation of the Coronavirus and its severe human and economic losses, along with the renewed conflict between the two largest economies in the world, Brexit anxiety and the massive evaporation of the stimulus approved by global central banks and governments, all will continue to be supportive of gold in advancing further.