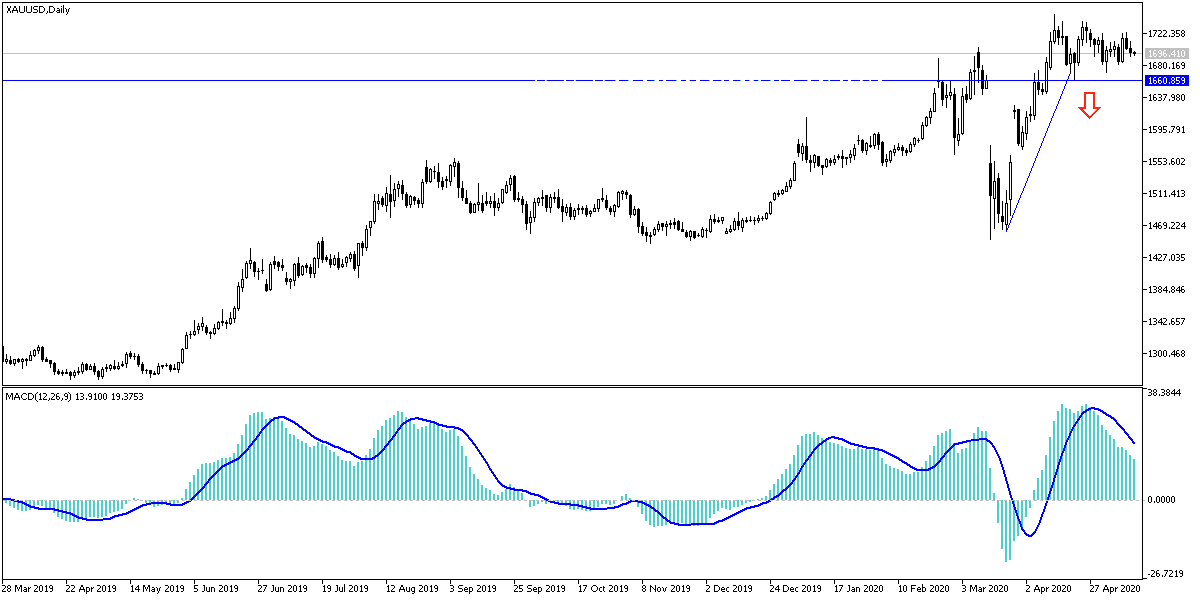

The return of the US dollar strength after the markets absorbed the jobs report results for the month of April, which carried a lot of alarming numbers contributed to correcting the gold price to the $1692 level, and cautious gains during last week's trading extended to the $1723 level. The price of the yellow metal stabilized around the $1696 level in the beginning of today’s trading, Tuesday, before the release of the US inflation figures. This performance did not get the gold out of its bullish channel, as it is still near the $1700 resistance, which confirms the bulls' control over the performance.

Alongside Coronavirus fears, additional factors have emerged that will support the yellow metal to return to its record gains track. The return of skirmishes between the two largest economies in the world over trade relations, especially with Trump's accusation to China about the global economic disasters caused by the Chinese-born Coronavirus. This is in addition to the start of the post-Brexit negotiations between the European Union and Britain. Reopening the global economy with warnings of a stronger second wave of infections and deaths from the Coronavirus will act as a catalyst for gold investors to buy from each lower level.

The number of COVID-19 cases worldwide rose to more than 4.1 million until yesterday, and South Korea has reported a new set of infections and its source has been in the nightclub area in Seoul, and China has reported four new cases in Wuhan, the city believed to be the source of the outbreak at the end of December 2019. Although impressive, South Korea contained the epidemic and controlled further outbreaks, using extensive tests and contact tracking. However, 29 of the 35 new cases reported over the weekend were found linked to Itaion, a region popular with nightclubs, according to The Guardian. The news prompted officials to postpone the opening of schools for a week.

In Europe, Spain, Italy and Switzerland, they all began on Monday to ease restrictions on closures. Paris has allowed stores and schools to reopen for the first time since March 17th, although the metro is running under capacity and many stations remain closed and passengers are required to wear masks.

Amid a global desire to reopen the economy, the United States, Jerome Powell, the head of the Federal Reserve, urged caution in reopening the economy. Powell warned of “a serious risk of a second and third waves of virus infection". Currently, the US economy is in a state of free fall. It lost 20.5 million jobs in April. The unemployment rate rose to 14.7%, the highest since the Great Depression. GDP - the broadest measure of production - contracted at an annual rate of 4.8% from January to March, and is expected to record a staggering 40% crash this quarter. This would be by far the worst of all dating back to 1947.

According to the technical analysis of gold: I still prefer to buy the yellow metal from each lower level, and after the recent decline, the most appropriate support levels to do so are 1688, 1675 and 1660, respectively. On the upside, $1,700 psychological resistance is still the gateway to move towards new highs. The closest levels of resistance for gold now are 1715, 1727 and 1740, respectively. Gold investors ignore the arrival of technical indicators to the overbought areas, as the global geopolitical and trade tensions, along with the Coronavirus, will continue to support gold gains for a longer period.

Gold will react today with the announcement of US inflation figures, according to the Consumer Price Index. As well as statements by some of the Federal Reserve Bank members.