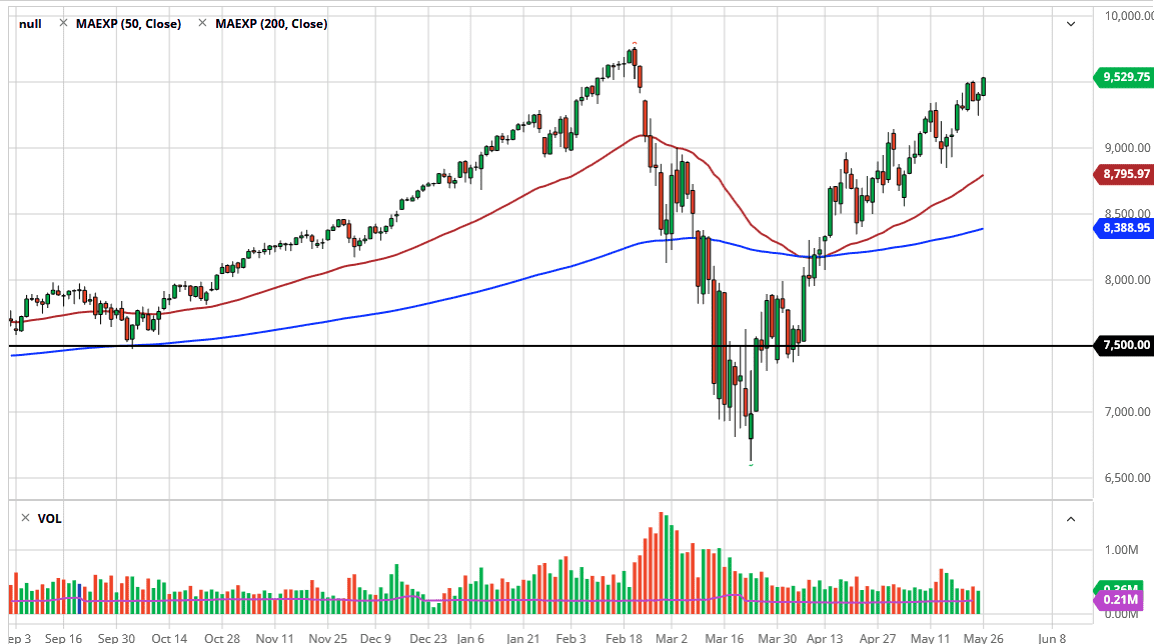

The NASDAQ 100 rallied a bit during the session on Monday, but keep in mind that it was Memorial Day, so it really does not matter. This is just futures trading, and futures trading of course allows a lot of trading around the world in thin markets. For the most part, it would have been retail traders putting money to work, and of course they tend to stick to the same main stocks that most Wall Street funds do, meaning that the stocks that make up the ETF that the NASDAQ 100 has become will continue to drive where we go next.

For example, the Facebook, Microsoft, Amazon, Alphabet, and Tesla performance will be what drives this market. Remember, when you are trading the NASDAQ 100 you are basically trading those stocks. They make up about 40% of the index, so it has nothing to do with overall economy, to simply how those companies are doing. At this point, these are the companies that for the most part seem to be impervious to the coronavirus break down, so obviously it is likely that the companies will continue to be where people flock to, and then of course they are simply the “darlings of Wall Street”, as all one has to do is watch CNBC or Bloomberg occasionally to see how everybody suggests these companies.

This brings up an interesting situation. It is not unless these particular company start fall apart that you can short the NASDAQ 100. At this point, it certainly looks as if the NASDAQ 100 is going to try to go to the 10,000 level and will certainly take on the all-time highs. We may be entering a scenario where the NASDAQ 100 greatly outperforms the rest of the indices in the United States, because the growth is not going to be very uniform anyway. At this point, pullback should see plenty of buyers, with the 9000 level offer a bit of a “floor” in the market. In other words, this is a scenario where you simply buy dips and do not bother shorting. If the market is to fall apart, then you start shorting the Dow Jones Industrial Average or the S&P 500, I would leave this one alone as there are a lot of cult stocks driving this one. That being said, it looks as if we are going to go higher at this point.