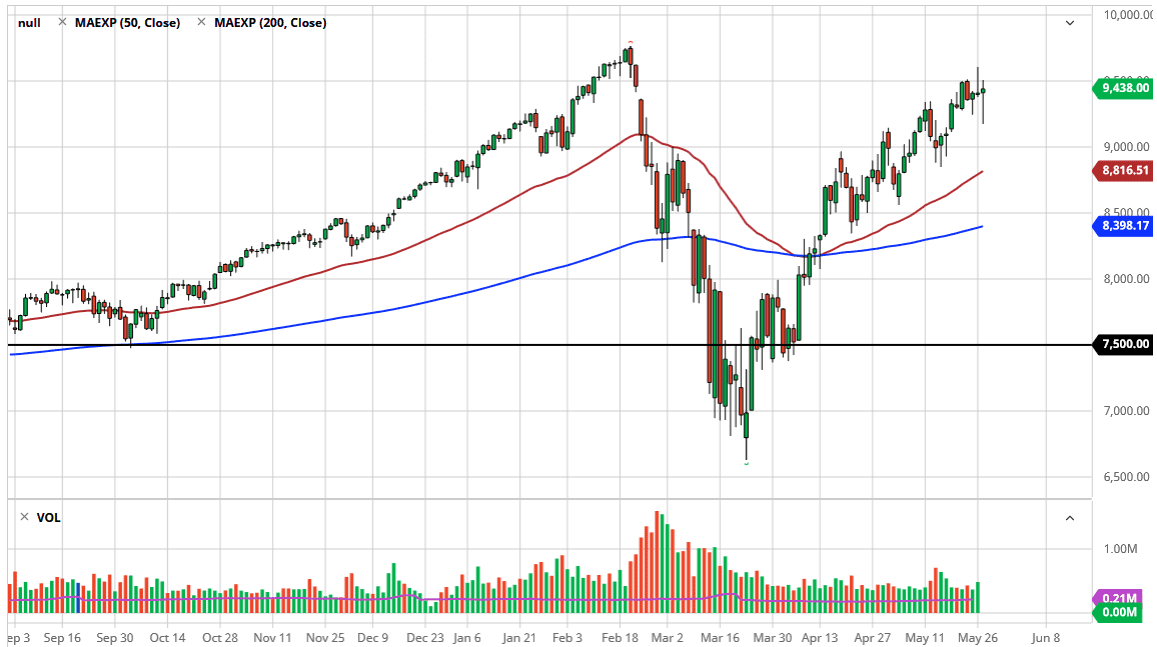

The NASDAQ 100 initially tried to rally during the training session on Wednesday before turning around to show signs of extreme weakness. However, we have turned around completely during the afternoon in New York, and therefore it looks as if the market never wants to fall again. Keep in mind that this is an ETF of the “Wall Street darlings”, namely Facebook, Alphabet, Netflix, Amazon, and Tesla, and some others like Intel. In other words, the top five or six stocks make up over 40% of the index. It is not unless you are willing to short all of these companies that you should be a seller of this index. It is designed to go higher, and the waiting of the index will continue to be rejiggered in order to keep it buoyant. This is an ETF investing, and not something to be speculating on.

Because of this, it is simply a matter of waiting for pullbacks in order to start buying. Quite frankly, if we start seeing indices falling in the United States, it is almost always better to short the S&P 500, or perhaps even the Dow Jones Industrial Average as opposed to this one as it is so highly levered to the sample names. After all, nobody really shorts Amazon or Netflix for any significant amount of time.

At this point, it looks as if we are going to try to go to the all-time highs again, which we are not too far from seeing. In fact, it is only about 400 points or so, which at this point could happen in a span of 24 hours. The question at that point will be whether or not it becomes a “double top”, and if it is, I will be looking at the S&P 500 to start shorting. The NASDAQ 100 simply cannot be shorted for any significant amount of time, and quite frankly it has an easier trade over at one of the other indices. If you are looking to short some of these companies, that is a different scenario, when you could be shorting individual names in the CFD market. All things being equal though, this is a market that has shown its resiliency time and time again, and I do not see that changing in the short term. Longer-term, you can make a lot of arguments for a bearish move, but again there is no point in trying to fight what is so obvious.