Increasing fears of negative interest rates in the United States, along with continued negative results of the US economic data, were a catalysts for gold to achieve more gains, which pushed it towards the $1718 resistance, the trough during yesterday's session was around the $1698 level. Gold price stabilized around the $1715 level at the beginning of Thursday’s trading. What suspended the pace of gains was the recent statements by Federal Reserve Bank Governor Jerome Powell, through which markets excluded a close approval of negative interest in the United States. Despite his warning of a sharp contraction of the US economy in the era of the Corona epidemic.

Federal Reserve Chairman Jerome Powell stated yesterday, citing the unprecedented speed and scope of the economic downturn caused by the Coronavirus, that the US central bank could take additional steps to avoid a prolonged period of low productivity and income stagnation. "On the part of the Federal Reserve, we will continue to use our tools to the fullest until the crisis passes and the economic recovery progresses well," Powell said during a webcast hosted by the Peterson Institute for International Economics.

However, Powell noted that the US central bank remains reluctant to impose negative interest rates, which President Donald Trump has repeatedly called on the central bank to enact. In this context, Powell said, "I know there are fans of that policy, but at the moment, this is not something we think about". "We think we have a good toolkit and this is what we will use."

The Fed Chairman noted that the economic outlook is "very uncertain and subject to significant downside risks" and suggested that it may be necessary for Congress to provide additional incentives. "Additional financial support may be costly, but it is worth it if it helps avoid long-term economic damage and leaves us with a stronger recovery," Powell added. "This trade-off is for our elected representatives who have tax and spending powers."

Powell's comments come one day after Democrats in the House of Representatives unveiled a new $3 trillion coronavirus bill that would likely face major opposition in the Senate led by Republicans. While the Federal Reserve and Congress have already provided a huge stimulus, which Powell described as "timely and appropriately large", he indicated that the initial response "may not be the last act."

Powell argued that the coronavirus pandemic raises a new set of questions, including how quickly it can be controlled, whether an outbreak can be avoided again with the reopening of the economy and the time it will take to develop new treatments or get a vaccine. "The answers to these questions will go a long way towards determining the timing and pace of the economic recovery," Powell said. "Since the answers are currently unknown, policies must be ready to deal with a set of possible outcomes."

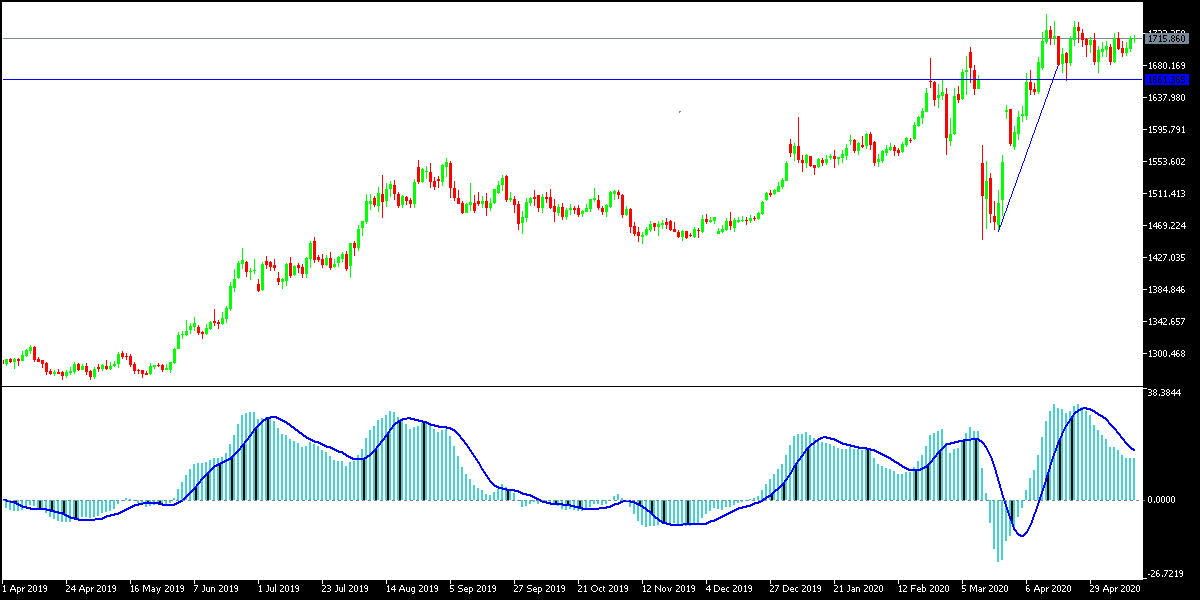

According to gold technical analysis: As is the previous forecast, the general trend of gold will remain bullish as long as it remains stable above the $1700 resistance. Gains stopped several times around the $1718 resistance, confirming overbought area, and this may provoke profit-taking sales, especially with excluding the hypothesis of negative interest rates in the United States at the present time. Powell's remarks covered the disastrous results of the US economy. At the present time, resistance levels 1719, 1727 and 1740 may be areas of interest for profit taking. Gold price will continue to interact with investor reaction to Powell's recent remarks and US unemployed claims today.